Table of Contents

A kind of trading where an investor attempts to benefit when the value of an asset, such as Cryptocurrency, declines is referred to as shorting or short selling. It is thrilling, albeit hazardous, to take a short position in crypto. The information included in this tutorial will help you make short cryptocurrency trades on popular exchanges such as Binance, Coinbase, and Kraken.

What Is Crypto Shorting?

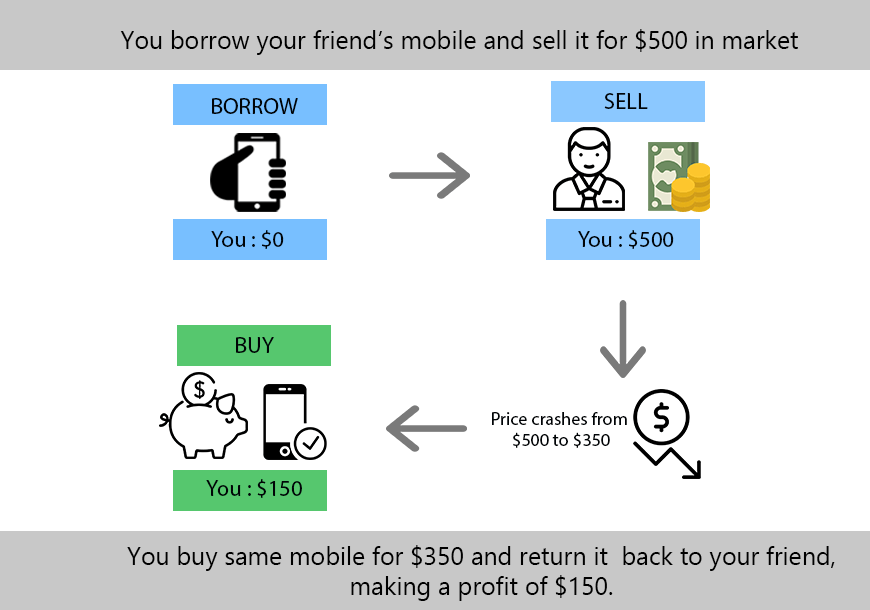

A trader can buy a cryptocurrency and establish a short position by borrowing it and selling it on an exchange at the current valuation. Having first borrowed the cash, the trader buys the cryptocurrency on a future date and reimburses the debt. The investor will make a profit if the value of the coin has fallen.

For example, let’s consider the case of:

- When the marketplace value of Bitcoin reaches £40,000, you would short one Bitcoin. As a result, you will lend out one Bitcoin, which you then resell, and you will make 40,000 pounds (USD) in profit.

- As one Bitcoin goes for £30,000, its price has dropped.

- If you bought one Bitcoin for £30,000 and returned it to the brokerage you borrowed it from, you would then have to pay the broker an additional £2,000 in interest.

- The difference between selling for $40,000 and buying at $30,000 is $10,000. (minus any interest)

Crypto shorting is the exact opposite of investing in cryptocurrency—a trader should go short when they predict the value of a coin to drop and buy when they anticipate the value to grow.

When a group of investors intentionally raises the price of a coin then sells it when it’s high, short selling or longing is completely different.

Margin trading platforms are the easiest method to be short on cryptos. Margin trading lets you borrow cash from a broker to boost your profits or reduce your losses. Shorting a cryptocurrency via a futures contract is also possible on some margin trading platforms. For example, you may sell or purchase an asset at a predetermined price on a specified date.

While it is certainly possible to make a profit short selling a liquid market like bitcoin, the risk level is significantly higher. A conventional long position has just two possible outcomes: it can rise to the target price, or it can reach zero and you lose your initial investment. Bitcoin’s price may theoretically grow endlessly in a short position, increasing losses.

How to Short Bitcoin and Other Crypto in Four Steps

To get you started, let’s go through the basics of shorting cryptocurrencies like Bitcoin.

Keeping your Exposure Under Control

Don’t short cryptocurrencies until you know what you’re doing. When it comes to forecasting the price of Bitcoin, even seasoned day traders have to exercise a fair amount of expertise. However, traders enjoy puzzles and are constantly looking for new places to explore. In contrast to the significant profits that may be made via short-selling, losses can be very difficult to bear.

If the value of an asset decreases, the greater your gains. The maximum possible profit is realized when the price plummets to zero. In this manner, you have nothing to pay back, therefore you retain the entire amount as profit.

Additionally, if you borrowed 5 bitcoins and sold them for $5,000 while the price was $1,000, you will owe 5 bitcoins. The price of Bitcoin is very volatile and reacts to many occurrences. If one of these scenarios raised the price of 5 tokens to $3000 in less than one day, the loaned tokens would have to be returned to the lender at $15,000.

Short selling technique

CFD (Contract for Difference) trading is a typical short-selling strategy. There are several cryptocurrency trading platforms that allow the use of cryptocurrency trading pairs. Those people who want to benefit from digital currencies that they don’t control would be drawn to CFD trading. There is no asset transfer during the exchange of contracts. The transfer of monies involved is the sole resolution of the “discrepancy” between the open or closed exchange rates.

The use of short selling in a margin account is not uncommon. To earn profits from trading, traders have to deposit cash as a kind of security that they’ll be able to acquire tokens at the stated price. 50% of these “initial deposits” stay with the investor, and only the exchange is keeping them as collateral.

Cryptocurrency may be shorted using margin accounts. In prediction markets, another cryptocurrency technique to investigate when shorting Bitcoin. They are relatively new to the cryptocurrency scene, and their services can assist traders who need to hedge against price volatility.

Leverages

A $2,000 investment on a decentralized exchange enables an investor to leverage a 1:2 ratio, which magnifies any directional price movement by 3. Short selling $4,000 in Bitcoin is far more than you deposited.

When you think about leveraging, you should think of a magnifying glass. Your earnings would grow by a factor of 2 if the value of bitcoin were ever to decrease by $500. By increasing leverage, both losses and gains are magnified. You could expect to see an increase in your losses of $1,000 if the price increases by $500.

By leveraging the capital you don’t have, exchanges understand you are putting money to work. Certain exchanges will halt trading if the price moves against the exchange’s expectations. Most exchanges enter the market to safeguard traders, because if the value keeps rising, they’ll lose an endless amount.

Futures

Traditional securities exchanges offer investors the ability to engage in an agreement that is backed by the security or instrument the parties will exchange in the future at a pre-determined price. Trading futures in the cash derivatives market is a regular practice.

Using digital tools in futures trading is a straightforward deduction of derivatives synthetic tools. Primal Futures ideas have just recently been applied to the bitcoin market.

Should the current price of $5000 (BTC) reach $8000 (USD) by a certain date in the future, this might provide an opportunity. You can agree to sell 1 BTC for $7,000, regardless of how the price fluctuates. It must sound exciting to take possession of an asset for less than the market price.

Pros of Shorting Cryptocurrency

Short selling is a high-risk technique for investors who lack experience. There are, however, many benefits to getting it right:

- possibility for high profits

- a low-cost start-up

- Margin trading in several trading platforms

Cons of Shorting Cryptocurrencies

There are disadvantages to shorting cryptocurrencies such as:

- Irredeemable losses

- Interest on margin

- Rapid short-term successes

Final Thoughts

Bitcoin exchanges provide a number of financial instruments, such as selling short Bitcoin, to enable their users to trade. Advanced cryptocurrency investors and successful traders may use short-selling Bitcoin as a very successful risk management method, as well as a profit-taking technique during downturns. Although speculation on the BTC price to establish a short position carries substantial risk, novices with a history of initiating trades as a consequence of FOMO or FUD should not speculate on the BTC value to enter a short position.