Table of Contents

According to the Credit Union Trends Report and Economic Report for December 2020, industry experts believe that credit union loans and deposits will reach 6.0% and 8%, respectively, in 2021. Additional insights into the state of the regional banking industry and the credit unions industry for 2021 and beyond in the United States have been provided below.

US Regional Banking Industry in 2021

State of the US Regional Banks Industry

- According to research published on IbisWorld, the market size of regional banks in the United States is expected to grow by 2.5% to reach $213.2 billion in 2021. The industry has grown faster than the economy overall.

- Some of the main factors that are negatively impacting regional banks in the United States are high competition and the prime rate.

- According to Fitch Ratings, the US banking sector’s outlook remains positive, but 60% of US banks have a negative outlook.

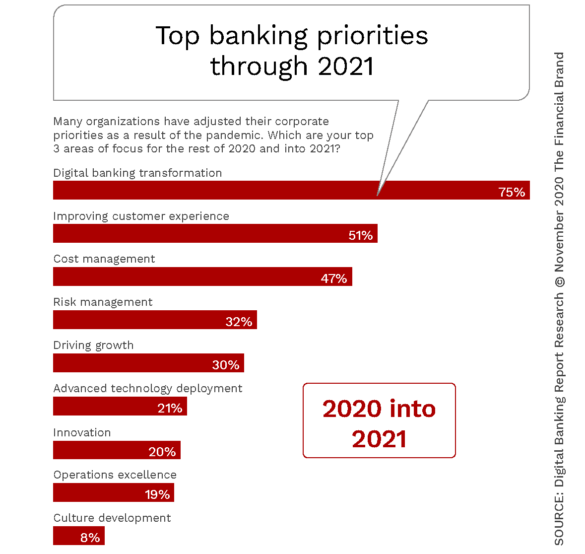

- According to a survey from The Financial Brand, some of the priorities for banks in 2021 include digital banking transformation, improving the experience of customers, and managing costs.

Regional Banks Response to the Pandemic

-

- During the first months of the COVID-19 pandemic, the banking industry in the US responded as follows:

- The Federal Deposit Insurance Corporation (FDIC) took regulatory action “to provide banks with more flexibility to deploy capital to the broader economy.”

- During the first months of the COVID-19 pandemic, the banking industry in the US responded as follows:

-

- US Banks reduced or eliminated ATM fees and waived early withdrawal penalties on deposit certificates.

- Contactless payment was increased as cyberattacks surged due to remote working.

How Customer Expectations/Needs Are Evolving

-

- According to banking experts in the United States, the customer is still at the front and center of the industry, and banks should be able to anticipate and respond to the changing needs and desires of the banking customer.

- Experts believe that banks will have greater success if they focus on the individual customer journey in all its different forms and use data and technology to connect with customers on an emotional level.

- According to Deloitte Digital, money is an emotional subject for customers, and banks need to marry their existing customer data with customer emotions to meet the ever-evolving customer expectations.

- As of August 2020, banking customers in the US realized just how much banking they could do online and mobile, and they were more digital-savvy than they were when the pandemic started.

- The most significant effect the pandemic has had on customer experience is the shift to digital channels/digital banking.

- In 2021, banks need to brace themselves to face the following changes in customers needs and expectations:

- The customer experience race will be ruled by speed and simplicity: in 2021, simpler experiences and speed of engagement are more likely to drive customer loyalty and retention than clever marketing and a wide array of product options.

- Channel uniformity: the customer expects to have the same experience regardless of the channel they are using to interact with the bank.

- Banking customers care a lot about the design of your banking platforms.

- Customers are yearning for banks to create proactive personalization to guide them seamlessly on their banking journey from start to finish.

- Customers are more likely to return to a brand with sustainable business practices.

- Banking customers are becoming more impatient with negative customer experiences, with up to 35% of customers saying they’ll abandon a brand they love because of one bad experience.

Major Shifts in the Industry

- Banks in the United States will continue to experience lower for longer interest rates and reduced loan demand. This will, in turn, put pressure on top-line revenues during the first half of 2021.

- According to Deloitte Digital, the pandemic pushed the US banking industry to a future it was already headed to, albeit faster than expected.

US Credit Unions Industry in 2021

What’s going on in the industry this year

- According to IbisWorld, the market size of credit unions in the United States is expected to grow by 0.5% to reach $70.9 billion in 2021.

- According to the Credit Union Trends Report and Economic Report for December 2020, industry experts believe that credit union loans and deposits will reach 6.0% and 8%, respectively, in 2021.

- In addition, yield-on-assets are projected to go down 64 basis points to reach a record low of 3.2%. This decline will be a result of decreased interest rates and stunted loan growth.

- Net Interest margins are also expected to fall to record lows to reach 2.7% in 2021, “as asset yields fall faster than cost of funds.” This will force credit unions to increase the variety of financial services and products they’re offering while improving efficiency and productivity.

- According to the CUNA Mutual Group, the following are the some of the top issues for credit unions in the United States in 2021:

- Record low net interest margins will most likely cause expense containment.

- The “high unemployment rates will lead to larger collections departments and higher provisions for loan losses.”

- Credit unions will need to monitor employee stress and morale constantly.

- Credit unions will be forced to invest in better technology for employees working from home.

- The new economic environment carries the possibility of making credit unions more profitable.

- The new year will bring more opportunities for prime real estate buying and branching in the future.

- The expected excess liquidity will make the search for higher-yielding assets more intense.

- Credit unions should prioritize members who are stressed financially to increase brand loyalty.

- According to CUInsight, the industry is foregoing profits for the short term profits to increase the “provision for loan losses in preparation for increased delinquencies and charge-offs in 2021.” Mortgage lending is also expected to slow down in 2021 as new home sales go back to normal.

- Credit union financing for new vehicles will slow down “because of the incentivized deals offered by captives and the continued effect of the pandemic on consumer confidence in our economy.”

Credit Unions Response to the Pandemic

- As the effects of the pandemic started being felt within the credit union industry, different credit unions responded differently to the pandemic. The most common response from credit unions in the United States was deferring massive credit to their employees. Below are some of the ways credit unions in the US responded to the pandemic:

- Coastal Federal Credit Union “implemented Skip-A-Pay for consumer loans and credit cards, modified mortgages, ramped up emergency relief loans, slashed late fees and NSF fees, tweaked mobile deposit limits and …identified nonprofits in the community that were making immediate impact, and provided them with nearly $700,000 in grants.”

- BECU Credit Union “launched new products, like a 0% APR personal loan for up to $1,000, and increasing member liquidity by waiving early CD withdrawal fees. To support the long-term health of our communities, we created and promoted new financial education content, and pledged support to COVID-19 response funds in nine communities in Washington and in South Carolina. We also implemented a 2:1 employee donation gift match for the month of May.”

- Genisys CU “deferred payments at no cost on millions of dollars in loans so our members could instead put food on their families’ table….helped hundreds of small businesses survive by processing their Payroll Protections loans when their banks wouldn’t even call them back…donated their entire pandemic inventory of masks and gloves to our local healthcare providers.”

How Customer Expectations/Needs Are Evolving

- Just like regional banks, credit union members’ expectations for 2021 are changing, with digital use surging and members’ expectations regarding trust, loyalty, personalization, and privacy changing rapidly.

- Credit union members and banking customers are increasingly demanding a more personalized banking experience where credit unions reach them with individualized messaging to ask questions, educate them, and engage them.

- The CreditUnion Insight has the following takeaways from 2020 to help credit unions in 2021:

- Create a comprehensive, omnichannel strategy: In the United States, Credit union members want sales and service experiences that are simple, quick, customized, and pleasant to use, and they want consistency across all engagement channels. According to a survey, over 45% of survey respondents said the pandemic had permanently changed the way they bank, while 31% were looking to increase their usage of online and mobile banking in the future.

- Use data to deliver personalized communication to credit union members.

Major Shifts in the Industry

1. Changing Dynamics at the NCUA

- According to The American Banker, credit unions in the United States should expect several uncertainties, including a transition period at the National Credit Unions Administration (NCUA).

- The association board recently received a new member, and President-Elect Joe Biden is expected to promote Todd Harper to the chairmanship, implying a shift in dynamics for the regulator of credit unions in the United States.

- When Harper, a Democrat, assumes offices, he will be “politically outgunned” since the current chairman, Rodney Hood, and his vice-chairman, Kyle Hauptman, are Republicans.

- Harper will find it hard to advance his policies, especially on the agency’s role in consumer protection, since it’s not widely expected that the two Republicans down the hall will second his policies.

- In addition, experts believe that the transition of leadership in the White House and Congress may bring about new relief to be used in offsetting a likely increase in delinquencies.

2. Field of Membership Changes Will Continue in Earnest

- When the pandemic struck, many credit unions in the United States put on hold their plans to expand their fields of membership. However, according to Sam Brownell, CU Collaborate founder, many credit unions have resumed their field of membership plans.

- According to Brownell, if new regulations from the agency are passed in 2021, one of the biggest hurdles for the growth of credit unions will be removed since credit unions will be allowed to include ATMs and shared branches as service facilities.

- This is good news for credit unions as they’ll be able to reach underbanked consumers and underserved communities to increase their memberships.

3. Acquisitions

- According to industry experts, it is difficult to tell if the number of CU-Bank deals will return to its 2019 levels in 2021.

- However, it looks promising since the number of acquisitions dipped as the pandemic became widespread, but they rebounded as 2020 came to a close.

- Experts believe that CU-bank deals in 2021 will be spread across the country and will not be limited to a few states, as was the case in 2019.

4. Cybersecurity Will be Huge Issue

- In 2021, many credit union employees will be working remotely from their homes. According to experts, this significantly increases the chances of phishing attacks targeted on employees by hackers.

- In the heels of cybersecurity breaches at the close of 2020, credit unions will likely shift their efforts from responding to the pandemic to improving the security of their banking systems.