B2B sales models were challenged tremendously in 2020 as sales teams around the world had to transition to virtual engagement. As such, B2B sales models shifted to things like new online events, webinars and podcasts in order to be able to seamlessly engage and support their clients during stay at home orders and lockdowns. Looking ahead to 2021, it appears that one of the key challenges for B2B sales models will be balancing the in-person physical experience with the digital brand experience. While news of global vaccine roll-outs present a glimmer of hope for a return to physical events and meetings, many virtual experiences will remain simply because of the value people are placing on the flexibility online experiences offer. People have come to realize that traveling hundreds, or even thousands, of miles to obtain the expertise of industry experts is no longer necessary. 2020 showed how easily someone can tap-in to expertise from anywhere in the world, and often based on their personal schedule and that is a convenience that many will likely not want to give up entirely.

We have curated six pieces of information, data, and/or statistics surrounding how B2B sales models have been impacted by COVID-19. This has included, but not been limited to, marketing and sales strategies. Additionally, we have also located five pieces of information, data, and/or statistics surrounding how B2B sales models will have to pivot, as well as the tactics industry experts and thought leaders are saying that needs to be considered, as we move forward into 2021 [post COVID]. All data presented has been sourced from credible and reliable sources with a global view.

COVID-19 Impact: B2B Sales Models

- Recent McKinsey global based research on how B2B decision makers are behaving across industries since the pandemic started, clearly shows that online and remote selling to new customers is considered as effective or much more effective as in-person engagement. Sales reps also believe “digital prospecting is as effective as in-person meetings to connect with existing customers.”

- Videoconferencing and chat have both emerged as the key channels being used for both interacting with clients and for closing the sales deal because of COVID-19. Videoconferencing has shot up from 38% to 53%, while online chat has risen as the preferred method from 40% to 49%. Data clearly shows that in-person meetings and related sales activities have dropped from 61% to 29% since the pandemic.

- The success metrics of this shift can be seen in the amount of revenue being generated from videoconferencing and chat. Videoconferencing revenue has jumped by 69%, with chat rising by 31%. What about the traditional route in-person method? The revenue generated there has dipped by 55%. It is of note that currently e-commerce and videoconferencing is responsible for 43% of all B2B revenue, which is more than any other channel. A small note: when customers were asked whether they prefer video to phone, the answer was overwhelming the former over the latter.

- COVID-19 has certainly disrupted B2B sales, according to this HBR source. There are very few businesses that have dodged the economic upheaval. About 50% of B2B buyers are putting purchases on hold as a result of the virus in industries such as automotive, travel, and hospitality. However, it is not all bad news. The other 50% of B2B buyers are not holding off on purchases, “meaning deals in their markets are still moving forward in businesses in the technology, e-commerce, and marketing sectors, which have not been hit as hard.”

- One key finding from an April 2020 study by McKinsey was that digital interactions are viewed by B2B companies now as two times more important to their customers than traditional in-person sales calls. This view is being driven by customer behaviors. Globally, a customers’ desire for digitally enabled sales interactions has jumped significantly when they are researching products. “Preferences include interacting with suppliers’ mobile apps and social media or online communities, with all three showing their biggest increase since 2019.” When digging into the preferences of B2B buyers, “mobile apps are twice as important to Chinese consumers for researching products versus for those in the UK or Germany.“

- A study conducted by the IBM Institute for Business Value found the disruption caused by COVID-19 can create fertile ground for marketing and sales innovation. Due to the pandemic, 73% of B2B CMOs say they’re now shifting more promotional activities online. B2B salespeople are facing a distance based pursuit of a collection of individuals. A webcast isn’t the same as bringing people together in person. Still, successful sales organizations are turning to digital methods and solutions to connect and get closer to decision-makers and influencers.

Post COVID-19 Impact: B2B Sales Models — Necessary Changes in Tactics

- According to Adobe, “the consensus among several industry experts is that marketplaces for B2B companies, and progressive web apps, are among the technologies that will see greater business adoption in 2021.” They also predict that B2B commerce will look a lot more like business-to-consumer (B2C) commerce with improvements to the user experience and a greater emphasis on direct-to-consumer (DTC) sales. Mackenzie Johnson is the marketing and partnership manager at BORN Group, which is a digital marketing agency that is based in New York. She asserts that “[a]s we recover, everyone’s expectations are that digital works. Going into 2021, the customer experience has to be excellent.”

- Long before the pandemic was even thought of, B2B online sales were growing much faster than retail sales. However, once global shutdowns and stay-at-home orders were issued in March 2020, a tremendous number of people gravitated towards online commerce simply out of necessity. There were some B2B companies that were left out of this though. As an example, software as a service [SaaS] B2B companies typically employ in-person demonstrations to show their value. Social distancing protocols, as well as the shut down of most businesses made this a non-starter. Those companies need to develop an “online alternative in order to continue educating and impressing potential customers.” Digital purchasing is now the new normal for the B2B industry, and should not be ignored. Looking into 2021, it is obvious that B2B sales models need to make it a permanent solution rather than a temporary workaround.

- According to Forrester research, in 2021, in order to meet the ongoing challenges of COVID-19, B2B sellers and sales leaders will have to continue to refine their methods and strategies. Forty percent of B2B sales representatives revealed that they “plan to modify their tactics to adapt to remote selling activities.” Further more than half [57%] of B2B sales leaders “plan to make deeper investments in tools with Al and automation.”

- Industry experts are predicting a greater level of digital interactions between buyers and suppliers which will disrupt current traditional sales models. Gartner research is asserting that in just five years, “80% of B2B sales interactions between suppliers and buyers will occur in digital channels.” Gartner also states that “B2B sales reps need to embrace new tools and channels as well as a new manner of engaging customers, matching their sales activity to their customers’ buying practices and information-collecting needs.” Three specific actions should be taken: diversify digital selling tools and channels, rethink B2B sales enablement, and prioritize the seller experience and coaching.

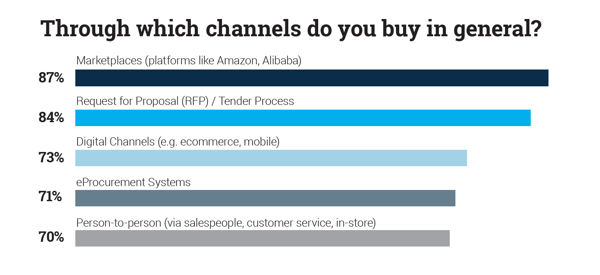

- Online marketplaces that bring buyers together with a variety of sellers have been around in some form for years, but they’re increasingly becoming a key part of B2B commerce because they provide access to a wide selection of suppliers and products. According to a recent study by market researcher WBR Insights, 87% of B2B buyers are already purchasing on online marketplaces. The growing popularity of B2B marketplaces makes them an important go-to-market strategy for businesses of all sizes, whether they start their own marketplace or list their products on existing ones. The report delves into “age differences across B2B buying by channels, preferences, and values for Millennials, Gen X, and Baby Boomers.” Online marketplaces will remain popular throughout 2021 and continue to gain traction.