Table of Contents

Cycles in cryptocurrency markets indicate whether or not it is time to purchase or sell if you understand how they work. As a general rule, remain on the upper edge of cryptocurrencies.

Even though they are aware of the potential problems, many investors find themselves being surprised when the market’s belly flips. To ensure you don’t get drawn into a cryptocurrency market “sinkhole,” it’s critical that you comprehend market cycles. By providing you with the information essential to invest strategically, we’ll demonstrate how to analyze market cycles while teaching you how to invest profitably.

What Is the Cryptocurrency Market Cycle?

A cryptocurrency market cycle is the span of time between the top and the bottom of the market, as well as the many stages it goes through. All financial markets go through cycles. It is a natural process that occurs repeatedly and will continue to do so. But in comparison to the stock exchange, crypto cycles tend to be far shorter, thanks to the quick price fluctuations.

Understanding and Interpreting Market Cycles

In every market, cycles may be discovered, and they are made up of distinct phases. Prices go up, peak, then decline and start all over again.

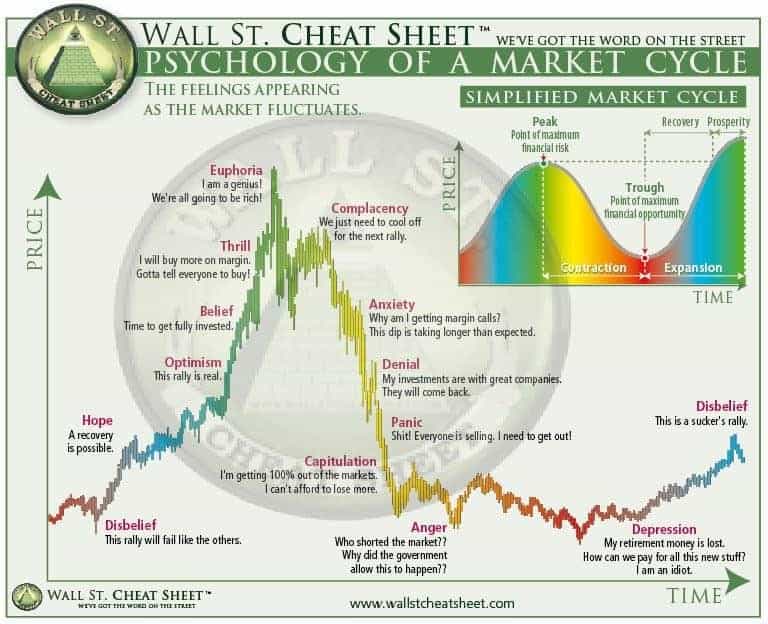

The following chart was developed by Karen Bennett of CheatSheet, who showed the dynamics of a market cycle. It captures the most often experienced emotions for investors under volatile market conditions. More than fundamentals influence financial markets.

Rookie traders may not be aware that markets go through regular cycles, and so fail to anticipate when the present cycle will finish. It’s difficult to select the highs or lows of a specific market cycle, even if you know when the cycle will occur. But, in order to get the most out of your trading strategy, you must fully comprehend the cycle. There are four distinct phases of a market cycle, and understanding them can help you predict when the market will enter each phase.

There are four distinct phases of a market cycle, and understanding them can help you predict when the market will enter each phase.

Accumulation Phase

During this stage of the cycle, this signal indicates that when the market has completed a top, prices will stabilize. Typically, as market trendsetters begin to buy again, that is when markets take a turn for the better. People believe that the worst is behind them, and they are hopeful that any trade will be a win.

Pricing is good here, so for every trader that pulls their head out of the sand and sells, a shrewd buyer is already poised to snatch up the position at a discount. Most beginning investments suffer considerable financial losses and disappointment before any progress is noticed.

As time passes, however, market sentiment changes from bearish to neutral.

Markup phase

Once the crypto has attained a stable value and is starting to climb steadily, the markup phase begins. Early movers leverage their specialized analysis skills to capitalize on changing market conditions. Prices are not dropping because sellers are slowing down the rate of increase.

While drawing attention to cryptocurrency, many early adopters also lose interest. Traders who have a lot of experience will notice that there are greater lows and greater highs. Trading also increases when FOMO and natural interest propel trading.

At this moment, values begin to rise, and the “greater fool theory” takes effect. Greed tends to rule, along with logic and common sense being placed in a secondary position. Furthermore, when those latecomers arrive, the financial investors and analysts will begin to liquidate their positions.

Prices level off or slow down over time. Those who are on the fence see this as a tremendous opportunity to acquire, because they believe this is a once-in-a-lifetime opportunity. When prices have risen to their final degree of magnitude, a selling climax occurs when they jump exponentially, making gains. The price of everything has been rising lately, and investors’ mood has shifted from being neutral and dull to enthusiastic.

Distribution phase

When the market moves into the third phase, we may expect to see a rise in the number of sellers. During the last bull market, bullish feeling evolved into a mixed state. The price of a good or service is often (but not always) confined to a particular range for a while.

The market will go in the other way towards the end of this phase. On the basis of past technical patterns, such as double and triple tops or head and shoulders, there is a high likelihood of distribution-related peak price.

At this point in the cycle, the sensations of anxiety, greed, and hope drive the bulk of the movement. Investors who have made early bets on the project are unsure about whether or not to exit and take gains. Negative sentiment begins to grow, and poor economic news or a significant geopolitical incident might trigger this shift.

A record number of investors are questioning optimistic expectations for the first time. As market players agree that a correction is needed before the uptrend begins, a severe sell-off is followed by a comeback. However, rising prices are unable to achieve prior heights, and when prices decline for the second or third time, fear grows.

Others who came in later and had a large investment are nervous about losing everything, but are excited by the prospect of regaining their investment. The market looks to be on the rise again. Due to the trading attention during this period, the distribution phase may have a considerable number of up to down days.

It might take weeks to many months, and sometimes even years, to get to a definitive understanding of underlying issues. In general, higher highs usually lead to lower prices. In the financial world, investors who had the bad fortune of missing previous opportunities to sell at a profit are compelled to hold their investments in order to maintain even (or decrease) their losses.

Markdown phase

While the third and final part of the cycle is most difficult for those that still hold positions, the 4th portion of the cycle is most terrible for those who no longer hold positions. Typically, investors that find themselves in this stage are new and inexperienced. In spite of the fact that their investment has gone significantly below whatever they paid for it, they don’t want to let go of it. These investors, who are generally early buyers or those who buy when distribution begins, will sell only when the market drops by 50% or more. Late-cycle traders give up hope when this happens, and that eventually spurs them to cut their losses.

The earlier investors, who previously earned returns on the investments, purchase the depreciated assets at this stage. It is widely expected that the market bottom is near, and investors will therefore take advantage of the ensuing price increase.

Understanding the Market Cycle Trends

In this analysis, we used Bitcoin as an example, because that’s the primary market. This is a more thorough explanation of market cycles in crypto.

- As the accumulation phase begins, smart money, institutional investors, and early adopters all acquire assets when they are at their lowest point. At this time, as individuals who hung on at the previous price peak suffer some rage and sadness, bottoming prices start to build.

- Bitcoin’s price begins to rise. Hope and scepticism are both present. However, successful investors “HODL” by buying low and selling high. During the markup process, this might happen.

- Investors buzz with enthusiasm while the markup phase proceeds, and that leads to even greater market increases. Greed tends to play into the mix as those who were anxious to join in are bought out by others who arrived earlier. Moods in the market include exhilaration, belief, and ecstasy. At this time, it is smart to either sell or hold HODL.

- The Bitcoin system now starts the distribution stage of the cycle, when it distributes money into the hands of investors. This is the greatest moment to sell because of the economic and political uncertainty.”

- Once the discount period has started, Bitcoin tends to drop. The two go hand in hand. Here is your last opportunity to sell, and the customers will definitely make a purchase if you haven’t already. Shorting and playing bounces are viable options as the price of Bitcoin declines.

- As negative feelings grow toward Bitcoin, the currency plummets even faster. When others sell in fear, you may keep adding to your short position. That’s when the game is bouncing about and the shorts are being closed.

- The bottom falls out toward the close of the markdown period. Many people feel angry and sad. Also, it’s an indication of the beginning of another cycle. Initial investors start to return as smart money is put back into the market.

Final Thoughts

It is absolutely essential for all traders to understand the cryptocurrency market cycle. To successfully identify the best moment to purchase or sell a coin, you must study the market and conduct extensive research.

However, it is also necessary to take into consideration the various market cycles. Without tools like technical analysis, understanding the current market conditions would be difficult. In order to succeed in trading, you must have the correct trading tools.