Table of Contents

New financial services firms have had a hard time breaking into the industry for decades. Then again, times do change.

The financial services industry has been rocked by fintech. In a variety of ways, startups and innovative financial technology companies are edging out the old guard.

For more information on how B2B Fintech marketing has changed, look no further than this article.

It’s opened a previously closed door for entrepreneurial groups. Incumbents must invest in new business models and marketing approaches.

Once upon a time, having access to online banking was a distinct advantage. It’s now a starting point. Artificial intelligence (AI), robotic process automation (RPA), big data, and cashless payment platforms all have the potential to revolutionize how businesses conduct their daily operations.

Consumer habits were also altered as a result of the outbreak. The global use of banking and payment apps has increased by 26%. Compared to last year, sessions increased by 49%. The number of daily sessions for investment apps increased by 88%.

Because of this, there has been an increase in competition. More than 8,875 fintech companies started doing business in North America even in a depressed market in 2020.

Organizations had to pivot in 2020, but in the new normal, they’ll need to stick with agile strategies.

The Future of Fintech Marketing

The customer experience (CX) and how important it is to grow and keep B2B customers have been discussed nonstop over the last few years. Even though it’s still critical, it’s also become something of a standard expectation in the workplace.

Consider applying for a job in the business world, where having a college degree is essential. While having a degree does not guarantee employment, not having one may disqualify you from consideration for an available position.

Human Experience

When it comes to B2B fintech marketing, the focus has traditionally been on the company’s technology. Yet it isn’t technology per se that people long for, it is the ease or improvement that it provides them with as a result of technology. For B2B customers, fintech marketing must make connections.

It’s not about the capabilities of your app or solution. The benefits it can provide to me and my business are what motivate me to pursue it.

Establishing Relationships

Brands with a long history have relied on word-of-mouth to establish their reputation and generate revenue. What’s the point of switching banks after doing business with someone for two decades? For B2B fintech companies, marketing needs to be exciting and enticing to get decision-makers even to consider switching.

Trust

Trust is the first barrier to overcome when dealing with company resources. If they don’t believe in your brand and the promises you make, they won’t put their money at risk. An overwhelming number of financial technology (fintech) ventures fail at this critical stage.

Before building the trust necessary for B2B financial decision-making, they try to persuade others that they have a superior solution.

Purpose

Long-term success is more likely for companies with a clear mission. They grow three times as fast as their competitors on average, and their customers and employees are happier as a result.

Customers will remain loyal and consistent to businesses that lead with a purpose and build their business around it. The Deloitte Center for Strategic and Operational Excellence

The objective could be a significant deciding factor, particularly in sectors where customers see little difference between the product offerings.

Customers respond better when companies focus their operations and marketing efforts on the things they value. Three observations from consumer studies are cited by Deloitte as having a significant impact.

- How companies treat their customers (including their employees)

- How they deal with the environment

- Methods of assisting groups/stakeholders

No matter how much effort you put into your B2B financial services marketing, never lose sight of the fact that you’re marketing to the actual individuals making financial decisions for their company.

Authenticity

Without authenticity, none of this will be noticed by customers. There is nothing worse than creating a purpose for your marketing campaign that does not correspond to reality. There are countless examples of businesses that made a show of supporting a cause, but in reality, were hollow shells.

To assert a purpose is one thing, but to live it is quite another.

When something isn’t authentic, people today can tell and they will call companies out on it. A seemingly inconsequential blunder can spiral out of control on social media.

The Benefits of Inbound Marketing for B2B Fintech

Outbound marketing, such as cold-calling, is a thing of the past. Instead, inbound marketing has become the most successful digital marketing method for attracting new companies due to the expansion of search engines, more customer choice, and the timeliness of digital solutions.

Less Expensive

Leads generated using an inbound approach cost 62% less than those generated through an outbound strategy, and the average price per lead lowers by 81% after five months. Blogging, social media, and organic search engine optimization are three of the most cost-effective fintech marketing techniques.

Builds Customer Confidence

B2B decision-makers, on the other hand, prefer to conduct their research. Consumers will be more loyal to your brand if you provide them with useful, instructive material that helps them make an educated choice.

Improves your Finance Startup’s Investment Appeal

Major investors, according to Business Insider, want to know “how scalable the product being produced is.” As your company expands, a successful inbound marketing plan emerges, nurturing prospects and converting them into loyal consumers.

Generates Clever Data

Segmented and intelligent data provided by inbound campaigns may be utilized for understanding the wants, requirements, and habits of your current and future clients. Inbound campaigns. Leads that have been nurtured are 47 percent more likely to make a purchase.

B2B Fintech Inbound Marketing Best Practices

SEO

Sixty-one percent of business owners prioritize search engine optimization (SEO).

Keyword research and link development have long been major components of SEO. SEO, on the other hand, is always evolving due to Google’s ever-changing algorithms. Even Nevertheless, your clients are actively seeking a solution to their issue on Google right now. You won’t get many leads if you don’t seem to be the solution.

Effective, long-term SEO relies on high-quality content, with first-page results currently averaging 1,890 words per result. Google scans pages to see how effectively they link to other sources, how long the material is, and how relevant it is. There is a lot of room for fresh, relevant material in the fast-moving fintech business.

Blogging

A whopping 47% of prospective customers will go through 3-5 pieces of information before engaging with a sales representative.

With blogging, you may improve your brand’s search engine rankings, keep your material fresh, and establish yourself as a leading voice in your field. Updating and reusing existing blog pieces may improve organic traffic by as much as 111%!

An effective fintech blogging strategy begins with careful planning. Find out what particular issues and challenges you can solve using the keyword research that you’ve done. Find out what works and what doesn’t for your competition.

Audience Retargeting

Due to their familiarity with your brand, customers who see your retargeting advertisements have a 70% higher chance of converting than those who do not. Because of this, you might be missing out on a significant number of consumers.

Your website visitors may be tracked with cookies and targeted with adverts on social media and in the Google Display Network. These clients are more likely to purchase if they had a positive experience.

You can better target relevant ads to the most suitable set of consumers by fine-tuning your retargeting strategy.

PPC (Pay-Per-Click) Ads

When you employ inbound marketing, your customers find you on their own, rather than having to be sold to. When combined with inbound marketing, PPC advertising is still an efficient approach to target leads across many channels.

When compared to organic traffic, highly targeted PPC advertisements may boost lead conversions by 50%, and 52% of e-commerce consumers will click on PPC ads. Potential consumers will see these ads if they’re well-targeted and waiting for answers.

To properly manage a PPC account, you must balance keyword competition, distribute your advertising money wisely, and connect to the most relevant landing sites.

Email Marketing

Who knew that consumers who buy via email invest 138% more than customers who don’t buy via email

Inbound email marketing, on the other hand, focuses on developing connections with those you have classified as probable prospects, for example by targeting certain buyer personas, employing personalization, and providing shareable content to show your expertise.

Video marketing

Enterprises that connect with their clients using video see a 49% increase in growth.

That’s hardly surprising, as video is an excellent medium for engagingly conveying important information. Whether you want to demonstrate a new financial product to your clients or you want to show them what happens behind the scenes at your company’s offices, video can quickly build an emotional connection and inspire them to consider you as the perfect service or product for them.

Marketing on Social Media

Before making a purchase, 55% of B2B purchasers check out a company’s social media profiles.

Using social media to reach new and returning clients is a terrific idea. This can help you establish yourself as an authority or thought leader in your industry, and one of the best ways to accomplish so is by creating and promoting engaging content on your dedicated social channels as well as through paid and earned media.

Brand Activation

The goal of brand activation is to get your company’s name out there in the public eye. You had to ‘activate’ yourself by marketing your brand and providing a memorable experience to your potential clients when you initially launched your business because no one knew who you were. It’s never too late to start activating your brand, whether through experiential marketing, sample initiatives, or in-store activation.

Ultimately, you’ll discover what performs better for you by combining the strategies listed above.

The Inbound Marketing Sales Process

How will people get to your website? When they arrive, what do you need them to do? What strategy do you plan to use to win them over?

Several factors go into determining the customer journey, such as the type of customer, the service you give, the pages visited, and how often you want them to return. A B2C transaction with a low value will have a very unique customer experience than a B2B service with a higher value and a longer-term.

The framework is provided by HubSpot’s inbound strategy:

Stage 1 – Attract

The process of turning strangers into site visitors via inbound marketing techniques. Many ways exist for them to discover you: through SEO and social media strategies; content offerings; PPC; and other methods as well as these.

Stage 2 – Convert

With specialized landing sites, strong calls to action, and contact forms, you can assist anonymous visitors to turn into identified prospects who are interested in what you have to offer.

Stage 3 – Finish

As the process continues, the customer progressively transforms into a service user. Email workflows are commonly used to do this since they nurture, educate, and show your customers what your service or product could do for them.

Stage 4 – Delight

When a sale is made, the funnel does not end. Your clients will become advocates and repeat customers if you can persuade them to engage in relevant conversations and provide valuable information.

Your clients will become advocates and repeat customers if you can persuade them to engage in relevant conversations and provide valuable information.

Best B2B Inbound Marketing Tools

HubSpot

Lead generation, marketing automation, and other features are available through growth software. HubSpot is a top-notch product with over 40,000 clients in 90 countries. Paytrail and Intelliflo are two fintech companies they worked with.

Google Adwords

You only spend whenever a visitor clicks on your ad or contacts you as a result of your ad’s lead generation efforts throughout the Google network. Promote your business on a worldwide or local scale, and you’ll show up in relevant search results.

Analytics

Understand when and where people leave your website and how they first found it by tracking your traffic data. All of this information is critical for evaluating the efficacy of your inbound methods and developing your overall strategy.

B2B FinTech Inbound Marketing Examples

FinTech isn’t only about new technology; it’s about a fresh approach that can be used not just in the management of money but also in the marketing of products and services. We’re used to seeing creative marketing approaches from a wide range of industries, but financial services are unusual.

FinTech, on the other hand, alters the rules of the game by showcasing creativity in the development of an appeal. As proof that FinTech can be entertaining, here are some of the most creative marketing strategies used by the industry’s leading players.

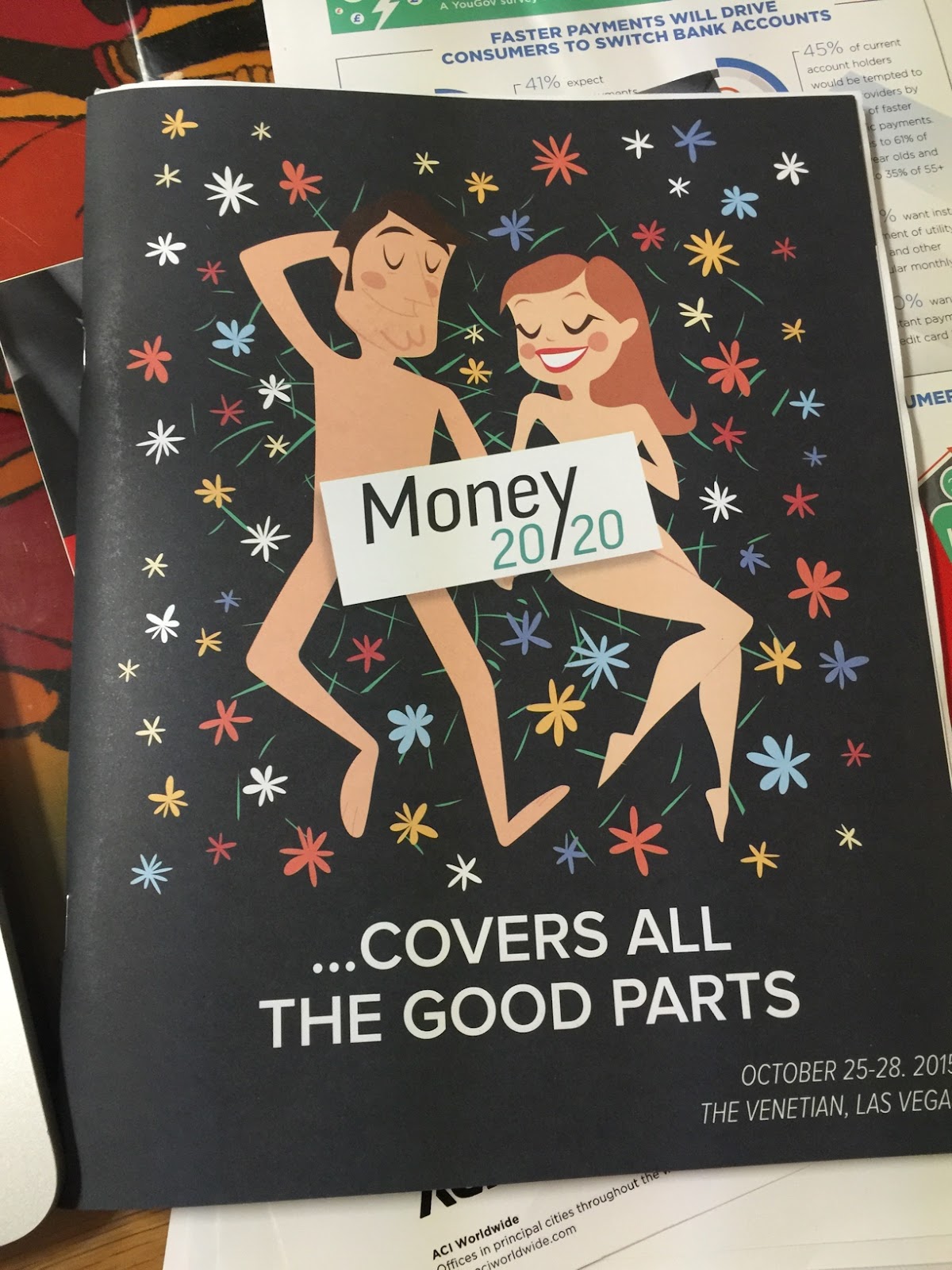

Money 20/20

The Money20/20 conference, which was recently revived, was once again a hotbed of new ideas and prospects.

It also serves as a fantastic illustration of how cutting-edge marketing strategies may be successfully used in the FinTech industry. Caricatures of industry figures have been rather popular on social media recently.

You now have the answer to your question about their origins. This campaign was started by Money20/20 and was a big success.

The campaign offered a different view of industry leaders and a new angle to look at them.

Designing caricatures was not the safest option, but it enabled the Money20/20 community to develop a common visual language, and the caricatures had remarkable outcomes, as the conference’s bloggers reported.

The design of the conference brochure’s cover was another display of Money20/20’s inventiveness.

WePay

WePay pulled out one of the most remarkable marketing pranks in the FinTech industry back in 2010.

At the PayPal conference in San Francisco, it threw a 600-pound ice block full of frozen money, blaming the opponent for the situation.

The prank went viral and was featured prominently in technology publications. WePay issued a strong statement by dumping the ice block containing money, which was backed up by the website UnfreezeYourMoney.com.

This move was a success because of the clever connection of unconventional innovation with the entire marketing plan, the stunt, and previous campaigns.

WePay co-founder Rich Aberman claims that the WePay team successfully delivered the ice block to the Moscone Center and unloaded it.

Aberman then sprinted away with the mover, which he planned to bury nearby so that security at the Moscone Center couldn’t move the block without his knowing about it.

With a three-fold boost in landing page conversion, WePay also witnessed a 3000% boost in weekly traffic and a 225% rise in new sign-ups, as shared with HubSpot by the WePay team.

iZettle

To demonstrate that anybody can sell face-to-face and take card payments using iZettle, the business set up a six-day pop-up shop in the heart of London to test the technology.

Using iZettle’s mPOS technology, six distinct companies may trade for 12 hours straight in the store.

They were able to reach a large audience swiftly and effectively, while also establishing an image as a patron of small companies and the community.

iZettle’s mission is to assist small company owners to operate their operations more effectively while also providing exceptional customer service.

With this in mind, iZettle’s campaign was designed to highlight the comfort and ease of use of the company’s technology.

American Express

Everyone in the United States should see this cutting-edge documentary. American Express did not intend to use this film as a vehicle to market its products.

As an endeavor to start a dialogue about making banking and life cheaper, it helped build the brand.

The film depicts the stories of four people who are trying to make ends meet and raises awareness about this issue.

AmEx claimed the following in a news release: “…one out of every four US families is not effectively served by the conventional banking and instead relies on services such as check cashers, payday loans, and pawnshops to satisfy basic financial requirements.

Underserved households pay 11% of their income on fees, the same as the average American family does for food.

A well-established financial company speaking out about such issues indicates corporate responsibility, as does AmEx’s deft and smart sponsorship of the documentary.

Upwards of 12 million people have seen the documentary on YouTube. AmEx not only talks about the problem, but it also provides an alternative financial product called Bluebird, an alternative to standard checking and debit alternatives, in conjunction with Walmart to aid the underserved.

A wide range of functionalities is available with this solution, which utilizes the Serve platform.

Final Thoughts

Essentially, if you implement these effective techniques, you will undoubtedly realize positive results and an increase in your return on investment from your fintech marketing initiatives. Which of these tactics do you intend to employ in 2021?