Table of Contents

For most SaaS organizations, the process of aligning their sales and marketing teams has been an uphill battle. Marketing may think sales isn’t following up on leads well, and sales may think marketing’s leads aren’t worth their time. Increasing the amount of Marketing Qualified Leads (MQLs), or leads that are most likely to become customers dependent on lead scoring, is a great method to increase consistency between your marketing and sales teams.

You may employ the strategies listed below to help your SaaS firm generate more high-quality leads.

What is an MQL?

Prospects who fit your target buyer profiles and show actual potential to complete the conversion process are referred to as marketing qualified leads (MQLs).

For this reason, programming students are probably not MQLs if your target market is CEOs of technology firms. When your revenue objectives are $30,000 per year or more, small firms with yearly software budgets of $5k may not be worth considering, no matter how much they appreciate your platform’s free version.

If you want to reach your marketing/business goals, you need MQLs to help you get there. MQLs indicate both a proven interest in purchasing your SaaS product and the ability to assist you to get there.

Your marketing efforts may be more targeted by identifying more MQLs, which allows you to spend less time and money on prospects who aren’t likely to purchase your software.

How do you Identify MQLs?

This combines two major elements of your marketing and sales strategy and is necessary before you can acquire MQLs.

Buyer personas: The traits of your target buyers that show your company their worth.

Marketing objectives: The marketing objectives that these buyer personas will help you attain.

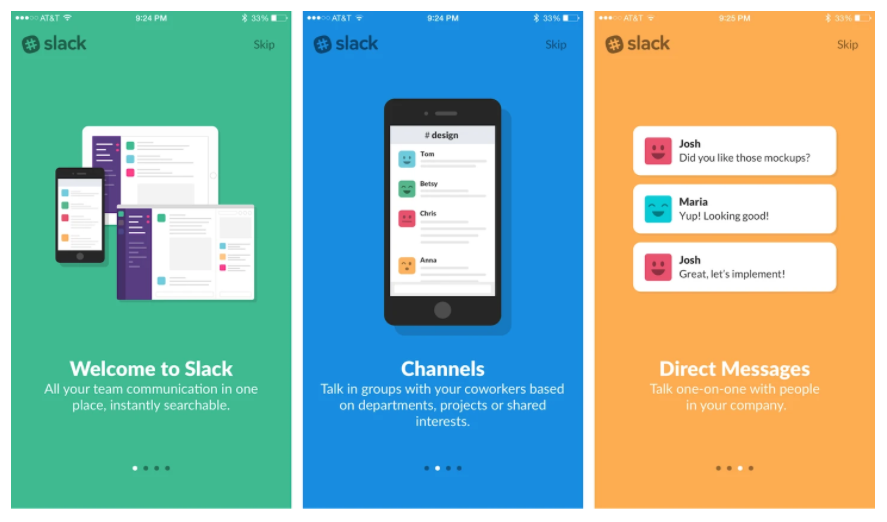

For example, a firm like Slack will have a wide spectrum of customer personas, spanning from CEOs of corporate organizations to bootstrapped creatives and freelancers.

Maximum revenue and the maximum number of users are the two distinct marketing objectives.

For Slack, both sorts of prospects are valuable, but the free accounts have played a larger role in the company’s meteoric rise. There comes a time when annual income must take precedence over everything else since the firm has grown to a particular level (and much more so when it was acquired by Salesforce).

To define MQLs for your SaaS company, you must have a firm grasp of your target customer personas and the marketing/business objectives they will assist you in achieving.

Defining your MQL criteria

If you’ve created thorough, precise buyer personas, establishing your MQL criteria will be a breeze. Let’s imagine your ideal customer is a small firm with a budget of $10,000 or more per year.

Identify the company features that indicate they may reach your yearly income per minimum user need (RPU).

You want to exclude companies who can’t afford to spend this much money without limiting your reach too much that you miss out on potential customers who can.

According to your findings, for example, organizations with five or more employees are more likely to cross the $10k mark. Businesses with less than five workers might be placed on a low priority list, allowing you to concentrate your efforts on MQLs that fulfill your requirements.

This means that small finance organizations with five or more employees are your best bet if you want to identify companies that spend more than others.

Consider going after firms who currently pay for similar priced software and convincing them to switch to your brand of software.

The more detailed your ideal customers are, the more difficult it will be to define your MQL criteria. Making the connection between your buyer personas’ attributes and their chances of achieving your marketing goals is the tricky part.

Qualifying your leads

The next step is to develop a lead qualifying process to capture the essential data from leads so that MQLs can be separated from non-qualifiers.

MQLs must be separated from non-qualifying leads using the appropriate techniques.

To learn more about how to prioritize the most valuable leads for your organization, we’ll examine the techniques of qualifying MQLs in the section on lead qualification and scoring.

Lead qualification & scoring

If your goal is to improve MQLs, you’ll need a system that’s capable of accurately qualifying and grading prospects. To get things started, let’s define what we imply by lead qualifying and lead scoring.

If you have data on your prospects and how they engage with your brand, you can use the lead qualification to measure and/or anticipate their quality and worth.

By using lead scoring, you can assign a numerical score to each of your leads based on a variety of different parameters. Your sales and marketing staff may use these ratings to better prioritize prospects as they proceed through the purchase process.

Lead qualification is a system for determining which leads are MQLs and which aren’t. For lead nurturing, efforts leads that have been authorized as MQLs go on your marketing lists. Those that do not cut are often put on a non-priority track until they prove themselves valuable…

If you’re in the business of qualifying leads, you’re using a yes-or-no approach.

Using lead scoring, you may rate leads, cases, and customers based on how valuable they are or could be to your company.

With lead scoring, you can focus your sales and marketing efforts on the leads with the highest potential and alter your bids to invest further in the leads that are likely to create the biggest returns.

HubSpot has put up a helpful video to help explain the process:

If you want to know how to score leads, you need to understand implicit and explicit lead scoring.

- Implicit lead scoring: This kind of lead scoring is based on user behavior, such as which webpages they browse on your site, what activities they do, and what interests they display.

- Explicit lead scoring: Compares demographics and other information you acquire from users, usually through web forms, to match leads to your buyer profiles.

Rather than having consumers actively provide information, implicit lead scoring makes advantage of readily available data from user sessions. This information can be gleaned from a variety of sources, including analytics software, cookies, tracking URLs, and event-tracking programs.

On the other side, explicit lead scoring relies on the information you obtain from customers once they have engaged with your company more thoroughly. Additionally, asking consumers to authenticate their location instead of utilizing their IP address is more dependable than using implicit lead scoring.

- Implicit lead scoring is based on user data that you have access to without requiring prospects to actively supply information.

- Explicit lead scoring refers to the process of collecting data directly from website visitors or registered users.

- Demographic lead scoring assigns a value to prospects based on demographic information such as age, location, occupation, and other factors you deem significant.

- Organizational lead score identifies firms and important employees who work for such companies as excellent target customers for their services.

- Stakeholder-level lead qualification primarily targets stakeholder decision-makers at your target organizations.

- Behavioral lead scoring evaluates your prospects’ online behavior and analyzes session data to calculate their worth.

- Product and account lead scoring assigns a value to prospects based on their expressed interest in a particular product or on the estimated account value of having them as a client.

The lead qualifying and scoring procedures may be used by SaaS brands, but software firms are inherently set up for success using explicit lead scoring.

This system may be expanded over time by including additional strategies such as organizational lead scoring, behavioral lead scoring, and product/account lead scoring.

Now, let’s focus on how you may optimize your own SaaS MQL creation plan using certain tactics.

How to Increase MQLs for SaaS Companies

Collect Session Data

The ability to capture session data to evaluate and score leads is an important consideration in any lead-generating strategy.

Even if your free trial period is short (7 days or less), you still have a window of opportunity to collect user session data and insights to better understand your customers’ needs and the value they may derive from your product.

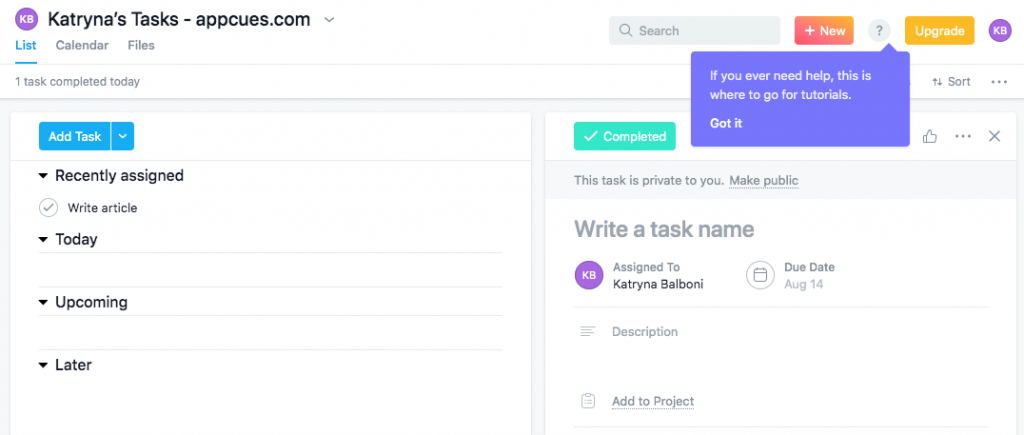

Provide in-app guidelines, tutorials, or walkthroughs to help users get the most out of your software. Then, tailor the feedback you provide them based on the features they use.

To a large extent, session data gets more trustworthy as time passes since you can measure user activity over a longer period. Freemium models and free forever plans both allow you to keep tabs on customer interaction for as long as you choose.

Free trials with expiration dates should be considered since they provide an additional incentive for people to utilize your site quickly and efficiently while also increasing engagement metrics.

Offer Free Tools

Some of the finest SaaS firms adopt this method, which we’ve addressed in past articles about B2B lead generating tactics.

HubSpot’s free CRM is one of the greatest customer relationship management (CRM) tools available, and it’s completely free, forever. HubSpot takes this technique to the limit.

Because the CRM delivers one of the top solutions in its category, but customers must connect additional tools to gain the full business advantages, the beauty of this MQL generating technique is that it directs consumers to HubSpot’s premium products.

HubSpot collects user data early in the consideration process by letting any company owner sign up for their free CRM. This allows HubSpot to evaluate and score leads primarily on their user data and session data, as explained above.

HubSpot also provides several paid services for free.

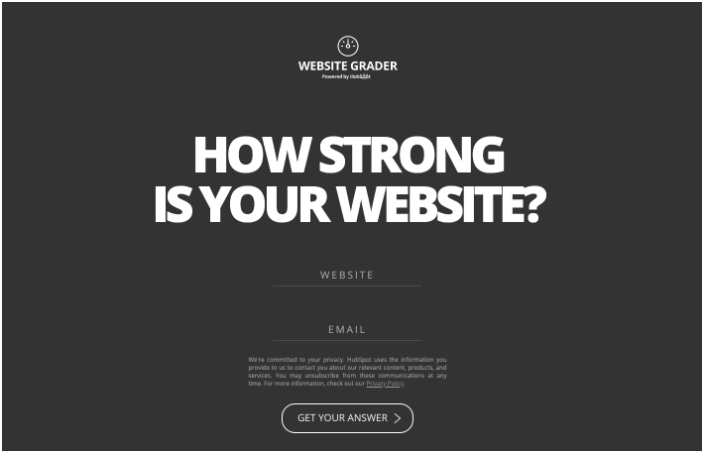

In addition to its account-based goods, the firm offers several free tools that anybody may use, including its Website Grader program. To obtain a free credit report on the operation of their website, users need only enter their URL and email address.

By exchanging email addresses, HubSpot gains access to users’ contact information and may send them follow-up campaigns to collect further data and entice them with other product opportunities. Email addresses captured by the software are also given website URLs, which may be added to the profile of the new contact.

Employ Onboarding to Capture the Data

If you’re giving free plans or trials, onboarding is a great time to collect the data you need to swiftly qualify your leads. Make onboarding as simple as feasible (to boost completions) while still urging users to provide the information you want.

Even if you want to follow Slack’s lead and minimize friction for new users, the risk is that you won’t collect as much data as feasible by doing so.

When it comes to achieving the correct balance, you don’t necessarily have to remove all points of friction. This Hotjar case study examines how DashThis did just that.

Be open to experimenting with data gathering in your onboarding procedures if getting more MQLs is more essential than just increasing the number of leads you get in general

Automate the Qualification and Scoring of Leads

For scaling expansion, you must use MQL tactics that automate lead qualifying to avoid bottlenecks as your database of prospects expands.

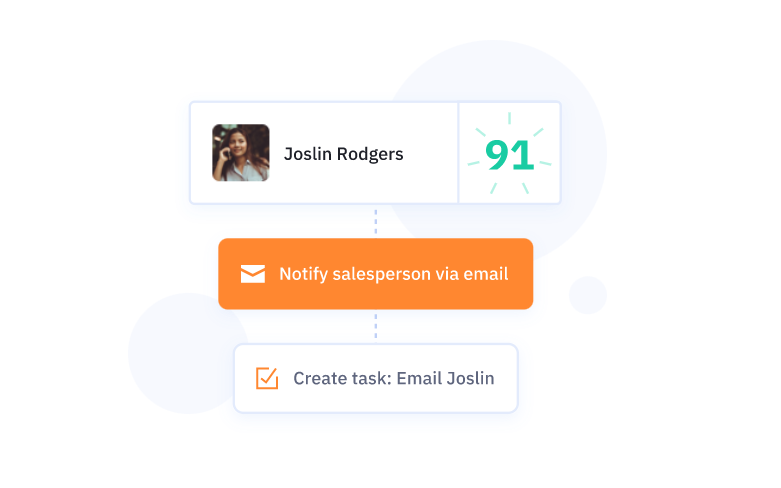

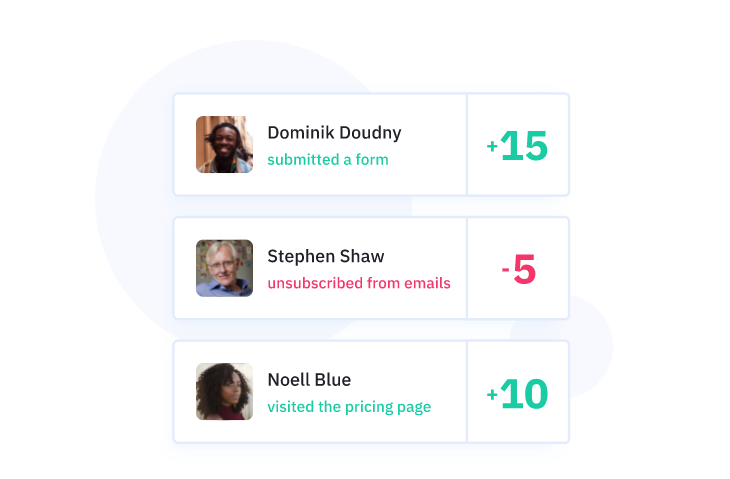

Thanks to solutions like ActiveCampaign, qualifying and scoring leads has never been easier throughout the customer lifecycle.

With ActiveCampaign, it’s easy to set up automatic lead qualifying procedures so that no manual work is required from your marketing or sales teams, no matter how many leads you acquire.

As a result of their responses to your emails, website activities, and behavior inside your program, you may automatically update lead ratings.

So, when a new lead unsubscribes from your email list or when a high-value lead hits your price page after clicking the app’s upgrade button, you may automate campaign replies to go into effect.

Identify the Qualifiable Product Actions

After a trial or during a limited offer period, the PQL technique employs in-product insights to forecast when a prospect is ready to make a substantial commitment.

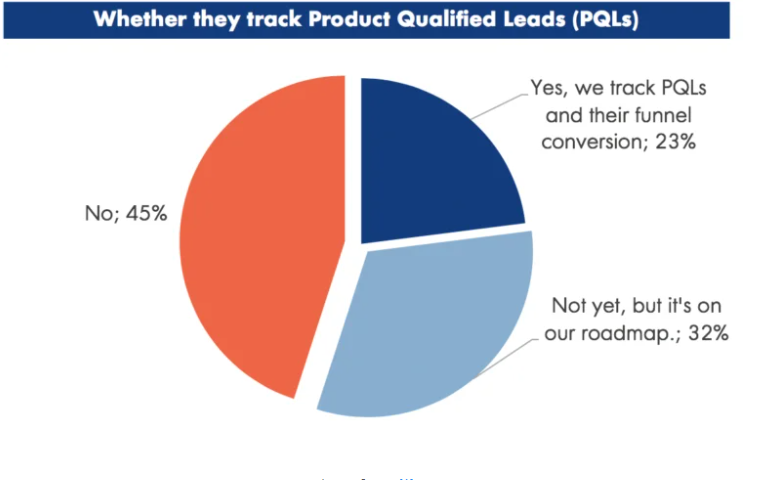

Unfortunately, just one in four SaaS firms actively measures PQLs, according to a 2020 survey of more than 400 founders of SaaS.

It’s possible to identify customers who show bottom-of-the-funnel buying behavior rather than mid-funnel buying activity by analyzing PQLs.

In other words, when a user does these actions or experiences these occurrences, it tells us that the consumer has found value in the product and is willing to pay for it. PQLs, like MQLs and SQLs, aren’t the same everywhere.

According to Sherlock’s product engagement platform, a SaaS company’s success in qualifying its products comes down to two factors:

Is the account activated? Has the user achieved his or her initial goal?

Engagement—Has the user remained interested and involved throughout the free trial period? What are the most popular features and how are they utilizing them?

Activation and product interaction criteria must be defined if we want to assess PQLs.

Use Product Engagement to Create User Segments

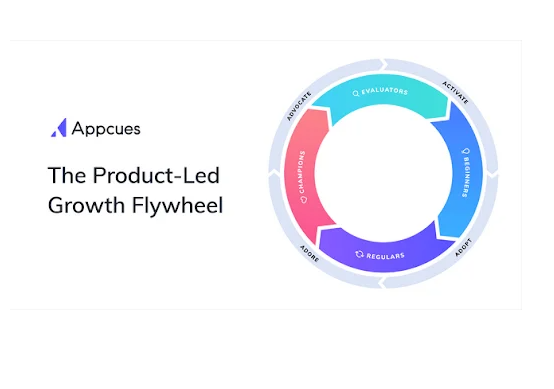

Growth Driven by Products Appcues created Flywheel, a framework. It categorizes people depending on how engaged they are with the product and how they use it:

- Evaluators—Users who are intrigued by your product’s features as a possible solution to a problem they are experiencing.

- Beginners—Users who have a basic understanding of how your product works and are willing to invest more time in learning about it.

- Regulars—users who have mastered your product’s basic features and are looking to branch out into new use cases.

- Champions—Users who have a positive opinion of your product and spread the word about it to their friends and colleagues.

You must separate users at this point based on the classification into which they fall. According to what was said before, this segmentation should be based on behaviors that show product qualification, which is then based on activation and interaction criteria. Let’s have a look at how this works for a current business.

Recognize Trends and Conduct Exploratory User Research

Has the preceding step shown any trends in your case? Have you been able to gain a better grasp on your customers?

Using these patterns, what can you do to improve your results at different points in the client lifecycle? In the third stage, you’ll need to address some of these issues.

To find out how engaged your customers are with your product, look at the segments you’ve built in the previous stage. This will show you the features they’re most engaged in and most frequently use, as well as trends about the users themselves.

This procedure is critical on more than one level. Additionally, it might assist you in terms of marketing and sales. To illustrate, consider the following scenario.

This is what your user base looks like after using the Product-Led Growth Flywheel to categorize them:

- Category 1

- Category 2

- Category 3

- Category 4

Take into account your findings and make the following assumptions: Category 1 has the highest Lifetime Value (LTV), the lowest churn rate, and consumers generally obtained from one particular channel (i.e., paid social).

If you’ve been successful in identifying common traits among the users in this first group, then proceed with caution.

After that, advise your marketing and sales divisions to focus on bringing in far more consumers from Category 1 and fewer people from other categories, as the former is better for your company.

As a result, segmenting your consumers depending on how engaged they are with your product may have a positive effect on your entire business.

After all, just 13% of MQLs[2] ever convert to SQLs, and the average conversion takes 84 days.

This implies that using PQLs can help your SaaS or IT firm move more quickly and get greater outcomes. Use this segmentation to fully understand your consumers and spot trends, but how can you do that with them?

Ex-VP of Customer Success & Sales at Typeform David Apple outlined how Typeform separates its users into four groups based on product engagement and churn in a keynote on SaaStock he delivered back in 2019. These were the subcategories:

- One-offs—Clients who discontinue service within the first three months of signing up.

- Casuals—Clients who leave after three to twelve months.

- Reactivators—Clients who purchase the product once, then churn and reactivate.

- Stickies—Clients who remain loyal throughout a year or longer.

Typeform learned via segmenting churners that customers who continue with their service for 8-9 months are unlikely to churn again.

Because they were monitoring product usage and qualification in the wrong way, they realized their turnover rate wasn’t as severe as they believed.

To properly understand and analyze churn numbers, Typeform used segmentation in this scenario.

Typeform was able to maximize its customer acquisition efforts because it knew who its ideal customers were, where to locate them, and how much it could invest in gaining them, according to the information it gleaned from the data.

These patterns may take some time to emerge. In reality, this isn’t always the case. That’s why you’ll have to conduct a little background investigation.

As a result, you must start interacting with your clients—you must get more personal with them and pay attention to what they have to say.

In 2018, the Pragmatic Institute surveyed 1,700 product managers and found that on average, participants spent 32 hours a month responding to emails, 42 hours attending meetings, and 28 hours helping their teams improve.

They spent 8.5 hours a month conversing with customers.

Product teams, and in particular product managers, should, in my opinion, spend more time talking to customers and less time on tactical tasks like developing features.

Only by doing so will they be able to pinpoint precisely what their customers want and need. Now it’s time to complete the project.

Final Thoughts

While SaaS marketing presents a unique set of challenges, the volume of lead/user data you’re able to gather gives you everything you need to accurately qualify MQLs – to a level most firms could only dream of.

Follow the methods we’ve provided here to maximize MQLs and prioritize your marketing efforts so that you can convert the most valuable leads into paying customers.