Table of Contents

Do you want to get to the bottom of things right away? Bitcoin and cryptocurrency trading is available on Coinbase and Binance!

How to Start Trading Crypto

To learn how to trade cryptocurrency, consider the following five steps:

Step 1: Create an account with a bitcoin brokerage firm.

If you don’t already have cryptocurrencies, you’ll need to open an account with a cryptocurrency brokerage company. Coinbase, Gemini, and eToro are three of the most reputable cryptocurrency brokerages on the marketplace currently. All three of these choices have a straightforward user interface and a large selection of other cryptocurrencies to pick from.

To create an account with a cryptocurrency brokerage, you will be required to supply personally-identifying information, much like you would when creating an account with a stock brokerage. You’ll need to give some basic information when creating your account, including your Ssn, location, date of birth, and email address, among other things.

Step 2: Deposit into your account.

Once you’ve registered with a cryptocurrency brokerage, you’ll need to link your bank account to your account. The majority of cryptocurrency brokerages accept bank money in the form of debit cards and wire transfers. Wire transfer is generally the most cost-effective method of funding your account –– and it is completely free on Coinbase and Gemini.

Step 3: Choose a cryptocurrency to invest in.

The two most popular cryptocurrencies for cryptocurrency traders are Bitcoin and Ethereum, which get the majority of their funds. It is simpler to trade with technical indications when dealing with larger cryptocurrency assets rather than tiny altcoin assets.

Many cryptocurrency traders invest a percentage of their cash in lesser-known cryptocurrencies. Although small and mid-cap cryptos are riskier than big and cap cryptos, they have a greater upside potential than the latter. Many tiny cryptocurrencies have seen gains of more than 1,000 percent in a few months, making them intriguing investments for investors who are willing to take on some risk.

Step 4: Decide on a strategy.

When it comes to buying and selling cryptocurrencies, there are a variety of trading indicators to select from, and most traders consider several different variables. If you are new to investing, you may need to consider purchasing a bitcoin trading course to help you get started.

Asia Forex Mentor is a well-known option that may educate you on how to invest in foreign currency, as well as other products such as bitcoin, among other things. The One Core Project has been highlighted on several financial information websites, including Benzinga, and is a personal favorite of the publication.

When it comes to stock trading, you may well have a strategy in place if you’re an experienced trader. Stock trading methods are also often employed in the trading of cryptocurrencies. Elliott Wave Theory is a trading method that many traders employ and that I enjoy. Elliott Wave Theory is concerned with the psychology that underlies market emotion, and as a result, it is particularly effective for speculative assets such as cryptocurrency.

Step 5: Safeguard your cryptocurrency.

If you’re actively trading your cryptocurrencies, you’ll need to put your money on an exchange to have access to them when you need them. If you intend to hang onto your bitcoin for the medium to long term, you should consider investing in a cryptocurrency wallet.

Cryptocurrency wallets are available in two forms: software wallets and hardware wallets. Both are reliable, but hardware wallets provide the highest level of security since they keep your cryptocurrency on a physical device that is not connected to the internet. To store their cryptocurrency assets, investors may put their faith in Ledger, which is a superb hardware wallet brand. For those searching for a digital wallet, there are numerous alternatives available for iOS, Google Chrome, and Android platforms that are completely free to use.

Beginners’ Best Solutions For Trading Cryptocurrency

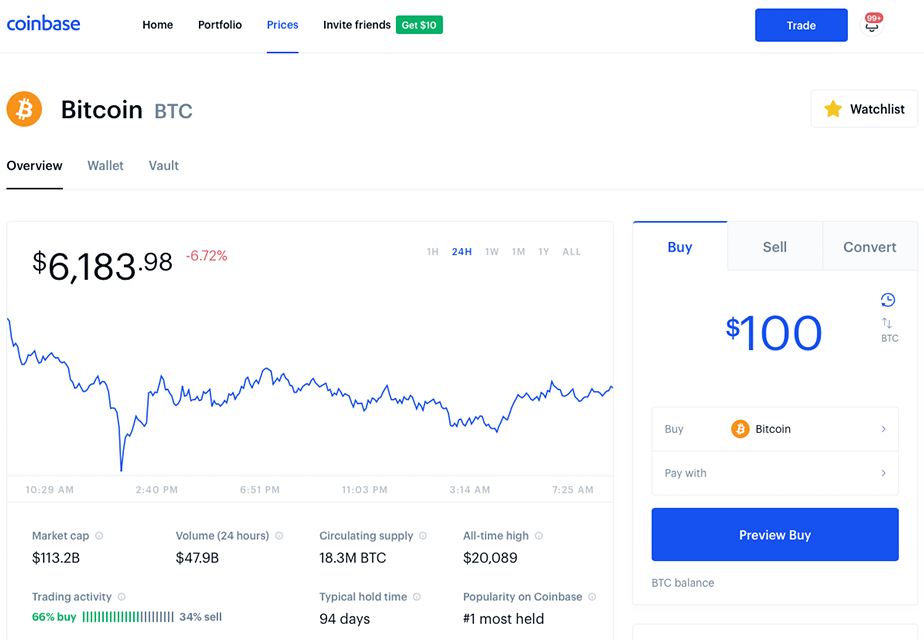

Coinbase

Currencies Available: 64

Transaction Fees: $0.99 to $2.99, 0.50% (Coinbase Pro)

Wallet Included: Yes

Coinbase has established itself as the largest popular cryptocurrency exchange in the U.S, serving as a standard on-ramp for new bitcoin investors. Bitcoin exchange Coinbase provides a broad range of goods, including crypto investing, a sophisticated exchange market, custodial accounts for organizations, a wallet for regular investors, and its stable coin pegged to the United States dollar.

Coinbase, which was established in 2012, is a cryptocurrency exchange that is completely regulated and licensed in all 50 states, except for Hawaii. Coinbase originally only allowed Bitcoin, but it rapidly expanded its offering to include other cryptocurrencies that met its decentralized requirements, such as Ethereum.

Its list of supported cryptocurrencies has grown to include Ethereum, Litecoin, Bitcoin Cash, XRP, and many more, with the possibility of many more if the required conditions are fulfilled.

Key features

- Coinbase provides a safe and convenient method to invest in and exchange cryptocurrencies.

- Coinbase now supports a growing number of cryptocurrencies, with a total of over 25 available.

- A straightforward user interface makes for an excellent learning environment.

- Coinbase Pro provides lower costs and more features than Coinbase, and it is completely free to use for anybody who already has a Coinbase account.

Pros

- There is a good selection of alternative cryptocurrencies.

- The user interface is quite straightforward.

- Liquidity is really high.

Cons

- Fees are excessive when without utilizing Coinbase Pro.

- There have been reports of users’ accounts being purged as a result of hacking.

- Perhaps not as many alternative coins as some other exchanges.

Binance

Currencies Available: Hundreds

Transaction Fees: 0.012% to 0.1%

Wallet Included: Yes

Binance is a cryptocurrency exchange that was launched in 2017 with a heavy emphasis on altcoin trading. Binance supports over 100 different cryptocurrency trading pairings. Additionally, it provides a plethora of fiat-crypto pairings.

By July 2021, Binance will have dominated the worldwide exchange sector, accounting for a sizable percentage of daily crypto trading activity. The exchange accepts only US Dollar deposits via SWIFT from global consumers, however, it also enables users to directly acquire a limited amount of cryptocurrencies using a credit or debit card. Deposits in 12 different fiat currencies, including the Euro, are permitted.

Binance is ideal for those interested in trading or investing in lesser-known cryptocurrencies. Binance allows users to trade over 50 different cryptocurrencies and is an excellent choice for those seeking more extensive charting capabilities than most other exchanges provide. The tools, graphing capabilities, and analytics that accompany your membership are very amazing, especially in light of the low costs.

Key features

- The Binance exchange is simple to use, making it ideal for both expert and newbie traders and investors. Binance offers a variety of trading platforms to accommodate traders with varying degrees of experience.

- Users may fund their accounts with cryptocurrencies via external wallets or with a credit card, or they can fund their accounts with fiat cash. FX risk is eliminated, as Binance accepts deposits in all major fiat currencies.

- Traders may conduct transactions from anywhere, since the Binance platform is also available on Google Play, the App Store, and the Android APK market. The solution is integrated with both iOS and Windows on computers.

- Users may receive incentives for investing or staking cryptos, as well as get quick loans backed by crypto assets. (Details are available in the Key Features section.)

- Binance offers the biggest amount of cryptocurrencies available on the market.

- Not only does the platform enable spot trading, it also supports margin and futures exchange. For further information, please refer to our Binance Futures study.

- Binance places a premium on security, including two-factor authentication and anti-phishing techniques.

- TradingView powers the charts – this provides users with a plethora of indicators and sketching tools to aid in technical analysis.

Pros

- Fees are lower than those charged by other widely utilized exchanges.

- Numerous cryptocurrencies and trading pairings to choose from.

- More sophisticated charting.

Cons

- Designed for more experienced users.

- The US edition of Binance features fewer trading pairings than the international version.

- Not every state backed it.

Selecting a Cryptocurrency

If you’re unsure which cryptocurrencies to invest in, you must understand that it all comes down to fundamentals.

Choosing a bitcoin investment may be simple; you simply need to conduct some preliminary research.

This section will discuss simple methods for determining which crypto to invest in…

Purchase method

The procedure for acquiring cryptos differs according to the platform. Some sites accept bank transfers, some take PayPal, yet others allow debit cards, while still more accept just cryptocurrencies for purchases. Consider the many payment methods accessible on the networks and select the one that is most appropriate for you. To begin, with no cryptocurrencies, you must select a platform that takes fiat cash, as this will ease your entry into the market.

Coins and tokens that are supported

Almost all cryptocurrency exchanges accept Bitcoin and Ethereum. There are, however, thousands of other cryptos, and some investors wish to diversify their holdings beyond BTC and ETH. Thus, before choosing a crypto exchange, you should familiarize yourself with the currencies and tokens it supports. Binance is the most popular platform because it exposes traders and investors to a greater variety of cryptocurrencies than other platforms.

Structure of fees

The transaction cost structure varies between cryptocurrency exchanges. Understanding a crypto exchange’s fee structure is critical since it enables you to know what you’re getting into when doing multiple operations. Ascertain that the platform you pick does not charge hidden transaction costs. You can select a platform that charges fixed transaction fees or one that charges on a more flexible basis.

Interface design and user experience

This is a critical factor in determining your success as a bitcoin trader or investor. A user-friendly design and positive user experience make it simpler to trade the various cryptocurrencies accessible. User experience, on the other hand, is subjective, and different interfaces appeal to different individuals. Additionally, verify a crypto exchange’s customer service and other client-related features. The platform’s accessibility should be made as simple as possible.

The Community

A small element of a cryptocurrency’s success is its following – therefore search for coins with active communities and dedicated followers, since this indicates that people have a real interest in and believe in the cryptocurrency.

Examine several subreddits, YouTube channels, and some of the commentary from their communities to determine what they have to say about your possible investment.

If you’re unfamiliar with the currency, visiting forums and perusing the Reddit community might help you grasp the excitement around an altcoin and if you should invest.

Analyze Fundamentals

The term ‘fundamental analysis’ refers to an investment’s underpinnings – its team, its objectives, and its strengths, for example. If you’re new to cryptocurrencies, don’t get too caught up in the technical details!

Fundamental analysis, on the other hand, will benefit you as much as technical indicators in the long term.

Thus, learning how to conduct basic analysis will enable you to make more informed investing selections. And in a market where the majority of participants are pursuing low-quality altcoins, fundamental research enables you to sort the wheat from the chaff.

The Technological Revolution

The underlying technology has a significant role in a cryptocurrency’s success:

You need to appreciate how it will perform in comparison to its competition – and what renders the solution unique. Keep an eye out for the game changers — the coins that will utterly disrupt their respective industries.

Reputation & Credibility

Is cryptocurrency respected on the internet? Are they well-known?

The bottom line is that if they have a terrible reputation, you know that you shouldn’t put your money into them – to be successful in this industry, you must have a high level of credibility and trust.

Therefore, conduct some Google searches and peruse crypto forums to learn more about the currency.

Additionally, you would like to invest in a currency that people believe in. You must avoid frauds!

The Plan

When selecting which crypto to invest in, seek a coin with a clear road map and ambitious development goals.

This is critical if you want to achieve long-term success.

Here are a few things to keep an eye out for:

- Timelines for the coin’s evolution. If there is no defined timeframe, this may indicate that the development team lacks dedication.

- When do they intend to deliver significant updates?

- If the currency has a finite supply, when is that supply anticipated to be depleted?

How to Pick the Right Cryptocurrency Exchange

When it comes to picking a cryptocurrency exchange, there are several considerations to be made. Novice users and traders who are just starting don’t know how to go about buying and selling cryptocurrencies online.

Because of this, it is essential for both novice and experienced investors to seek further information before making any moves.

Jurisdiction

This element is easier to understand than the others. It’s either yes or no.

Is the exchange mostly used by consumers who live in your nation and state? The exchange will not be able to assist you if the response is no.

Other exchanges have internet addresses specifically designated for each country. For example, US-based customers may have to go to “exchange.us” instead of “exchange.com.” The jurisdiction of exchange represents the target market, as well as the specific locations in which they may conduct business thanks to bitcoin legislation and guidelines.

User-friendliness

Do you have any trading experience?

Investors who are more recently acclimated to the world of investments may be frightened by order books and chart displays and a complex to understand interface with plenty of graphs and other information.

On the other hand, if this is true, a beginner-friendly exchange may be the ideal alternative. Many bitcoin trading platforms have “fundamental” and “advanced” layouts, making it possible for customers to customize their experience. These other investment-only guides are meant for people who are just beginning into crypto investing and for newcomers to prevent any misunderstanding.

Liquidity

Learning the importance of liquidity while investing in bitcoin is a crucial first step. To trade, traders need the liquidity to be able to execute deals at any given moment without causing significant price movements. Thus, when a market has a large number of transactions occurring on any given day, a good exchange must have an order book with a sufficient volume of orders.

For that volume, an exchange needs either a big number of users or high-volume traders who have a lot of assets on the exchange. The quantity of orders for the currency being bought or sold determines whether there will be anyone eager to purchase or sell.

Alternatively, if just a few orders are available, paying more than necessary becomes the norm. It is possible that selling might cause prices to go down, and as a result, an investor misses out on some potential earnings.

High volatility frequently occurs in the crypto markets, therefore liquidity is critical during those times. Less liquidity can lead to more volatility, increasing the chances that prices either increase or fall substantially.

Asset selections

Do you wish to swap assets? Most exchanges do not provide trading pairings for all the different forms of cryptocurrencies.

While the larger market cap currencies generally have a higher chance of being transacted on prominent exchanges, these coins also have a greater exposure to exchange hacks. To seek smaller-traded currencies that are more exotic, investors might have to go to more unusual exchanges.

Security

Everyone needs a safe crypto exchange. You must trust the exchange operators to hold your coins on an exchange. In the vast majority of situations, investors will come out empty-handed if the marketplace gets hacked or a staff robs the company of its holdings.

In the vast majority of cases, an exchange will make its security measures available to customers in one of the several places on its website. Security can never be guaranteed on exchanges, but some factors to consider are if the exchange has been operational for a long time, has a large client base, and has seen the least number of problems.

Reputation

When on the weekend it comes time to pick a restaurant, many individuals research restaurant reviews on Yelp to aid them. Visitors that are interested in bitcoin exchange websites should check their internet reviews. On the other hand, as most crypto exchange customers are subject to a larger financial risk than having a meal on Friday night,

Volatility in trading fees

A lot of people have realized that fees constitute a hidden expense whenever it comes to buying cryptocurrencies. The fees extracted from most or all operations are the basis of their revenue.

Some marketplaces, like Binance, have their own “cryptocurrency tokens” on their platforms. The tokens enable these exchanges to provide discounts on trading costs to token holders. Fees will be cheaper if the user owns Binance Coin (BNC) in their Binance wallet. The fees are paid in BNC (Bitcoin Non-Custodial Cash System) instead of in bitcoins.

Customer Service

No bitcoin exchange app is perfect. For beginners, a set of questions would be posed on the fundamentals of cryptocurrency and how the exchange functions.

The urgency for customer service, with money on the line, happens sometimes. Customer service response time can lead to significant financial losses in the crypto markets.

Investors should check the credibility of an exchange’s customer support service because that is why customer support is important for investors. Are they fast to respond? Are consumers satisfied with their service? The exchange does its best to highlight excellent customer service, does it not?

Insurance

Certain or all of the user’s funds may be covered by some exchanges. To investors who dislike the concept of putting their investment to a firm with whom they’re unfamiliar, this may be an enticing feature. When something disastrous happens, the trade of insurance shields investors from loss.

There are many insurance policies, therefore it would take a separate study to find out specifics about a particular exchange.

The technical infrastructure

Exchange customers can benefit from developer-built matching engines that improve their overall trading experience. Exchanges with highly accurate matching engines can handle rising volume and volatility, which means they are better equipped to match orders.

While the ability to easily and rapidly couple new order types and trading pairs with the trading engine is important, a strong matching engine also includes other aspects of the exchange’s infrastructure, making it much easier for the marketplace to service its clients.

Knowledge and Assets

A majority of the most prominent cryptocurrency exchanges are exactly that: trading platforms. Cryptocurrency is given up in exchange for other cryptocurrencies or fiat cash.

However, other exchanges trade derivatives of cryptocurrencies, such as options, futures, or other derivatives, rather than actual cryptocurrency. Futures and options are two popular kinds of derivatives where investors contract to purchase or sell a resource for a specified price on a future date. This commodity does not swap hands.

In certain derivatives exchanges, traders can utilize leverage, which allows them to make larger wagers than the amount of money they have in the marketplace. Let’s use an example: a dealer with $1 million in their account may place $10,000 in trades because of 10x leverage. It’s a two-edged sword.

Withdrawal and deposit limits

You may also wish to make withdrawals even if you want to hold on to your Bitcoin for as long as feasible. While the majority of exchanges don’t have a minimum deposit restriction, there are minimum withdrawal limitations imposed on account holders. A good illustration of this is that traders may only be able to withdraw USD 25,000 or equivalent in cash or cryptocurrency per day.

Consider restrictions like these if you’re looking to move a lot of money. Cryptocurrency exchange apps, no matter how good they are, can contain restrictions on the amount of money that users can move in a particular timeframe.

Benefits of Cryptocurrency Trading

For those individuals who are looking to get their feet wet in the world of cryptocurrency exchanges, now is the moment. Subsequently, investors will be better positioned to start investing in cryptocurrencies and will have a greater shot at succeeding in trading. So, as you can see, traders may reap significant benefits by completely immersing themselves in trading.

Cryptocurrency’s wild price fluctuations

Due to a lot of short-term speculative interest, the cryptocurrency market has seen a lot of volatility. Bitcoin prices varied greatly during the year from October 2017 to October 2018, from a peak of $19,378 to a low of $5851. The new technologies will frequently be popular with investors due to their speculative appeal.

The constantly fluctuating value of cryptocurrencies adds to the excitement of this market. The significant intraday price swings that occur can offer a wide range of trading opportunities to traders who choose to go long or short, but they also carry higher risk. Make sure you have done your homework and set up a risk-management strategy before diving into the bitcoin market.

Cryptocurrency exchange trading hours

Since the cryptocurrency market does not have centralized control, the market is open around the clock, seven days a week. Transactions between individuals, done via bitcoin exchanges around the world, are performed instantly. Also, there are times when the market adjusts to modifications to infrastructure, such as ‘forks.’

Through IG, you may trade other cryptocurrencies such as the US dollar against other currencies, such as the dollar, all day, every day from 4 AM on Saturday to 10 PM on Friday (GMT).

Faster, smoother fluidity

Liquidity is the term used to describe how fast and readily a cryptocurrency may be changed into cash, without affecting the price of the cryptocurrency. To bring about improved pricing, quicker transaction speed, and more accuracy for technical analysis, liquidity is crucial.

Cryptocurrency transactions are usually called “illiquid” since the majority of the activity is happening on numerous exchanges, resulting in little deals having large effects on market values. Since bitcoin markets are so volatile, this is partly the reason.

Yet, thanks to IG’s mixed sources of pricing, you may enhance liquidity while trading CFDs with us. The greater likelihood of deals being performed promptly and at a lesser cost.

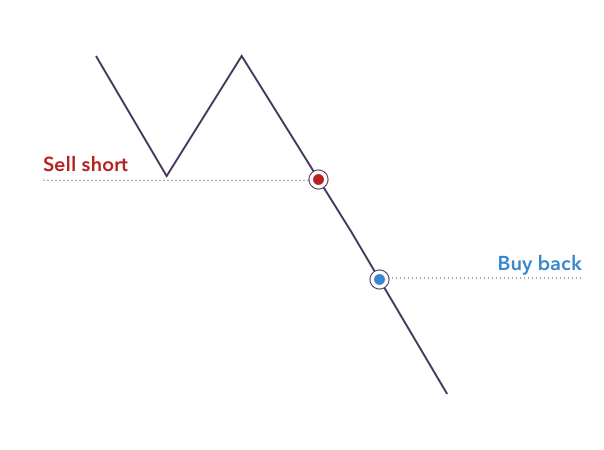

The investor can go long or short

You’re investing in the cryptocurrency hoping that it appreciates. You can take full advantage of decreasing or increasing market prices while trading cryptocurrencies. Going short is known as this.

Another way to express this idea is to state that, if you have decided to establish a short CFD strategy on the value of Ethereum because you feel that the market is likely to collapse, then this would be an example of your plan coming to fruition. Your transaction would profit if the price of ethereum decreased vs the US dollar. You will have a loss if the price of ethereum rises versus the US dollar.

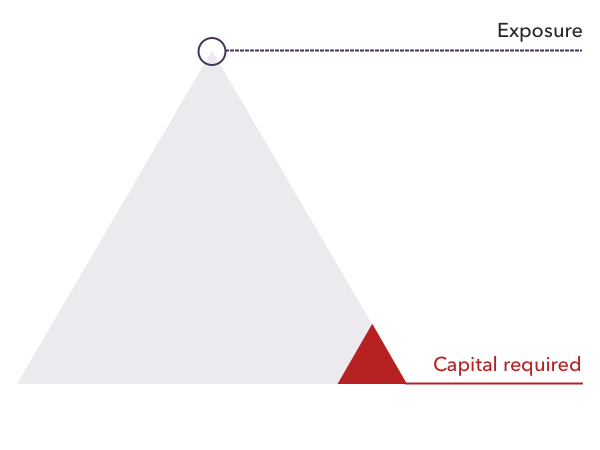

Financial leverage

For CFD trading, your balance is leveraged. You are allowed to open a position using only a percentage of the whole amount of the transaction, as collateral. For example, if you had $10,000 to invest in bitcoin, but it only ties up $10,000 of your cash, you would acquire a big exposure to cryptocurrencies.

Margin trading gives you the chance to generate significant returns from a very little investment. An added benefit is that it will exacerbate any losses, whether they are more than your original investment for a specific transaction or not. Trading CFDs puts a large amount of risk on your trading account.

It is equally critical to implement a risk management strategy that is following regulatory guidelines, including a proper stop and limit.

Account creation takes less time

Buying cryptocurrencies means that you will have to set up an exchange profile and keep the coins in your digital wallet on your own. As this procedure is slow and difficult, it may also be limiting and time-consuming.

You will no longer need to access the exchange directly with IG because we act as a middleman between you and the underlying market. Your time to trade will be cut drastically, so you might be ready to start trading sooner. However, with our easy application form and quick online verification, you may trade in just a few minutes.

Consider the distinctions between buying and trading cryptocurrencies before making a choice. See our video for additional details about the table below.

Final Thoughts

When compared to regular fiat exchanges, cryptocurrency trading offers several distinctions. To succeed in crypto, you must identify reliable information sources, conduct thorough research, choose the most suitable exchange platform and wallet, and establish benchmarks and portfolio management tools.