Table of Contents

Inventory monitoring, reconciling lines of credit and bank activity, accounting for taxes (such as sales tax), and utilizing double-entry accounting principles (i.e., simultaneous revenue and cost tracking) are all activities that any small company accounting software must be able to accomplish on a daily basis. All of the programs on our compilation of the top-rated accounting software for small businesses are capable of performing such functions.

Our Aproach

Before selecting our top five accounting software alternatives, we researched nineteen accounting software providers that offered unique solutions for small businesses. Cost, scalability, usability, popularity, and accounting features were all taken into consideration. One of the most significant considerations was a firm’s reputation since the more a company has been in business, the more likely it is that any technical faults have been fixed, ensuring that a company’s critical financial information would be presented properly. The capacity to scale was the second most essential factor to consider since when a company expands, its accounting requirements expand as well, and moving financial data to new programs may be time-consuming and difficult. Also taken into consideration were the simplicity of use and cooperation for business owners as well as workers and accountants due to the fact that it is critical for all users of the system to be able to access and analyze financial information at the same time.

Benefits Of Using Accounting Software

- The ease with which it can be used.

Generally speaking, accounting software solutions are simple to use and browse. It also doesn’t take considerable time to train new staff in your company. And, after they’ve been trained, the task is completed considerably more quickly, allowing you to devote more time to fulfilling the needs of your customers.

FreshBooks is among the most user-friendly accounting software programs on our list, according to our research.

- Data Protection and Integrity.

Even as the appeal of such systems continues to grow, there is a greater emphasis placed on maintaining data integrity and security in these platforms. In order to combat this, most accounting solutions, such as QuickBooks, Tipalti, and others, have state-of-the-art data security measures.

- Completing forms on time.

It is no longer necessary to be worried about missing a timeframe for filling out a form or completing your tax returns after you have included an accountancy software platform in your business operations. The majority of these responsibilities are taken care of via automated processes or regular reminders.

- Keep track of your money.

When you perform your accounting by hand, it is difficult to keep track of your funds. In reality, it is fairly common for one or two operations to go unnoticed.

With the appropriate accounting system in place, you can control and evaluate your transactions in real-time, ensuring that you never lose sight of your finances again.

Furthermore, calculations for items such as discounts to clients on large purchases and performance incentives for staff become much more simple as a result.

- Reliability and accuracy.

Accounting software tools may reduce the possibility of human mistakes, resulting in improved compliance and effective record-keeping procedures.

- Cut costs whenever possible.

A small firm may not always be able to afford to hire staff for every position available. Many are required to collaborate with colleagues from other departments.

Even if the costs of setting up and education with an accounting system are high in this case, it is only a one-time expense that you will have to bear. In the long run, the overall costs are far less expensive than the cost of hiring an additional accountant.

Using this program, you may save money if you’re running an online business and want features such as inventory monitoring, access to financial information, and the ability to charge clients.

- Predictive analytics.

You may make use of software technologies to estimate and forecast potential losses and earnings. Furthermore, you can gain valuable insights that will assist you in making better business decisions in the future.

I was able to prepare ahead when I converted from a sole proprietorship to an S Corporation, paying payrolls and income tax requirements in advance so that I didn’t get a nasty surprise when the tax season rolled around.

What to Look for

When considering small company accounting software, here are a few questions to ask yourself and your team.

Is it possible to access the accounting software from any location?

There are still certain accounting software programs that operate on a desktop computer and can only be accessible from a specific computer. The majority of modern technologies are cloud-based and can be accessed from any device connected to the internet, either in a browser tab or through a mobile app on the device. The ability to collaborate and integrate with other company applications is typically enhanced as a result. If having access to your accounting information from any location is important to you, consider a cloud-based solution.

Is it compatible with my bookkeeper or accountant’s software?

In the event that you are dealing with an off-house bookkeeper or accountant, one of the first steps you should do is to figure out which accounting system they use. QuickBooks is nearly everywhere, but other firms, like Xero, are making inroads too though. QuickBooks is the most widely used accounting software in the world.

Is it a scalable solution?

You need an accounting system that can scale to meet the needs of your growing company. You should seek choices that can be updated as necessary if you intend to scale, and you should avoid placing restrictions on the use of specific features.

Is it equipped with the functionality I require?

Is inventory control a top concern for your company? Do you deal with international transactions on a regular basis? Is it necessary to have built-in payment processing? Do you require the program to be able to communicate with other items that you already own? If in doubt, take advantage of the free trial period given by the majority of service providers.

How much would it set you back?

It’s doubtful that price will be a determining factor in choosing which software to test — but it’s vital to understand what charges to anticipate and which features are included in the pricing when evaluating different software options. Subscription prices for most accounting systems begin at less than $20 per month, although add-ons may raise the cost.

Key Features of Accounting Software

There are several features of an accounting system that contribute to its usefulness as a tool. As a small company owner, it’s critical to understand what qualities to look for in a website. The majority of online accounting software includes functions such as receivable accounts, accounts payable, banking, and reporting. Inventory control, project management, time tracking, and payroll tools are just a few of the features available.

The following are some of the most important characteristics to look for in your accounting software:

Feeds from the Bank

This feature allows you to link your software to your company bank or credit card accounts in order to obtain a daily report of your transactions. Due to the elimination of the need to manually upload transactions, you will save valuable time. You’ll also be provided with a regular, rather than a monthly, summary of your financial accounts. Consolidation may be made easier with the use of a real-time bank feed function, which allows you to reduce it to a modest daily chore rather than a monthly struggle.

Dashboard

When you log into your account, you’ll be welcomed by a dashboard that provides you with a summary of your transaction history and important indicators, such as working capital, profits, and losses, account balances, costs, accounts receivable and payable, and sales, among other information. Some accounting systems allow you to modify the information that appears on the screen initially by rearranging the data.

Invoicing

If your company issues invoices, having the option to mail them and take online payments can help you get paid more quickly and efficiently. Some accounting applications provide integrations with third-party payment processors, while others require you to utilize their in-house payment processing services to handle payments. It is advantageous for accounting to be able to function as an invoicing generator as well.

Invoices that are automatically generated

The system may be set up to automatically produce and create invoices for recurring costs, such as subscriptions if you use this functionality. You can specify how regularly invoices are issued – daily, weekly, monthly, or yearly – as well as whether or not there is an end date for the billing cycle.

Payment Reminders Sent to You Automatically

It is possible to use this function to notify consumers of impending and past-due payments. Some websites include example mail messages that you may use as-is or modify to suit your needs. After that, you may specify when you’d like the notifications to be delivered. You can choose to deliver thank-you emails to clients after they make a payment using some software packages.

Reconciliation of Bank Accounts

Consolidation software can discover possible matches amongst your bank transfers and the bills and payments you’ve recorded into your accounting system, saving you the time it would take to manually comb through your financial institution for that information otherwise. You can next decide whether or not to accept or reject the proposed matches. The most effective programs offer possible matches while you reconcile your accounts. A few applications provide a reconciliation function in their mobile applications.

Financial Accounting and Reporting

Financial reports may be generated by virtually any accounting application. However, some are basic than others, and some need you to commit to a more expensive plan in order to access additional reporting features. Make certain that the software and plan you pick offer the sorts of financial reports you want if you have unique requirements. Detailed reports may assist you in understanding and interpreting your financial data so that you can make educated business decisions.

Apps for mobile devices

Even while not every accounting and invoicing software has mobile applications, the top ones do. There is, however, a wide range of features available in mobile applications. Some merely enable you to collect receipts for expenditure monitoring, while others allow you to produce and create invoices, and yet others include nearly every function available in web-based accounting software. You should investigate if the software you’re contemplating has a mobile application and, if so, what capabilities are included in the application that will assist you in managing your business when you’re away from the desk.

Integrations

It saves you significant time by eliminating the need to manually move information from one place to another. The ability to link your accounting system to other business applications you use spares you even more time. Among the most prominent types of connections offered with accounting software are payroll, payment processing, point-of-sale systems, and customer relationship management software. Integration with existing systems allows you to reduce the amount of time spent educating personnel who will be using the program.

Keeping track of billable hours

If you work as a consultant or if your company pays clients on an hourly basis, you’ll need a program that allows you to monitor and bill your time, or that can interface with the time-tracking system you currently have in place. This is a critical feature for independent contractors.

Inventory Control and Management

It is necessary to have an application that assists with inventory monitoring and purchase orders whether you own a retail, e-commerce, or distribution firm. It is possible that you will need to upgrade to a higher-tier plan in order to use this function. If you want more extensive inventory management capabilities, seek software that can be integrated with a specialized inventory management system.

Project-Based Billing firms, freelancers, and consultants that collaborate with customers on projects or assignments should search for an accounting system that will assist them in keeping track of the activities and budgets associated with their projects. Customer invoices for monitored time and project expenditures should both be possible with the software you choose to purchase.

Support for a Large Number of Businesses

You may integrate over one business into your membership with several of the services we reviewed, however, some firms charge an additional fee for this convenience. Furthermore, the sorts of accounting solutions that are crucial to you will be determined by the unique requirements of your company. When it comes to running a small freelancing business, project-based billing may be the most crucial item on your wish list. A full-featured mobile app, on the other hand, maybe at the top of your to-do list if you want to perform some work on the go using your smartphone.

Freshbooks

FreshBooks is a prominent small business accounting software company that provides a comprehensive suite of invoicing and bookkeeping solutions for its customers. FreshBooks’ accounting software keeps track of every company transaction, whether it takes place online or offline, and reports on them. Premium options are available from Freshbooks, with monthly prices starting as low as $15 per month for the most basic plan.

Using Freshbooks will offer you the resources you need to better manage and govern your schedule, finances, and transactions, as well as your transactions themselves. Your money will be tracked in real-time, all of the time, thanks to the well-organized infrastructure and visually appealing dashboards provided by Coinbase.

As a result of FreshBooks’ specialized support team, which tailors FreshBooks to your specific business needs, monitoring your cash flow is easier than with the majority of other small business accounting system options we examined. A free 1-month trial of the program is also provided, so there is no financial risk on your part in trying out the product.

Key features

- Creating invoices — You have the opportunity to customize your emails and generate your own invoices that are fully customized to include your logo and signature.

- The Automatic Expense Tracker — requires just that you link your bank account to the program in order to receive automated updates on your expenditure at specified frequency.

- Keep Track of Your Time — Keep track of the precise time spent on tasks such as engaging clients, completing a project, and other similar tasks.

- Accounting — Provides simple, double-entry accounting tools that are straightforward to use.

- Project Management — Provides comprehensive project management capabilities while also facilitating cooperation between team members.

Pros

- Because it is mobile-friendly software, you may keep in touch with consumers by using the mobile application provided.

- The user interface should be welcoming and intuitive.

- Compatibility with several languages and multiple currencies

- Because it is cloud-based software, it is both affordable and simple to use.

- Excellent customer service is available by phone, email, live chat, and ticketing system.

- Excellent customisation is possible.

- Recognizes credit cards, corporate credit cards, and ACH bank transfers online. Creates project budgets on a regular basis to keep your team up to speed with the latest information.

- Produces insightful information that is both robust and actionable

- Free 30-day trial period is available.

- Every transaction is secured with SSL certification to ensure increased data security and to protect the integrity of the system.

- Expenditure monitoring, time tracking, expense inputs, and customizable invoicing are all available at no additional cost.

- Dashboards that are simple and easy to access will enhance efficiency.

Cons

- It is not feasible to deploy on-premise.

- There isn’t a free plan available.

- There are improvements that can be made to the measurements, goal-setting, and reporting capabilities.

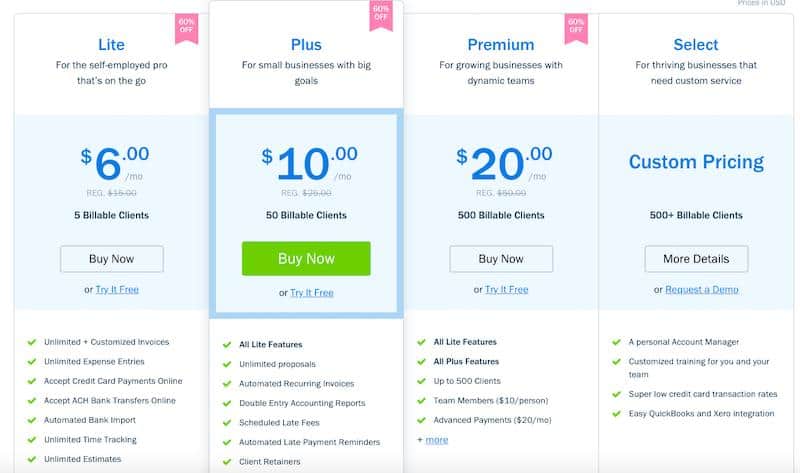

Pricing

QuickBooks

For the most part, QuickBooks Online runs well, and the vast majority of accountants are comfortable with its interface and functionality. As a result, if you’re paying an accountant to manage your finances, utilizing it makes sense.

Despite the fact that QuickBooks has been around for quite some time, the program has only become better with time. It would benefit you to make use of the online assistance or, at the very minimum, to view some YouTube videos in which users demonstrate the software using screencasting tools.

Key features

- Invoicing — design personalized, elegant invoices, financial documents, and projections that you can deliver in minutes.

- Accounting reports and dashboards – evaluate how your firm is functioning in real time with personalized reports and dashboards.

- Cash flow management — Enter invoices from suppliers and reimburse them only when they are due. You may also set up regular payments to save yourself some time.

- Expense monitoring — keep note of every expense you incur during the month in which you must pay your taxes. With QuickBooks mobile app, you can also take pictures of receipts and store them.

- Inventory management — This feature enables you to see the amount of goods you have available whenever you buy or sell inventory since it is updated in real time. Real-time inventory value is also available, which is automatically updated throughout the day and allows you to maintain track of purchase requisitions by keeping a record of what you’ve bought from each vendor.

Pros

- Provides a risk-free 30-day trial period.

- It is possible to deploy on-premises as well as in the cloud.

- There is a lot of customer service available via the phone, mail, tickets, and even live chat.

- Every day, it does automated backups to ensure that you are always up to date.

- This service offers financial institution level data security (128-bit SSL cryptography) to ensure the confidentiality and integrity of your data.

- Accounting services are available 24 hours a day, seven days a week via any device.

- Unlimited access to the platform enables effective, real-time cooperation between various members of the team and between other teams.

- Bookkeeping software is compatible with a variety of operating systems, including Windows, Macintosh, Android, and others.

Cons

- There is no free plan available at this time.

- Support is only available in English, and customer service is not available on weekends.

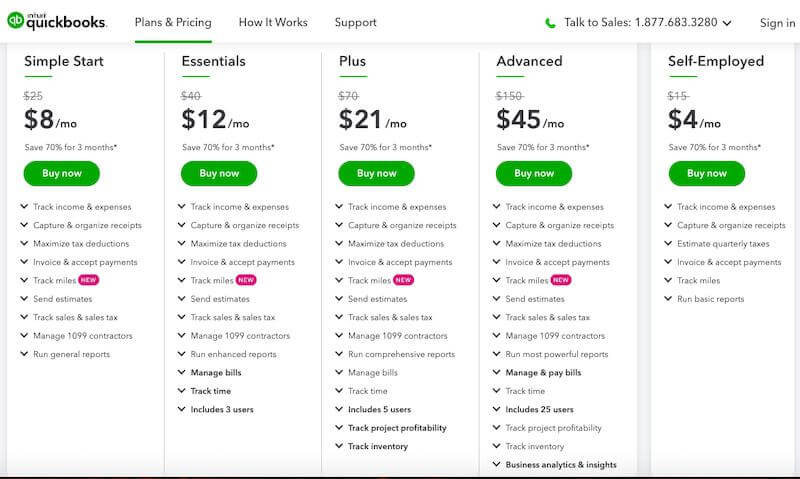

Pricing

Accounting Seed

Developed by Accounting Seed, a fully configurable software solution, Accounting Seed assists you in managing all accounting-related elements of your organization. In addition to being extremely adaptable and simple to use, it also fosters a collaborative atmosphere that helps you to make smart business decisions.

Their open design, which is backed by Salesforce, enables both open personalization and dependable connectivity with tools both inside and outside of Salesforce. Best-in-class encryption, collaboration, and automation are all provided in one convenient location with this simplified database.

Key features

- Financial reporting — Accounting Seed provides a comprehensive range of conventional accounting results, including profit and loss statements, financial statements, cash flow statements, comparisons of budget to actual, comparisons of budget to budget, and many others. They also provide customized reports with bespoke style and computations that are suited to the needs of every organization.

- Flexibility — Accounting Seed offers a plethora of customization features that allow you to modify any business process to meet your specific requirements. This offers customization regarding unique entities and attributes, documentation, security, and a plethora of other capabilities.

- Profitable — Their software is simple to use, and their sales department gives possible incentives to new clients who sign up with them.

- Any task that can be mechanized is one that can be incorporated into a logic loop. This comprises event integration, batch automation, scheduled task automation, as well as the complete digitization of internal control procedures, amongst other things.

- Inventory control management — Maintain complete control over inventory and order management, from purchase to replenishment.

- Sales order management — It allows for the creation of a streamlined sales order procedure that is centralized. A sales order may be created, inventory can be allocated to reserve goods, shipment information can be recorded, and a purchase order can be created straight from the sales order.

- Purchase order management — Completely personalize purchase requisition management by tracking the development and authorization of purchase orders, the reception of products in warehouses, and other activities.

Pros

- An interface that is easy to use and intuitive

- Automate subscription billing and automatic recurring charging based on your requirements and requirements.

- Integration with Stripe allows you to accept credit cards, handle ACH payments, and use other features.

- Analysis of previous, current, and upcoming actions to assist you with billing management

- Purchase orders may be easily integrated with sales invoices and accounts payable.

- Because it is hosted in the cloud, it is simple to set up.

- Customer service is available through phone, email, and tickets.

- You have the ability to link several banks as well as many clients to your account.

- Generate bank reconciliation statements in a matter of minutes.

- Features that allow for powerful automation reduce the need for human data entry that is prone to errors

- The system is very flexible and customizable.

Cons

- Reporting is restricted.

- ACH payments are subject to fees, and customer assistance is limited.

Pricing

- Their website does not provide any information on price. To receive a customized quotation based on your company’s requirements, you may get in touch with their sales staff.

ZipBooks

ZipBooks is an easy-to-use yet sophisticated accounting software solution that may assist you in taking your company to the next level of success. You may use it to help you simplify all of your accounting tasks as it is a cloud-based application.

Key features

- Accounting — Provides a comprehensive and simple accounting solution. You may generate ledgers, bank reconciliation reports, balance sheets, trial balances, income statements, and other financial statements.

- Billing — One-time and recurring billing to ensure that you are paid as soon as possible

- Smart and automatic costs tracking Intelligence – Provides you with a comprehensive set of tools to produce and gather meaningful data and insights to help you stay on track with your business. There are several features available, including the ability to produce a company’s performance score, invoicing quality score, and do smart searches.

- Harmonization — You may synchronize all of your checking accounts and keep all of your financial information private.

- Team Management — Enables all team members to have access to similar data in real-time, allowing for more effective cooperation and communication.

Pros

- It is possible to send an infinite number of invoices.

- Ability to handle an unlimited number of vendors and customers

- Free 30-day trial period is available.

- This program synchronizes with Microsoft Excel and Lite plans.

- You have the option of sending invoices in several currencies.

- PayPal and Square are two options for accepting digital payments, and you can also use them to access accounts receivable plans.

- Allows you to deliver personalized quotes and estimations to customers.

- Cloud-based software that is both affordable and simple to use is becoming increasingly popular.

- Customer service is provided by phone and email.

- Has a fantastic free accounting software solution for freebie users and bookkeepers, as well as a high-quality premium plan for those that can afford it.

- Clients may be texted straight from the ‘Accountant’ custom plan, which also includes time monitoring throughout customer accounts, bulk transaction modification, and a single portal for comprehensive client management.

Cons

- Only the English language is supported.

- There is currently no option for on-premises deployment.

- There is no live chat service or ticket-based customer assistance available at this time.

Pricing

Zoho Books

A comprehensive online accounting platform, Zoho Books manages money, automates company processes, and enables you to collaborate with colleagues from different departments all in one place.

Key features

- Inventory management — It provides comprehensive inventory management, ranging from tracking stock levels to replenishing supplies.

- Project management — With capabilities such as time tracking, role-based permission to track time, documenting project expenditures, and issuing direct invoices, you can undertake full project management.

- Forecasting and invoicing — Create estimates in seconds and transforms them to statements with a single click after they have been accepted.

- Automation — Take use of the software to automate time-consuming, error-prone, and high-volume processes that are otherwise inefficient.

Pros

- Offering a 14-day free trial, as well as connections with Google, Mastercard, Razorpay, Microsoft 365, and other third-party services

- Compatibility with mobile platforms is complete.

- Because it is cloud-based, it is both affordable and simple to set up.

- Customer service is available through phone, email, and online ticketing.

- It is very configurable because to the RESTful API.

- Interface that is easy to use and intuitive

- It is possible to track the credit status of clients and generate new orders through integration with Zoho CRM. as well as additional

- There is a large selection of invoice layouts to pick from, each of which may be extensively customized with a logo and delivered to clients separately.

- Capability to work in several languages and multiple currencies

- Bills may be created, sent, and managed online, and stock levels can be automatically adjusted.

- Create recurring invoices for purchases that you make on a regular basis.

- A customer portal is available for simple acceptance of quotes, bulk payments, and other tasks.

- With real-time information access, you can confirm sales orders, keep colleagues up to date, and eliminate delivery mistakes altogether.

- View dashboards, charts, and reports for all collections, payables, and inventories in an one location.

- Receipts, invoices, and bills may all be scanned and information extracted using the auto-scan function.

Cons

- There is no on-premise deployment available.

- There is no live chat assistance available.

Pricing

Final Thoughts

A large number of various accounting software alternatives are available in the marketplace. The most effective accounting system is the one that best meets the demands of your company. Based on our hundreds of hours of study and evaluation of all of these businesses, the list we’ve compiled for you above should provide you with a decent sense of which small business accounting software would be the most beneficial for your individual company’s requirements.