Table of Contents

Do you have any plans to get involved in the cryptocurrency market? Buying in Initial Coin Offering (ICO) coins is one technique that comes highly recommended. These are digital currencies that have been placed into circulation as a result of initial coin offerings (ICOs).

Because they are provided at cheap rates to attract interest before they can begin to be traded on the markets, ICO cryptos are an excellent choice for investors. So when the tokens first appear on the market, they’re in great demand, and early investors may profitably sell them.

Despite the fact that ICOs provide a lucrative investment opportunity, not all of them are legitimate. Brad Garlingehouse, the CEO of Ripple, and Joseph Lubin, the co-founder of Ethereum, both criticized the fact that the majority of ICOs were frauds.

With this post, you’ll be equipped with the knowledge you need to decide which initial coin offering (ICO) to buy-in and how to get the most out of your money.

What Exactly are ICOs?

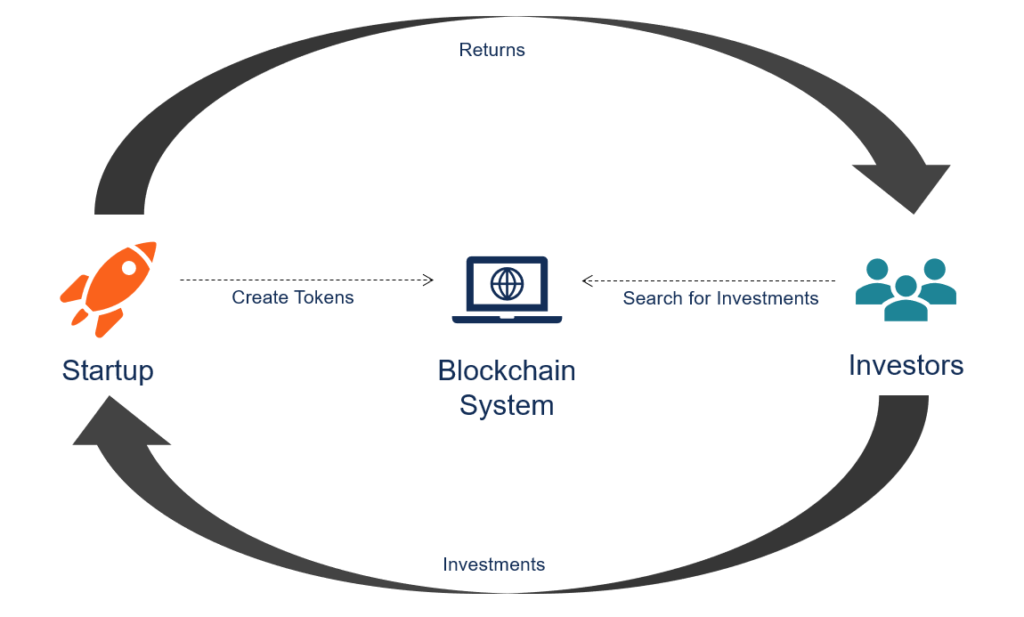

What does it imply when someone talks about an ICO? Capital can be raised by a cryptocurrency through an initial coin offering. An ICO is a means for a firm to raise money through the use of a token sale. The firm may then utilize this money to develop a new currency, software, or service in the blockchain ecosystem.

Traditional firms often make an initial public offering (IPO) to obtain cash.

In return for their investment, interested parties will get the company’s own coins in the mail. An ICO, like an initial public offering (IPO), may be compared to a stock offering. It’s not an exact analogy because the ICO might be useful in and of itself for the software service or product being delivered.

Some initial coin offerings (ICOs) have generated enormous profits for their investors. Other ICOs, on the other hand, have proven to be scams or a waste of time.

Just as with an IPO, you never know if you’re investing in a huge firm or being duped by an unscrupulous entrepreneur. It’s also possible that the start-up may collapse completely. Early access investment carries some risk.

ICOs, on the other hand, are almost unregulated. When studying and investing in ICOs, investors must be extremely cautious and diligent.

How ICOs Work

Initial coin offerings are complex processes that need the expertise of a wide range of disciplines, including technology, finance, and legislation. Blockchain-based initial coin offerings make use of decentralized platforms to raise money while aligning the interests of diverse stakeholders. Below is a step-by-step breakdown of how an ICO works:

Identification of investment objectives

A company’s aim to raise cash always kicks off an ICO. Fundraising campaigns are targeted at certain individuals or organizations, and the firm puts together investor-friendly information on these entities.

Token creation

Once the initial coin offering is complete, tokens will be created and distributed to investors. Tokens on the blockchain are essentially digital representations of some kind of asset or service. Tokens may be traded and are fungible. Since the tokens are only alterations of current cryptocurrencies, they should not be mistaken with cryptocurrencies. Tokens, as opposed to stocks, do not provide the holder an ownership share in the firm. An alternative is to get some kind of ownership in the company’s creations in exchange for tokens.

In order to generate the tokens, developers must use one of many different blockchain systems. In contrast to the establishment of a new coin, creating tokens does not necessitate writing the code from start. Alternatives include using pre-existing blockchain systems like Ethereum, which allow tokens to be created by making small changes to the source code.

Marketing campaign

A firm will often launch a marketing campaign at the same time to entice investors. To reach as many investors as possible, most campaigns are run online. However, the marketing of ICOs is presently prohibited on a number of big internet platforms, including Facebook and Google.

The initial public offering

Tokens are created and offered to investors after they have been created. There may be multiple rounds to the offering. Token sales revenues can be used by the firm to create a whole new product or service, while investors can either immediately use their tokens to benefit from the new product/service they have invested in, or they can wait for the value of their tokens to appreciate.

Initial Coin Offering (ICO) vs. Initial Public Offering (IPO)

What does it imply when someone talks about an ICO? We’ve compared ICOs to IPOs to try to find an answer to this issue.

An IPO is an option for conventional firms looking for a fast infusion of cash. Individual investors can buy shares in a company through an IPO, allowing the company to raise money in this manner.

Similar to an ICO, the token used in an ICO represents ownership in the firm or project.

However, an ICO and an IPO vary in two respects. Because they are mostly unregulated, initial coin offerings (ICOs) lack the oversight of government agencies like the Securities and Exchange Commission (SEC). Due to its decentralization and absence of oversight, ICOs are far more flexible in their structure than IPOs.

To meet the company’s objectives and the project’s requirements, ICO formats vary widely. There are many alternative ICO formats depending on the financing goals, token quantity, and token pricing.

Like a crowdfunding event, an ICO may also engage with fans eager to invest in a new initiative.

Crowdfunding campaigns, on the other hand, are donations that help launch a product. Investors are drawn to an ICO for a variety of reasons, including the possibility of a high return on their initial investment. Crowdsales, on the other hand, is the term used to describe an ICO.

Types of ICOs

The following are two types of initial coin offerings:

- Private ICOs

Only a small number of investors may take part in exclusive initial coin offerings. Companies might opt to establish a minimum investment amount and only authorized buyers are allowed to participate in private ICOs.

- Public ICOs

Initial coin offers (ICOs) for the general public are a type of crowdfunding aimed towards the general public. Because virtually everyone may participate in a public offering, it serves as a type of democratized investment. Regulators, on the other hand, are beginning to favor private ICOs over public ones.

Because of the emergence of crypto and blockchain technology, initial coin offerings (ICOs) are becoming increasingly popular. Almost the course of the year, over $7 billion was generated via initial coin offerings (ICOs). The amount more than doubled in a single year, from 2017 to 2018. Telegram conducted the biggest ICO to date. It raised more than $1.7 billion through an unlisted private ICO in the UK.

Which ICO Tokens Should You Invest In?

The first step in investing in ICO tokens is to pick the correct ICO. However, this is not a simple task due to the continuous influx of new ICOs onto the market. Here are the measures to take in order to invest in the best ICOs:

Analyze the Composition of the ICO’s Team

You may learn a lot about the project’s sincerity by evaluating the ICO team. Follow the membership of the advisory and development teams to learn more about them and their previous achievements.

Social media sites like LinkedIn and the companies where members are employed might provide you with information on them. You might even make contact with them, particularly if you’re doing it via social media.

In order to assist the initiative to grow into a successful endeavor, it’s vital to understand the team members’ dedication, talents, and abilities. Avoid coins when past crypto and non-crypto activity has yielded unfavorable feedback from the community.

Analyze the White Paper for the Project

Tokens are just as valuable as the projects to which they are linked, so choose wisely! As a result, only put money into an ICO token that is tied to a promising enterprise. You should read the white paper of the project that’s behind the token of interest if you want to learn more.

The white paper is a comprehensive study that educates readers about a challenge and the proposed solution. Details on the project, tokens, and distribution are included. It’s a talking point used by the ICO’s creators to show why an entrepreneur should purchase the tokens and join the project.

If you have any questions regarding the project after reading the white paper, be sure to ask the developers. Before investing, make careful to enquire about even the most minute aspects of the ICO and the project.

Get the Latest Opinions from Well-Known Crypto-Communities

People who wish to learn more about cryptos may turn to sites like Reddit and Bitcointalk, which have amassed a wealth of knowledge on the subject. When it comes to investing in cryptocurrencies, the communities have the ability to look at projects from many perspectives and come up with solid judgments. You may ask a question about an ICO you’re interested in and wait for a response, or you can look back at previous market reports for more information.

Keep in mind that even in the crypto community, favorable discussions about ICOs may be found distributed through reward schemes that solely aim to highlight the good things about an ICO. Consequently, you should just examine reports that are in line with your own and your professional evaluations.

Verify the Funds’ Long-Term Purpose

The long-term usage of ICO money may tell you a lot about a project’s potential as an investor. Only buy in ICOs that use the cash raised to further the growth of the project. The value of a crypto project’s tokens might rise significantly if it is actively developed over time.

How to Invest in Initial Coin Offerings (ICO)

Once you’ve chosen your desired ICO, you may proceed to purchase the tokens that are currently on sale. As an example of how to buy in crypto tokens, have a look at the following example:

Read the Token Purchase Procedure through

Token sales are designed differently for each ICO. In many situations, they offer a webpage where interested parties can acquire tokens using a variety of payment options. For those who want a more streamlined trading experience, there are crypto exchanges that are better suited.

For a successful purchase, be sure to strictly adhere to the authorized crypto selling method. Check, for example, the number of tokens consumers may acquire at the maximum and least levels. A lot of tokens aren’t moving to one party because of the restrictions.

Open a Wallet That Supports ICO

Open a compatible wallet after you’ve decided on an ICO to invest in. If you have a cryptocurrency, you’ll likely need a digital wallet to store it. Although this is the commonly accepted definition, it should be noted that digital currencies are not really stored in wallets.

The codes stored in crypto wallets enable users to connect to their blockchains, transfer and receive their currencies, and track their trading history. They also help users keep track of their transactions. To protect your currencies on a blockchain, you’ll need private keys, which are unique codes that only you have access to. The key should never be divulged to anybody save the owner.

Aside from that, there are other codes known as public keys that serve as the wallet’s address. Additionally, your wallet will produce a seed phrase for use in the event that you misplace your private keys.

Check to see if the wallet you’ve chosen is compatible with the ICO token you’re considering. Ledger Nano S and MyEtherWallet are excellent examples of crypto wallets. Keep in mind that you must never divulge your wallet’s seed phrase or private keys to anybody.

Become a Member of the Exchange Where the Tokens are Being Sold

In order to purchase an ICO token, you must first sign up for an account on a cryptocurrency exchange like Binance or KuCoin. This requires the creation and financing of a user account.

Using Kraken or Localbitcoins.com to transform your funds to the supported token is necessary if the exchange hosting the ICO only enables customers to buy the new coins with other currency like Bitcoin. The next step is to transfer the tokens to the marketplace hosting the selected ICO.

Navigate to the exchange’s trading platform and choose the new ICO token to buy. After that, link your exchange account and make the purchase using the coins you’ve matched. When the additional ICO tokens are added to your exchange account, you’ll receive credit.

Transfer the Tokens to your Wallet

Because they are consolidated and a simple target for hackers, most bitcoin exchanges are deemed unsafe. Every big loss in cryptocurrency history has occurred at the exchanges if you keep track. For example, in 2011, a breach of Mt. Gox resulted in a loss of over 600,000 BTC and a recent attack on Youbit led the exchange to file for bankruptcy

To keep your ICO tokens safe, make sure you transfer them to your wallet as soon as you buy them. Because you are the only one with access to the secret keys, this location is thought to be more secure. A hardware wallet or a paper wallet will keep your tokens safer than any other method of storage.

How to Profiting from an ICO

Once you’ve found a solid ICO, there are a number of methods to reap the rewards. It’s important to keep in mind that the method you choose will be determined by your own goals, such as whether you want to sell your coins right away or keep them for an extended length of time.

Sell Tokens When Prices Rise

Buying tokens during the ICO and reselling them when the price rises is the most straightforward method. There are just a few people that have the chance to buy tokens during an ICO since there is such a restricted supply.

As soon as the tokens are made available to the public, individuals who missed out on the opportunity to buy them drive the price higher. This is an excellent time to liquidate your holdings and realize a profit.

Trade the Tokens on the Exchanges

Instead of profiting from an ICO by selling the tokens as soon as they reach the market, you might want to think about trading them. Trading cryptocurrencies entails taking positions for the short- or long-term, depending on the market conditions.

Understanding how volatile the cryptocurrency market can be is crucial. In order to minimize the risks involved, traders should invest time in learning how to read market patterns and how to use key tools like a stop loss.

Advantages and Disadvantages of Initial Coin Offerings

In an initial public offering (IPO), investors get stock in return for their investment. There are no actual shares in an ICO. Companies that raise money through an initial coin offering (ICO) provide investors a cryptocurrency token in exchange for their money. Investors often pay with an already popular token (such as bitcoin or ethereum) in return for a corresponding amount of new tokens.

In this day and age, launching an ICO to produce tokens is really simple. It is possible to generate cryptocurrency tokens instantly using internet services. When comparing the differences between stocks and tokens, investors should bear this in mind: a token has no inherent value or legal assurances. It’s the job of ICO managers to create tokens in accordance with the ICO’s conditions, collect them and then redistribute them to investors in accordance with their strategy.

When an ICO first begins, early investors are typically encouraged to acquire tokens in the hopes that the project will be successful once it has been launched. If this occurs, the valuation of the tokens they bought during the ICO will rise above the price established during the ICO, and they will make a profit. An ICO’s major advantage is the possibility of huge profits.

Many investors have become billionaires as a result of ICOs. ICOs raised an estimated 12.7 million in 2017, with 435 of them being successful. There was a $5.6 billion total money raised in 2017, with the ten largest projects contributing 25% of the total. Tokens bought in ICOs returned 12.8 times their initial investment in currency terms on average, according to the study.

In the bitcoin and blockchain sectors, ICOs have brought new problems, dangers, and possibilities to the forefront, all at the same time. The prospect of rapid and substantial returns on investment is what attracts many investors to initial coin offerings (ICOs). This optimism has its roots in the most profitable ICOs of the last several years, which have in fact generated enormous profits. However, the excitement of investors might lead individuals astray.

Overaggressive and underinformed investors are easy victims of scam artists since ICOs are mostly unregulated. Financial authorities such as the SEC do not regulate them, thus monies lost to theft or incompetence may not be recovered.

Early in September, a number of government and non-governmental organizations reacted negatively to the rapid increase of initial coin offerings (ICOs) in 2017. A ban on initial coin offerings (ICOs) was announced by the People’s Bank of China, which deemed them harmful to China’s financial system stability.

The People’s Bank of China forbade the use of tokens as money and banks from providing ICO-related services to its customers. In response, the price of bitcoin and ethereum fell, which many saw as a foreshadowing of future cryptocurrency regulation. Existing offers were also punished by the prohibition. Advertising for initial coin offerings (ICOs) was outlawed by Facebook, Twitter, and Google in early 2018.

Final Thoughts

Large blockchain initiatives and some of the best cutting-edge token projects around the world use crypto ICOs as a technique for raising funds. Performing your own research before investing in an ICO is a must. The majority of the time, the ICO initiative will walk you through the procedure step-by-step.

Every week, a slew of new, hot crypto-related initial coin offerings (ICOs) are announced. Tokens on the cryptocurrency ICO list are all based on the promise of profits of 1,000 percent or more in a short span of time.

The ICO sector, which was almost non-existent before, has produced tens of billions of dollars in revenue and offers huge upside, but the downside is equally substantial.