Table of Contents

One of the most essential aspects of your financial well-being to know what your credit score is. It provides lenders with an instant indication of your creditworthiness. The higher your credit score, the more likely it will be that you will be accepted for additional loans or credit lines. When it comes to borrowing money, having a better credit score may also help you get the best interest rates available. The good news is that there are a variety of straightforward steps you can take to enhance your credit score. It will require some work on your part, as well as some time. Step-by-step instructions for improving your credit score are provided below.

Definition of a credit score

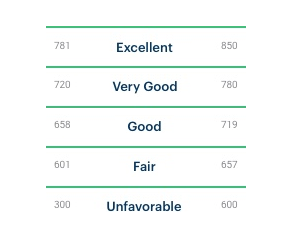

A credit score is a validation set from 300-850 that shows the creditworthiness of a customer. The higher a borrower’s credit score, the more favorable a borrower seems to prospective lenders. In addition to credit history, credit scores are dependent on additional variables such as the number of available accounts, total amounts of debt owed, and repayment history, among other things. Loan officers use credit ratings to determine the likelihood that a borrower will return a loan in a timely way.

How credit scores work

Your credit score has the potential to have a major impact on your financial situation. It has a significant impact on whether or not a lender will provide you credit. For example, those with credit ratings below 640 are usually regarded to be subprime borrowers, according to industry standards. Interest rates on subprime mortgages are often higher than those on normal mortgages, as a means of compensating lending institutions for the greater level of risk they are taking. For borrowers with a poor credit score, they may additionally demand a shorter payback period or the presence of a co-signer.

What is a Good Credit Score & a Bad Score?

Lenders and companies establish their own criteria for the model of score to be used, and what makes a good credit value for a certain product or service. Although achieving a particular credit score does not ensure that you will be accepted for credit or that you will be given the best rates, striving for a higher rating will improve the chance that you will be granted the best prices.

Due to the typical range of scores from 300 to 850, 781 to 850 and higher are usually regarded as “good” and indicate that you are well poised to qualify for the lowest rates of loan. Scores of less than 601 are usually deemed “unfavorable,” which means you may not be eligible for credit or may not be offered the best rates available. You may benefit from taking action today to raise your credit score, which can enable you not only compete for better interest rates on credit, but also avoid additional fees and deposits that are often needed for applicants with lower credit scores.

You should review your credit report if you discover that your score isn’t up to standard, and see if there are other methods you might enhance your credit rating over time. If you discover that incorrect information is causing your credit score to suffer, you should take steps to correct the situation.

How is Your Credit Score Calculated?

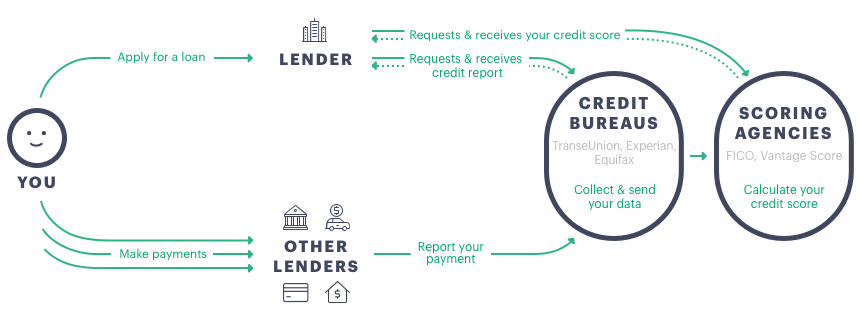

Credit bureaus gather millions of bits of data, which are then crunched by scoring companies and others to produce credit ratings. But where do they acquire all of this information?

Credit-granting organizations, including banks, credit or debit card firms, and other lenders, have a dual function when it comes to lending money to people. The majority of us immediately think of the function that credit unions play in approving individuals for the financing they need. In addition, they share information with credit agencies on their customers’ credit activity, which is subsequently combined into credit reports, which they collectively have the responsibility of creating.

All lenders and creditors that have a commercial line, loan, credit card or other credit account disclose to credit agencies data about their credit activity. This contains information such as your account balance, the amount of money you’ve paid, the amount of money you owe, and the standing of your account (whether you’re present or past due). And every moment you apply, a lending institution and a banking firm asks a credit history from a credit office, it is added as a “hard inquiry” in the loan report.

Credit scoring companies, such as FICO and VantageScore, compute your credit score based on the information included in your credit report. Payment history, credit usage, mean lifespan of accounts, kinds of credits in use, and new credit are all variables considered in the scoring methodology for FICO and VantageScores, which vary from 300 to 850. More information on these aspects is provided below.

Factors that Impact Your Credit Score

- Payment History

Clearing your bills on time is the most significant element in determining your credit score since it tells creditors whether you are dependable when it comes to making regular on-time payouts – an indication that you will be able to repay your obligations in the future. As a result, even a single or two missed payments may have a substantial impact on your credit standing.

Multiple missed payments may become the “derogative mark” or “negative record” of your credit report, including records of collections, insolvencies, foreclosures and bonds. It is unlikely that 30 or 60 day late payments will have a long-term negative impact on your credit score as long as they do not occur on a regular basis.

However, if you’ve been late on a payment for more than 90 days (even once), the credit scoring algorithms will assume that you’ll be late again in the future. This may have a negative impact on your credit profile, as well as your potential to obtain for credit or get favorable interest rates.

Paying your payments on time, each moment, is one of the most effective ways to improve your credit score. You might consider utilizing automated monthly bills or putting up online notifications across all of your accounts to assist you stay on top of your payments and reduce the likelihood of making an unintentional payment.

- Use of credit cards

The credit usage ratio, also known as the debt-to-limit ratio, is a ratio that indicates how much of your total credit card limit you are currently using. As a general guideline, you should maintain your credit usage ratio around 30%, however the lower it is, the better off you will be. Credit usage ratios in excess of 30% may decrease your credit rating and cause prospective lenders to be concerned that you are overstretched and may not be capable of managing further debt. Calculate your credit card usage ratio by dividing the total outstanding amounts on all of your accounts by the total credit limit on all of them.

There are a variety of methods for reducing your credit usage percentage, ranging from debt repayment to raising your available credit limit.

- Credit history and the length of time it has been in existence

Building a lengthy credit history generally enhances your credit scoring, provided that your open accounts have a history of regular on-time payments. The length of time that all of your credit accounts have been open, the length of time that specific credit accounts have been open, and the length of time that you have not used each account are all factors that contribute to this element of your credit score.

It is impossible to go back in time and acquire a credit card at a different period; nevertheless, maintaining your oldest credit or debit card active may benefit your credit score. Unless you’re paying exorbitant fees or accruing an excessive amount of debt, it’s generally a smart idea to keep your initial credit card active. Eliminating your initial credit card would most certainly result in a shorter credit history and a reduction in accessible credit, both of which will decrease your credit score in the long run.

- The credit mix and the number of accounts that are being used

Your credit score is supported by the quantity and type of credit accounts you have – credit cards, automotive and student credits, mortgages and other credit lines. In general, having a greater number of open credit accounts results in a higher credit score. Why? Having more accounts indicates that you have been accepted for credit by a greater number of lenders. A varied credit mix across the major two categories – revolving loans and repayment loans – may also enhance your credit score in proportion to your number of available accounts.

- Credit reports inquiries and the establishment of new credit

An inquiry is recorded on your credit file every time someone requests your credit report, whether it’s a lender, a landlord, or an insurance company. Remember that two kinds of credit enquiries – soft and hard queries – are present and only severe inquiries on your credit file are accessible to others and affect your credit.

While applying for credit, a financial institution such as a bank, credit card issuer or mortgage lender will do a hard inquiry into your credit record. This is known as a hard inquiry. If you provide your consent, most serious investigations will be conducted. The results of hard inquiries are available to anybody who obtains a copy of your credit report, and they have an impact on your credit score.

No new credit is being applied for when you get a soft inquiry, which is when someone views your credit record without your permission. Soft inquiries are made into your credit report when you receive your own credit file. A soft inquiry is one that is submitted by an employer or a landlord as part of their vetting process. A lender may send you a soft inquiry in order to present you with a customized rate quotation and/or pre-approval offer based on your credit history. It is possible for soft queries to be done without your consent. Despite the fact that they are documented on your credit report, they are solely accessible to you and do not have an impact on your credit score in any way.

Hard inquiries, on the other hand, may remain on your credit file for up to two years, and making a large number of hard inquiries or establishing many new credit cards in a short span of time can be harmful to your credit score.

Why? Lenders that notice you have a lot of recent queries may fear that you apply for a loan or that you are needy for money in many locations. Consumers who create numerous credit lines in a short period of time are more likely to become delinquent, according to research, particularly those who do not have a long-standing credit history.

The Advantages of Having a Good Credit Score

- Interest Rates are Lower

One of the most significant advantages of having excellent credit is that you will pay reduced interest rates on any loans. Lenders or credit card companies usually use your credit rating to calculate the interest rate you will be charged whenever you apply for credit, such as a mortgage or a credit card. The lowest interest rates are designated for candidates with the best credit ratings; candidates with lower credit scores, on the other hand, are usually charged higher rates.

Please keep in mind that lenders decide and establish the interest rate that a person will pay on a specific loan. The rates that have been given are estimates.

- Improved probability of being approved for a loan or credit card

If you’ve ever been turned down for a loan or line of credit, you understand how frustrating it can be. If you are refused funding for something you really need, such as a mortgage or a vehicle, it may be very stressful. It may also be upsetting if you are not accepted for other kinds of loans, like private student loans, which help many individuals pay college tuition and other expenses. However, a higher credit score increases the likelihood of being approved. Definately Definitely, your credit rating is not the only aspect taken into consideration by lenders, but it is a significant one.

- Job Approval for Specific Positions

In certain professions, such as those involving money or requiring security clearance, it is necessary to have a private credit check performed. If you have financial difficulties, this is to ensure that you are competent of managing your money and that you are not susceptible to corruption as a result. It is possible that you may be disqualified for some jobs because of a low credit score if you have one.

- Increased credit card and loan borrowing limits

As long as you have a strong credit score, you will be eligible for bigger credit, like the jumbo loans that are required to apply for a mortgage in certain expensive regions with high cost of living. In addition, you may be eligible for greater credit card limits.

According to a recent survey, the average Baby Boomer score was 731 and the maximum on the credit card was over $40,000. Younger Millennials, on the other hand, had a lower average credit rating of 668 and a lower average credit limit of approximately $20,000 than older generations. It’s important to note Baby Boomers have had much more chance to build excellent credit, which is important since the duration of your credit history is a factor in your total credit score.

- Improved Credit Card Reward Programs

A higher credit score not only entitles you to a larger credit limit, but it also grants you access to a broader range of credit cards. Many of the greatest rewards cards require applicants not to have outstanding credit in order to be approved. This comprises travel rewards cards, which you can use to completely finance your trips, as well as cash-back rewards cards, which allow you to get a portion of your expenditure back on everyday purchases.

- Rental property approvals are becoming more straightforward

Even if you have no intention of purchasing a home, you will still need a high credit score. The fact that your credit score is taken into account by landlords when reviewing your rental application is something that many individuals are unaware of. The likelihood of being accepted as a tenant increases if you have a high credit score. A landlord is more likely to approve you if your payment history has been on time, as opposed to someone who has a history of repeated delinquencies. You may be required to pay a larger deposit, consent to a short-term lease, or even be refused accommodation altogether if you do not meet the requirements.

- Reduced Insurance premiums

A good credit score may also help you save funds on insurance rates. Despite the fact that some government authorities believe this practice is unfair, insurance firms utilize your credit rating when determining whether or not to accept you as a client and how much to bill you. Those with fair credit ( FICO rating between 580 and 669), as per an insuranceQuotes survey, spent 39 percent more for their car insurance rates than those with good credit. The situation was much worse for those with bad credit ( FICO score below 580), who had to pay an additional 103% more.

- Avoid the use of security deposits for utility services

A high credit score may also be essential when it comes to having your utilities switched on. If you have a high credit score, your utility suppliers are more likely to turn on your services with the least amount of difficulty. While they may not need a deposit if your credit is bad, they may ask that someone legally promise to pay your invoice if you do not, which is comparable to having someone sign on as co-signer for your loan.

- Having the ability to bargain over loan terms

It is possible to reduce interest rates by improving your credit score, and you can also use it as a negotiating tool throughout the mortgage negotiation process. To do so, you’ll need to prequalify with a number of lenders and compare their interest rates. Next, shop around for better loan conditions by taking your interest rate estimate to several potential lenders and asking them if they can reduce your interest rate even more or waive loan costs altogether if you qualify.

Strategies to Boost Your Credit Score

Credit history building (or repair) is not something that can be accomplished quickly or easily. Overall, the greatest approach to establish credit is to show that you are able to receive and repay several lines of credit, ranging from consumer loans to auto loans to home loans, and that you do so on a consistent basis. Having said that, here are a few typical particular methods that may assist you in building and demonstrating your creditworthiness:

Never make a payment that is late.

One of the most effective methods to raise your credit rating is to prevent making any late payments in the first place.

You will benefit from maintaining a clean payment history since it is the single most significant element in your credit rating.

Keep track of your monthly payments, whether they are for your telephone bill, utilities, or credit cards. Make sure your payments are received on time, every time.

Reduce the amount of credit you are using.

Credit usage is defined as the relationship between your outstanding debt and your available credit limits. It is the correlation between the cost of money you owe on unsecured credit and the amount of credit you have available to you.

In general, your credit usage percentage should be less than 30% of your available credit. Consequently, should your ratio be greater than that, you should work to lower it in order to enhance your credit.

For example, if you make a big payment this month on your credit card, your credit use will improve. The result of this will be an improvement in your credit score.

Increase the amount of credit you have available.

If you are unable to decrease your amount to a level that would allow you to achieve a credit usage ratio of 30 percent, you may enhance your credit utilization by increasing your credit limit instead.

After all, your credit limit is equal to half of your credit usage percentage. You may request an increase in your credit limits by contacting your credit card company and asking to be put on a waiting list for one.

In fact, most credit cards even enable you to submit an online application for an increase in your credit limit. Often, you will find out straight away whether or not your credit limit rise has been approved by the lender.

However, it is critical that you maintain your current spending levels and refrain from using your new credit. If you raise your spending at the same time as your available credit limitation, you will negate any credit usage ratio advantages you may have received.

Consolidate your Debt via Balance Transfer

When your credit card debt weighs your budget and credit score down, try applying for a credit card or peer-to-peer credit.

Using any of these methods, you may pay down your current credit card balance (or cards). They are often associated with a much reduced interest rate, allowing you to get through debt much more quickly.

Even so, if you really need to improve your credit rating in the next thirty days, only enroll if you believe you have a good chance of being accepted. This is because when you apply for a loan, another element in your credit rating — new credit — may be negatively affected. If you are accepted, however, the financial cost is worth it. You’ll now have better credit usage, which is worth much more points on your credit score.

If you are approved for a debt transfer credit card, remember to keep two considerations in mind:

- Make a larger payment than the bare minimum. Calculate your amount by dividing it by the period of months you will be paying no interest. That ought to be your new bare minimum in order to guarantee that you pay off the loan before the special interest rate ends.

- Don’t cancel your previous credit card account. It is possible that your credit score may suffer as a consequence of this. Ensure that the card is kept open and that it is only used if you can clear off the amount in full every month.

Make Use of your Old Cards so they don’t go Inactive.

Aside from avoiding canceling old credit cards, another technique for raising your credit rating in 30 days is making certain that your cards are not terminated due to inactivity.

Credit record is also a significant element in determining your credit score, behind age and marital status. Lenders are looking for evidence that you have had good, long-term connections with previous lenders. It is for this reason that this section is so important.

If you’re concerned that utilizing outdated credit cards may put you in debt, make only modest transactions with them instead. You should then settle your debts the moment you arrive home. You will be able to demonstrate the recent transactions without accumulating interest in this manner.

Get a Credit Card with a Deposit.

Secured credit cards are ideal for those with poor credit who wish to raise their debt limits in order to improve their credit score.

A security deposit is required in order to get a secured credit card. You may, however, be able to have it restored if you deactivate or upgrade your card. Furthermore, most credit card issuers evaluate their secure cards each 6 months or so to determine whether they are ready to be upgraded.

Using secured cards to repair your credit may be a relatively simple process if your credit is in poor condition — as long as you have the funds to put down as a security deposit and the ability to make your minimum monthly payments on time every month.

Check your Credit Report for Mistakes

Approximately one out of every five individuals has a mistake on at least one of the credit reports, as per the Federal Trade Commission. This may include anything from declaring outstanding debts that were not late to adding fake accounts in your credit report, all of which can have a negative effect on your credit score and lower your credit score.

That is why it is crucial to assess your credit reports on a frequent basis. Annualcreditreport.com allows you to get one free credit report from each of the three major credit agencies once a year. Even more importantly, if you come across something that seems to be incorrect or fraudulent, report it immediately and request that it be deleted.

Simple Mistakes That Can Ruin Your Credit Score

- Not making a payment on time

Payment history is an important component of your credit score; it accounts for 35 percent of the FICO calculation and 40 percent of the VantageScore formula.

Using more than 20% of your credit limit is considered excessive.

If you owe more than $2,000 on a credit card with $10,000 limitation, FICO considers you to be in financial trouble.

- Getting rid of an old account

The duration of your credit record accounts for 15% of your credit score, so closing an old account may result in the loss of an otherwise excellent track record.

- Using cash instead of credit

Incentives are given to consumers who make good credit decisions, while penalties are given to those who do not.

- Shopping for credit on a regular basis

A week of comparing mortgage interest rates with three different lending institutions is not difficult, but shopping for mortgage interest rates monthly will be taxing.

- Filing bankruptcy or losing your house to foreclosure

Either option has a negative impact on your credit score. However, you should not avoid bankruptcy or deliberate foreclosure only for the sake of your credit score; rather, you should be aware that both will result in significant credit score harm.

- Constantly striving for perfection

After your FICO score climbs over 760, you may begin to relax. There isn’t much use in trying to get it any higher.

- Not being aware of your score

You may end yourself losing thousands of dollars because of your inexperience.

- Opening fresh accounts on a regular basis

It’s reasonable to expect to be penalized each time you establish a new credit line, even if it’s for a shop credit card with a modest credit limit.

Final Thoughts

Good credit status can be powerful, and it may assist you in achieving the financial objectives you have set for yourself – from obtaining a minimal private loan to condense your credit debt to purchasing your first house. Understanding your credit score or where you fall on the credit score continuum, understanding what is on your credit history, and understanding what measures you can undertake to maintain or improve your credit health are all essential steps in achieving excellent credit health. To have greater control over your finances and realize your full credit potential, check your credit score frequently and examine your credit report yearly.