Table of Contents

Cryptocurrency prices dropped nearly 20% in one day: Is this the dip we’ve been expecting? After Elon Musk’s tweet about reversing Tesla’s acceptance of Bitcoin as a payment option, the volatility wiped away up to $365 billion from the crypto market.

At the time of writing, however, Bitcoin and Ethereum — the two most valuable cryptos — had recovered by 0.8% and 2.1%, respectively. Since investors are becoming increasingly concerned about interest rates, the cryptocurrency market still provides positive potential.

“How do I exploit this market drop and make the most of it?” is a question you may be asking yourself. This is the perfect post for you. Investing in the crypto market at a low price will be discussed in detail in this post.

What Is Buying The Dip?

There is a lot of volatility in the financial markets, particularly in the cryptocurrency markets. The prices don’t just go in the direction of the trend, whether it’s bullish or bearish. Instead, they look for chart corrections, which might be a good place for traders to enter the market.

Buying the dip is a common investment technique that may be applied here. If traders feel that the present trend will continue, they should initiate a strategy when the price drops.

When an asset’s value plummets and the dealer sees their position in the red, or if they aren’t in a position, the price might easily fall much more, it may be difficult to put this theory into effect.

However, even when the chance to purchase the dip is there, it’s the difficult aspect of overriding basic human feeling and moving forward regardless of the existing trading position that makes it so difficult.

Considerations Before Buying a Dip

You’ve been keeping an eye on the price of cryptocurrencies while hoping they’d go down in value. Isn’t it time to finally invest now that there appears to be a correction taking place? To avoid making a costly mistake, consider the following.

- Is this the right moment for you? It’s never a smart idea to buy anything just because it’s on sale, and this holds true for crypto as well. Most investors can’t tell the difference between a price reduction that’s just transitory and one that’s an indication that prices are likely to plummet even more. Consider whether or not you’re capable of handling the inherent danger with cryptocurrencies. This is something I’ll stress over and over again: before you acquire any cryptocurrency, ensure you got a reserve fund and a very well investment portfolio in place. If cryptocurrency prices continue to decline while you invest every spare euro, you run the danger of jeopardizing your financial future. Consider the big picture. Your crypto investment could have to be liquidated sooner than you intended because of an unforeseen expenditure, and if values have fallen, you could lose a significant amount of money as a result.

- Choose your crypto investments wisely. All digital currencies aren’t created equal; some have a better chance of success. You’d check a company’s earnings reports and long-term goals before investing in its shares, wouldn’t you? You should do the same thing here to see if a cryptocurrency has potential for long-term growth. Think about whether or not the money is already being used in the actual world. While the prices of hot cryptocurrencies may rise in the short term, there is little chance of their increasing in value over the long run.

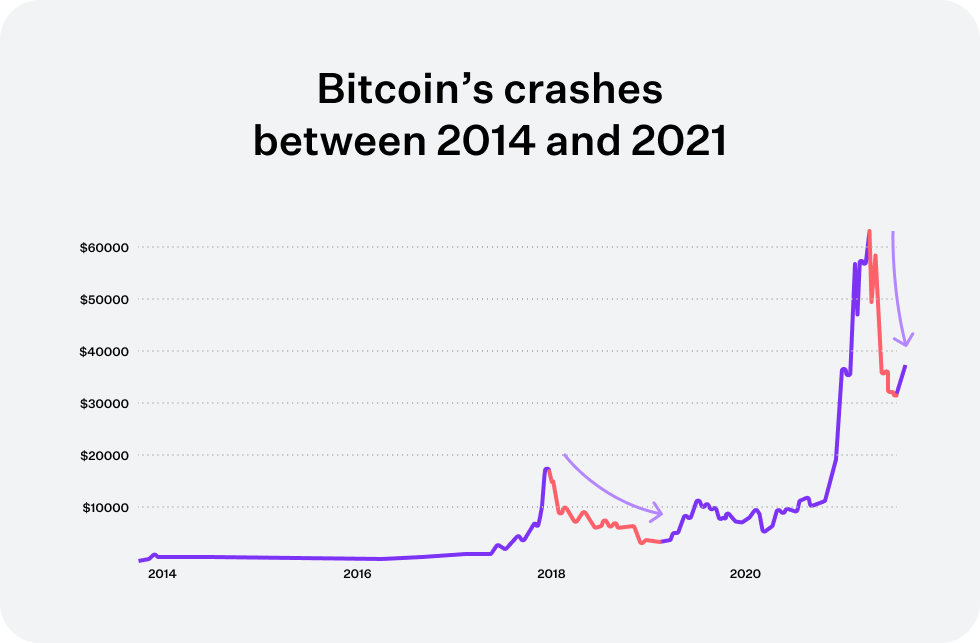

- Recognize how volatile cryptocurrency is. When buying a stock at a discount, the usual belief is that costs will rise again, thus buying now will result in larger profits in the future. The crypto movement is only getting started, and no one is sure what will happen. While its long-term viability remains uncertain, several cryptocurrencies have recovered from past crashes and there is no assurance that they will do so in the future. Do not thus assume that what has occurred previously will occur again in the future.

When it comes down to it, “buying the crypto dip” is a gamble on the future of decentralized money. It truly does resemble playing the lottery with the knowledge we have now. Not everyone will enjoy it, so do your research before spending any money on it. Also, don’t be fooled by marketing hype. Only time can tell if you’re one of the fortunate ones who walk away with a fortune from this. The decision is yours to make, as it always has been.

Last but not least, strive to do better than I did and avoid being a walking advertisement for the buy high, sell low meme craze. I don’t believe the effort is worthwhile.

How to Buy The Dip in Four Easy Steps

- Step 1: Recognize the Overarching Trend

A bullish market is necessary for crypto investors to profit from purchasing the dip, therefore they need to conform and adapt their investment plans accordingly.

With the help of MACD indicator lines, you can figure out where the market is headed. Two lines make up the MACD: a longer moving average and a shorter signal. MACD is an oscillator that measures the momentum of a price movement. It indicates a bullish trend when, for example, the 26-period moving average passes the 9-period signal line.

- Step 2: Locate the Market Dip

As a result, there is no foolproof method for locating the low point in the distribution curve. A candlestick graph and resistance lines, on the other hand, might confirm a drop, or the end of a dip, in the market.

First and foremost, a price downturn in a positive trend is a dip in prices that is much higher than the support line of the trend (in green). Trading in cryptocurrency begins in the red section and ends in the green portion, which is where a dealer may close out his or her position in the cryptocurrency.

It’s possible that, on April 19, 2021, prices will break through resistance and proceed on a downward trend, signaling the beginning of a new trend. If the drop closes in on support (seen in green), this may mean that the market’s direction is about to shift.

- Step 3: Recognize the reasons why dips occur

Other tell-tale symptoms of a crypto bear market include macroeconomic developments, breaking news, and, obviously, tweets from the community! A million dollars may be moved by a single phrase, and Elon Musk’s Tweets are among the most effective. Elon Musk is posting a series of tweets that minimize Bitcoin, leading the King of Cryptocurrencies to experience a major sell-off. The maneuver has been dubbed “a four-dimensional chess move” by Yahoo!

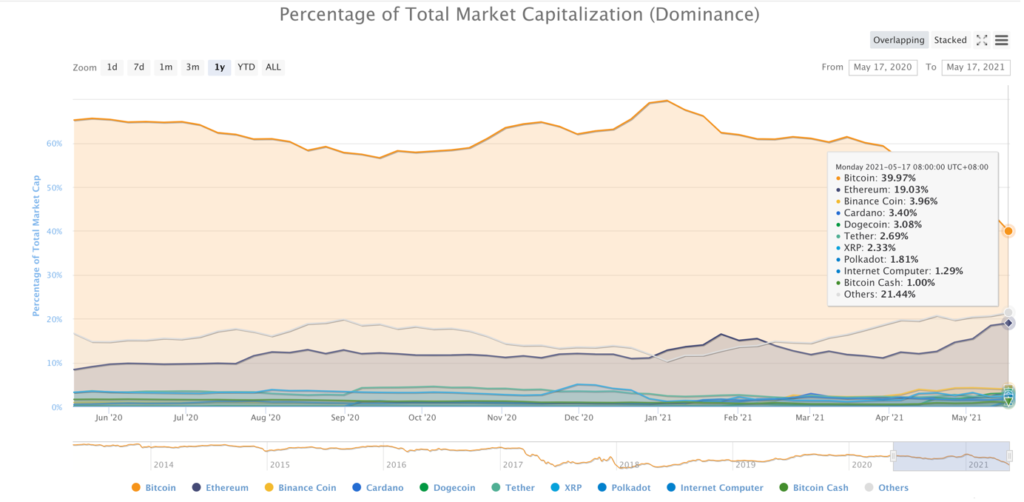

Bitcoin’s supremacy has been eroded by 20% month-to-date, according to CoinMarketCap. As a result, this is not a slump, but rather a correction.

A more realistic explanation for the decline in the value of cryptocurrencies might be the political turmoil occurring throughout the world. Several variables, particularly in terms of length and strength, might contribute to a decrease. However, because of its uses in decentralized finance (DeFi) and a variety of other sectors, cryptocurrencies are becoming a more feasible alternative for inflation hedges.

- Step 4: Selecting a Trading Platform

What is the significance of selecting an exchange? To profit from purchasing the dip, the cryptocurrency trader must have features such as the ability to create limit orders and the ability to process transactions quickly. Bybit facilitates the establishment of long positions in Bitcoin futures and processes. 100,000 transactions per sec are possible.

Transactions per second (TPS) is the volume of transactions that can be processed by a blockchain network in a second, or the number of matching machines that can be processed in a second.

Pros of Buying the Dip

This enables cryptocurrency traders to make transactions at the optimal moment to maximize profits.

Many investors like to invest when the market is at a low point, which is called buying the dip. When coupled with technical analysis, it has a reasonable degree of reliability. The following are some of the benefits of using purchasing the dip as an investment plan.

It is a repeatable process

It is not always possible to time the market in a controllable manner. As a result, many investors prefer to take a more conservative approach, such as purchasing and holding. Buying the dip is primarily reliant on mathematical equations, which are very predictable in their results. Fibonacci ratios are time and value wave connections that have been calculated. Corrective waves, for example, have a retrace factor of 38 percent of the prior impulse frequency.

Increased Profits

The sole purpose of investing in stocks or cryptocurrency is to benefit from the transaction. A buying opportunity for investors is to enter the market at a much lower price by waiting for the market to correct itself. The expectation is that when the market recovers, they will be able to resell the assets at a better price. You will earn good profits if you can timing the market correctly.

Cons of Buying the Dip

Buying the dip is a viable trading strategy, however, like with other trading methods, it does not guarantee profits. If you make a mistake, you might end yourself purchasing a position that is about to go over a cliff. Some of the drawbacks of purchasing the dip are listed below.

Recovery Is Prolonged

The key to generating money by purchasing the dip is recognizing when prices have dropped for a while. Unfortunately, determining whether a fall is a short-term blip or the beginning of a downtrend can be difficult. If you get this incorrectly, you might find yourself with worthless assets. While, on the other side, dollar cost averaging protects the investment against market fluctuations.

There is a risk of missing out

Buying the dip necessitates a continuous vigilance over the market, looking for signs of a decline. Usually, you only have a little window of opportunity to determine if the decline is transitory or a warning indication. If you don’t invest and your analysis turns out to be inaccurate, you will have missed out on a lucrative chance.

The September 2021 Bitcoin Dip

Bitcoin’s price is on a continuous dip, heading toward $40,000 on Friday after briefly touching $45,000 on Thursday, following a downward pattern that has been in place for several weeks.

Following a prohibition on cryptocurrency transactions and production by China’s central bank, which proclaimed all cryptocurrencies to be unlawful in the nation, bitcoin has experienced a precipitous plunge. Since reaching a high of $52,000 on Monday, September 6, Bitcoin’s price has been hovering about $45,000 ever since, unable to break beyond the $50,000 barrier.

Before the latest fall, Bitcoin had been steadily increasing after dropping below $30,000 in July.

Earlier this year, Bitcoin hit a peak of more than $60,000, and the cryptocurrency’s current rise has highlighted the cryptocurrency’s cyclical nature at a period when more and more individuals are interested in becoming involved. The price of Bitcoin has gradually increased in the weeks between the most recent July downturn and its current high points earlier this month, with multiple daily highs exceeding $50,000. Again, Bitcoin is a very volatile asset, so these highs and lows are expected.

What Does This Dip Mean for Crypto Investors?

Volatility like this is to be anticipated for long-term crypto investors who use a buy-and-hold strategy. Humphrey Yang, the financial guru behind Humphrey Talks, believes recent market drops are nothing to be concerned about. Yang says he avoids examining his assets during dangerous market falls.

When Yang claims he’s gone through the 2017 cycle, he’s referring to the ‘crypto collapse,’ in which many major cryptocurrencies lost a lot of value, including Bitcoin. I’m aware of how unpredictable these things can be; on some days, they’ve dropped by 80%.

Cryptocurrency investments should account for no more than 5% of your whole portfolio, according to experts. If you’ve done that, Bill Noble, Chief Technical Researcher at cryptocurrency analytics platform Token Metrics, says you shouldn’t worry about price volatility anymore.

There will always be volatility in the market, according to Noble. “It’s something you’ve had to put up with,” she said.

The same technique Yang advocates for any long-term investments: just set it and forget it as long as your cryptocurrency investments don’t interfere with your other investment goals and you only invest the amount you’re willing to lose.

If you’re concerned about a sudden decline in the value of your crypto assets, you may be putting too much faith in them. You should only put money into investments that you’re willing to lose. No matter how much your crypto holdings have dropped, the same advice applies – don’t act rashly or drastically alter your plan too fast. Instead of buying crypto directly, think about what you would be more comfortable doing in the future, such as committing less money to it or diversifying your portfolio through crypto-related equities and blockchain funds.

Final Thoughts

Opportunities entice people, but they’re only worthwhile if you’re ready to put money into them. Even if cryptocurrency price drops occur frequently, not all of them will be recovered. Extensive research is a great approach to make use of them. You’ll discover knowledge that’s far more valuable than a small discount most of the time.