Table of Contents

Even if you are new to cryptocurrency, it is likely that you have heard about tokens. Despite the fact that their idea is similar to that of cryptocurrency coins, their functions go well beyond just monetary transactions.

In this cryptocurrency tokens tutorial, we’ll go over the differences between a token and a coin, the most common forms of cryptocurrency tokens, and how to invest in crypto tokens.

What Are Crypto Tokens?

On top of the current blockchain networks, blockchain-based companies or initiatives create their own value units called tokens. A completely separate digital asset type, they may have extensive compatibility with the cryptocurrencies of the network.

Tokens are generated by systems that build on top of blockchains, whereas cryptocurrencies are the indigenous assets of a certain blockchain technology. As an example, the native token of the Ethereum blockchain is ether (ETH). While ether is the Ethereum network’s native coin, the Ethereum blockchain is also used by numerous other currencies. There are a number of cryptocurrencies developed on Ethereum, some of which include DAI, LINK, COMP, and CryptoKitties. With these currencies, you may participate in decentralized finance systems, access system services, and even play games on the networks for which they were designed.

For the creation of crypto tokens, there are a number of widely used standards, the bulk of which are based on Ethereum. Standards for creating tokens that may work together inside Ethereum’s network of decentralized apps include ERC-20 and ERC-721. ERC-721 was created to enable tokens that are not fungible and cannot be exchanged for other tokens of the same type. Hundreds of distinct ERC-20 tokens and thousands of different ERC-721 tokens will be available by 2020, according to Blockstream’s latest projections. New tokens will likely be created to satisfy blockchain’s increasing use cases, resulting in an increase in the total number of tokens.

Tokens that use cryptography are often configurable, permissionless, trustless, and transparent in nature. To be programmable, a token must operate on software protocols consisting of smart contracts that define the token’s characteristics and functionalities, as well as the network’s rules of engagement. No additional credentials are required for anyone to use the system because it is permissionless. No central power controls the system, which means it is trustless. Instead, it operates according to the rules specified by the protocol stack. Finally, transparency means that everyone can see and verify the protocol’s rules and transactions.

Because they are based on the same technology as cryptocurrencies, crypto tokens have the potential to represent a variety of other types of goods or services in addition to just holding value. As an example, there are cryptocurrency tokens that represent both tangible and intangible assets like processing power or storage space, such as real estate and art. As a governance tool, tokens are commonly utilized as a voting mechanism on certain parameters, such as protocol updates, and other choices that determine the future trajectory of various blockchain initiatives. Tokenization is the process of generating crypto tokens for various purposes.

There will be more and more unique digital assets created in the future as the blockchain sector develops to meet the diverse demands of all ecosystem players, from large corporations to individual consumers. When compared to the physical world, it is easier to create new digital assets because of this. This means that new digital assets have the potential to revolutionize a variety of sectors by revolutionizing how they interact and generate value.

How Crypto Tokens Work

As previously said, cryptocurrency tokens are nothing more than tokens. Tokens, which exist on their own blockchains, are used to represent cryptocurrencies or virtual currencies. Unlike traditional databases, which store information in rows that are connected together, blockchains store data in blocks that are linked together in a chain. That is to say that each of the cryptocurrency tokens, also known as crypto-assets, represents a certain amount of money.

As you can see, it all works like this. A cryptography approach is one that uses encryption algorithms and cryptography such as elliptical curve cryptography, public-private key pairs, and hashing functions to protect these entries. Cryptocurrencies, on the other side, are electronic payment systems that use virtual tokens to facilitate safe online payments. Tokens are represented in the system by ledger entries.

While these crypto-assets are typically associated with transactions, they may also be used as the transaction units on blockchains that utilize standard templates like Ethereum’s.

Smart contracts or decentralized apps are the basis for these blockchains, which utilize programmable, self-executing code to handle and manage the different blockchain transactions.

Such a cryptocurrency on the blockchain might, for example, represent the number of consumer loyalty points that a retail chain has accrued. Another cryptocurrency token may provide token holders access to 10 hours of video-sharing blockchain streaming content. For example, a crypto token may be equivalent to 15 bitcoins on a certain blockchain, or it may represent other cryptocurrencies as well. Traders and holders of the blockchain can trade and transfer crypto tokens between themselves.

What is the Difference Between Coins and Tokens?

The distinctions between crypto coins and tokens may be discerned based on the definitions provided above. However, we’ll draw your attention to the following points so you’ll comprehend them better:

- Tokens lack a built-in blockchain, compared to coins.

- By virtue of the fact that it uses an existing blockchain, token creation is less costly than coin creation.

- When a project creates its own blockchain and migrates its tokens to the new blockchain as coins, they might become tokens again. Binance Coin (BNB), Tron (TRX), and Zilliqa (ZIL) are among the tokens that have successfully migrated from the Ethereum network.

The General Concept of Tokens

First, we looked at how everything connected to cryptocurrencies and covered encryption briefly; now, we’ll look at how tokenization is utilized in the space.

The general meaning of the term “token” To put it another way, a “token” is anything that serves as a placeholder for something else.

Tokens in cryptography have the following meanings: Data is referenced by a token, which is an encrypted string. Tokenization is nothing more than a kind of cryptography.

An algorithmically produced string of data is used to represent the original data in “token” form for purposes of computer security. This eliminates the need to transmit even an encrypted copy of the original data over the internet. Despite the fact that the token is supposed to be linked to actual data, it really contains none. Digital payment systems, such as Apple Pay and Square, as well as credit card companies and cryptocurrencies, employ this sort of token.

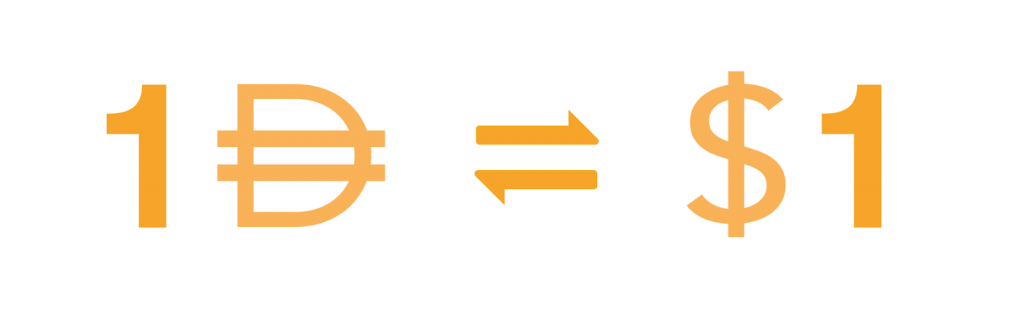

When it comes to currencies and tokens, there are a few things to know. One dollar note in paper or electronic form means $1, whereas one bitcoin symbolizes the value of one bitcoin (BTC), and so on. A currency token reflects the value of one bitcoin (BTC). Hence, currency tokens like dollars and cryptocurrencies are intrinsically worthless in this sense.

The idea of utility tokens is that they don’t all have to represent money or value. Tokens may be used for a variety of different uses. The Filecoin tokens, for example, give users access to a decentralized cloud storage platform on the cloud. To be a currency provides several benefits, but not all of those benefits are related to commerce or value.

Tokens such as ERC-20: “Token” has a different connotation in the cryptocurrency world. Altcoins are referred to as “tokens” when they exist on the platform of another coin rather than on their own. Tokens of this sort exist on a number of platforms, including Ethereum, NEO, and others. For the purposes of illustration, let’s use Ethereum, the most prominent of these platforms, where “token” refers to any ERC-20 token produced on Ethereum that isn’t the native coin Ether.

The word “token” in cryptocurrency refers to all of these things at once… and does it with a certain amount of latitude.

Cryptocurrency Tokens in Terms of Encryption

Tokenized data related to transactions can be transmitted across the web and stored without compromising sensitive data in cryptocurrencies.

As a result, while each token is distinct and relates to crucial data required to generate transactions, it does not actually contain that data. The transaction has been hashed.

The public ledger may be used to verify who owns what amount of Bitcoin without disclosing any personal information.

As a result, the Blockchain is brimming with these kinds of tokens, each one resting alongside public transaction data. For each transaction, the sender generates an identifier token (of the encrypted kind), and the remainder of the transaction data is stored alongside it.

Because the token is used to identify a transaction, it is referred to as a “TXID.”

It appears as follows:

TXID: 947153d332beaf39dec6 an unique reference ID number: 8883 B F B F B C 2d61436 D 81584 D Tokens look like this: 1JMk91gy6MUBuySoxoArB6MtyeNhhSa7dr- 0.0000596 BTC (a hash of the sender’s public key; their public address)

FROM: 17JvnxVuxmxYfrtJvdedhxjL8XrSF8tYqV (the sender’s public key hash) • 0.02451455 bitcoin

TO: 39fiTiMqHKToAfC4tZK2jhTzxenE7VhQMi – 0.02451681 BTC

TO: 39fiTiMqHKToAfC4tZK2jhTzxenE7VhQMi – 0.02451681 BTC

Everything that isn’t clear text or a sum of BTC is a hash. The first string is the TXID token produced when a transaction is created. The following three are public addresses that correspond to balances.

Generally speaking, when someone uses the term “token” in cryptocurrencies, they mean the above-mentioned “token” PLUS the idea of a money token/value token.

People aren’t saying “oh see, I have a TXID” when they use the word lightly. They imply that I am the rightful owner of the Bitcoin assets recorded in the ledger, not the other way around.

Key Features of Cryptocurrency Tokens?

Transactions are irreversible.

It’s impossible to go back and undo a transaction once it’s been validated on the blockchain

Transactions confirmed on the Blockchain cannot be reverted after that point. This means that no operation on the blockchain can be rolled back, not even by the national government’s authority.

A good reminder to double-check your transactions and make sure they’re as described here should help as well.

- The perfect volume

- Message delivered to the proper recipient’s inbox.

You can’t get your funds refunded if you lose them to scammers or hackers. In the event of a failed transaction, your tokens will be returned to your wallet.

Transactions are pseudonymous.

On any blockchain, transactions and addresses are completely decoupled from actual world identities.

On any blockchain, transactions and addresses are completely decoupled from actual world identities. Random sequences of about 30 characters make up blockchain addresses, making them nearly unintelligible. They’re not entirely anonymous, though. They don’t know who you are.

Most cryptocurrency exchanges need identification before allowing you to register. It is possible to trace operations back to you if you use these exchanges to make a purchase or a sale.

Quick and worldwide transactions.

The blockchain network has lightning-fast transactions.

Because the blockchain network is so quick, transactions may be verified in under a minute, beating out traditional methods like international bank transfers.

If you were in the US and wanted to transmit an Ethereum transfer to someone in Japan, you could do so in 20 seconds.

It’s important to keep in mind that the network can get overloaded if there are too many transactions, however, this is quite unusual.

Transactions are safe and secure.

Wallets that use public-key cryptography to safeguard cryptocurrency funds are known as cryptocurrency wallets.

Private key cryptography protects cryptocurrency assets stored in a wallet.

Despite the fact that it seems convoluted, all it really means is that the money in your digital wallet is protected by sophisticated mathematical methods

Your wallet can only be accessed with a secret key that only you have. This means that no matter how much someone tries, they will never be able to hack into your wallet. However, if you provide your private key to a third party, your money may be compromised. Think of your secret key like a PIN for your bank account; never tell anyone where it is or what it does.

There is no third party involved in the transactions.

It’s important to note that, unlike traditional currencies, the blockchain belongs to everyone, and it’s confirmed by no one except the miners.

Because it is not backed by fiat currency, the blockchain belongs to everyone, and it is confirmed by people who don’t have any of your cash on hand. In contrast to a bank or PayPal, there is no centralized body that manages your transactions.

You may lose everything if a central power is ineffective or corrupt. You’re secure with the blockchain since it’s a shared and open public ledger controlled by no one but everyone.

Crypto Token Types

In contrast to what some people may believe, cryptocurrency, tokens, and coins are not interchangeable concepts. What, therefore, distinguishes them? In this part, we’ll find out.

Utility Tokens

Tokens are created with a specific purpose in mind, generally inside the app or network for which they were created. A utility token is most commonly used as a means of payment for purchases made on the platform. MEP tokens, for example, maybe utilized on the Medipedia platform to pay for healthcare services.

The release of utility tokens by a corporation is intended to give its customers a way to pay for a new product or service that the firm is offering, and which was presumably built using blockchain technology. Buying utility tokens during an ICO sale might save you a lot of money in the long run because the tokens are sold for a fraction of their market value.

Security/Equity Tokens

Tokenized securities function in the same way as conventional securities. Tokens that serve as stocks or shares of a firm are known as equity tokens, and they are issued to buyers once the cryptocurrency offering has concluded. It is possible to obtain certain rights as well as equity in a firm by acquiring security tokens.

In contrast to utility tokens, security tokens are constrained by federal regulations and stock trading regulations. Equity tokens can be accessible outside of the system on which they were created by their very nature. Unlike utility tokens, the worth of security tokens can grow or fall in accordance with the success of the project.

Reward Tokens

For a given blockchain application, these are reputation tokens that may be used to establish trust. These are presented to somebody as a token of appreciation as a reward and are often provided at no cost. When service providers on the platform receive Medipedia Point Rewards (MPR) based on their ratings, this is a great example. A reward token differs from a normal token in that it does not always have a monetary value attached to it.

Asset Tokens

Real-world assets like gold, property, and bonds serve as the collateral for asset tokens. By using these tokens, you may purchase or sell actual assets with the value they represent. This makes physical asset trade on digital platforms more efficient.

Currency Tokens

When it comes to making purchases, a currency token works just like actual money. For example, Bitcoin is a form of digital money that can be used to purchase and sell items with online/offline businesses that take this currency as a medium of exchange. Exchangeable for fiat and cryptocurrencies, currency tokens may be sent to anybody with a digital wallet. They can also be swapped for other currency tokens.

Platform Tokens

Decentralized applications (dapps) are delivered via platform tokens using blockchain infrastructures. Dai, for example, is classed as a stablecoin since it is soft-pegged to the USD and its value is maintained by mechanisms incorporated into smart contracts, but it can also be categorized as a platform token since it is based on the extensively used Ethereum blockchain.

It’s impossible to discuss cryptocurrencies without bringing up the Dai stablecoin as an example.

Because of the blockchains, they rely on, platform tokens acquire increased security and the capacity to facilitate transactions. From servicing gaming and digital antiques (such as CryptoKitties!) to the worldwide advertising and marketplace sectors, platform tokens cover a wide range of use cases.

Transactional Tokens

They function as units of account and are traded for goods and services as transactional tokens are used to transact. They frequently work like regular currencies, but they can also give extra benefits in certain situations. If you take Bitcoin or Dai as an example of a decentralized cryptocurrency, you may conduct transactions without the need for an intermediary like a bank or payment gateway. Additionally, Dai serves as a medium of exchange for other networks, providing transactional efficiency. With the creation of xDai, the POA Network has made it possible to conduct transactions quickly and cheaply by using a sidechain.

Not every transactional token is a currency. Other businesses, like global supply chains, are using transactional tokens to put the blockchain’s immutability and elasticity to use.

Governance Tokens

Because of the proliferation and evolution of decentralized protocols, it is important to fine-tune the decision-making processes that surround them. With on-chain governance, all stakeholders may cooperate, discuss, and vote on how a system should be managed. Blockchain-based voting systems are fueled by governance tokens, which are frequently used to show support for planned reforms and vote on new ones. MKR is the cryptocurrency used for governance in the Maker Protocol.

How Cryptocurrency Tokens are Generated?

- Mining is the primary method of generating cryptocurrencies. Miners, as previously stated, are in charge of validating blockchain transactions.

- Miners, like anybody else who works, are paid for their labor. The blockchain’s currency is used to compensate the miners. As a result, Bitcoin miners are compensated in Bitcoins, whereas Ethereum miners are compensated in Ethereum tokens (also known as ETH).

- This means that the more transactions that take place on a blockchain means more cryptocurrency tokens will be produced for that blockchain.

- Pre-mined tokens are also used to provide the groundwork for future cryptocurrencies. Pre-mining occurs due to the inutility of trading with only one unit of a cryptocurrency.

- If the USD were to be reinstated, starting with $1 would be illogical because there isn’t enough money in the market to go around. A more reasonable starting point would be $500 billion, but even that sum is still insufficient for global trade.

- Coin creators follow a similar strategy with their individual cryptocurrencies, starting with at least 10 million tokens to stimulate trading and transactional activity.

- Each time a transaction is confirmed by the network’s miners, more tokens are added to the blockchain.

- It’s critical to understand that a cryptocurrency’s future supply is finite. To combat inflation, developers might set a limit on the amount of tokens that exist using smart contracts.

Benefits of Cryptocurrency Tokens

Medium of exchange for money

- Using cryptocurrencies instead of traditional forms of payment is an option.

- Using cryptocurrencies instead of traditional forms of payment is an option. A guy once paid for a pizza with 10,000 Bitcoins, which became a viral sensation.

- Cryptocurrency is being accepted as a payment option by businesses both online and in physical stores. This demonstrates that even in the real world, cryptocurrency may be used to pay for products and services.

Investment in a company’s shares

- Tokens of Ethereum (ETH) will be given to investors instead of shares of the firm.

- Before we go any further, let’s have a look at the basics of initial coin offerings (Initial Coin Offering).

- ICOs are crowdsourcing initiatives that resemble initial public offerings (IPOs) in many ways (Initial Public Offering). Instead of getting stock or dividends, investors who contribute to a certain financing goal will receive digital tokens in return.

- Instead of receiving stock in the firm, those who invested in the Ethereum ICO received ETH tokens.

- Tokens could also be used to reward early-stage investors with a portion of the company’s earnings. Investors will receive a portion of the startup’s profits for each token they own.

- A token is eligible for a share in the company’s earnings, but not all of them are. Token dividends are unlawful to receive in the United States, which explains a lot of this.

- It is the same as a regular distribution of dividends to shareholders for the tokens that do give them out. In other words, when your tokens grow, so do your dividends.

A method of data transmission

Ethereum is a great illustration of how cryptocurrencies may be used to move data around.

When it comes to utilizing bitcoin to transfer data, Ethereum stands out. Buterin realized that the same blockchain technology utilized by Bitcoin as a medium for transactions can also be used for data transmission by Ethereum’s creator Vitalik Buterin

He thought blockchain technology could do more than simply check transactions; he thought it could transmit and validate data across the blockchain as well.

Because cryptocurrency tokens can hold data and information in addition to monetary value, their applications are more resilient.

The blockchain is now being used by businesses such as Provenance to authenticate information between two or more locations. For example, if you own a seafood restaurant, you might use bitcoin tokens to prove that the marine food is fresh and was harvested the same day.

Some banks have also experimented with the notion of storing and verifying bank transactions using crypto tokens and the blockchain. Transparency would be improved, and traditional bookkeeping would be displaced.

Should You Invest in Cryptocurrency Tokens?

The introduction of cryptographic tokens sparked a revolution. In the absence of current information, you may believe that investing is solely for the wealthy. This was true up until a short while ago.

With the advent of crypto tokens, investors of various income levels may now engage in the stock market. No longer are you restricted because of your financial status?

You are welcome to join if you so choose. That’s all there is to it. Furthermore, you should only purchase cryptocurrency tokens from a reputable vendor because they represent the financial industry’s future. Missing out on possibilities and more money is all that will happen if you don’t.

However, there is a caveat:

It’s not all roses and butterflies all the time. Focus on the following information to help you stay grounded and aware of your professional position in the business.

There will be some crypto tokens that don’t turn out to be great investments. Not every platform makes it simple to get started. Some will provide just mediocre outcomes. As a result, choose a cryptocurrency token that has a solid foundation in business.

Simple Steps To Buy Crypto Tokens

Are you still debating whether or not you should acquire cryptocurrency tokens? Time is ticking away, and you don’t have a second to waste.

Setting a Budget

Of course, as you accumulate more crypto tokens, your earnings will rise at an exponential rate. As a result, the ancient adage “the more, the merrier” is applicable here.

However, only you know how much money you have saved or have available to invest each month. Identify an amount of money you’re prepared to invest and stash it away in a cryptocurrency wallet instead of your local bank account.

Remind yourself that you’re creating something that will be valuable in the long run. Consequently, you might want to hold off on jumping all-in with a budget that’s either too high for your financial circumstances or one that’s too low to allow you to reap significant rewards.

Selecting a Coin

Fiat cash (often referred to as “ordinary money”) can be used to purchase crypto tokens, and you only need to do it once. After that, you’re free to do anything you want.

In order to purchase crypto tokens, users often use Ethereum (ETH) or Bitcoin (BTC) (BTC). After paying in fiat money for ETH or BTC on an internet exchange, you transfer the required amount to an ICO address and receive the crypto tokens in return.

Analyzing Initial Coin Offerings

This year, it’s quite likely that Bitcoin will reach $10,000. Ethereum’s price will continue to rise until it reaches the $500 mark in 2018.

The success of initial coin offerings (ICOs) has grown in tandem with the meteoric rise of major cryptocurrencies. Over $10,000,000.00 has been funded through crowdsourcing vehicles ranging from video game customizations to Disney-related companies.

To be successful, every initial coin offering (ICO) must have a deadline and a goal. Transfers happen instantly. The costs of these ventures do not result in additional fees for investors because there is no third-party intermediary.

There are several initial coin offerings to choose from. However, sifting through hundreds of ICOs to discover the hidden jewels is a thankless process. You should also be aware that not all ICOs will succeed before becoming overly enthusiastic and trying to invest in as many as possible. Some may be unable to succeed. Some may just vanish. Many of them aren’t worth your time due to the platforms’ shoddy construction, which will cause you stress.

It’s one issue to have a solid product supported by a viable company that actively pursues growth. Something else entirely is supporting dubious Initial Coin Offerings (ICOs) that have no business plan and are just interested in impressing you with a flashy white paper and a few spectacular claims that aren’t backed up by any evidence.

Another significant problem is that owing to technological constraints, most of the ICO’s proposals cannot be implemented. All of the token allocation guidelines must be included in the white paper in order for the investor to understand exactly how the initiative will come to fruition.

Storage in a Secure Location

If you put money in a haphazard pocket, you’re likely to lose it. That’s something that happens to everyone at some time in their lives. Digital cash storage is no different from real-life storage. You’ll need a secure wallet that’s available to you at all times.

Be wary of services that just say they will ‘keep’ your crypto assets. They might be lying. Investigate the information you find.

What method will they use to do this? What sort of technologies do they employ? You should be able to do whatever you want with your money if you have it in a digital wallet.

Fast Invest lets you manage crypto assets on the blockchain and gives you easy access to all the data you need on a simple dashboard. You’ll have access to comprehensive statistics, so you’ll be able to keep tabs on every transaction.

Fast Invest will offer a digital wallet that can be accessed via a web browser or a mobile app. Fiat and crypto transfers are also available for free amongst other features for Fast Invest members who have FITs.

Bitcoin and Ethereum may be stored or exchanged for fiat currency or used to borrow and invest in other cryptocurrencies all through this one wallet. There will be no one outside of our community that can access this information. Fast Invest FIT holders need to act quickly if they want to be included.

Investing Intelligently

Taking the time to do something correctly doesn’t have to take a long time. You won’t grow any smarter by overthinking the procedure, but you might find up in a never-ending loop where you have too many alternatives and are unable to make a decision.

It’s at this point when analytical paralysis sets in. You get stuck because you want to do things correctly, but there are so many options that it’s overwhelming and perplexing. This one has the potential to put a hold on your investments, revenue streams in the future, and overall performance.

Crypto P2P lending is an excellent way to make an investment. Your passive income will increase gradually and certainly as long as interest rates remain between 8 and 15 percent.

If you’ve never bought crypto tokens before, you might be surprised to learn that the process is much simpler than you think. Fast Invest, for example, offers a great initial coin offering (ICO) that has every possibility of paying off handsomely in the long run.

As long as you follow our easy 6-step guide, you’ll be well on your way to being a successful crypto investor. You have the power to change your financial future right now if you act now.

Final Thoughts

People frequently use the term “cryptocurrency” to refer to both the native currencies and the tokens, which is confusing. In light of the differences between these two digital asset classes, it would be more accurate to refer to them as “crypto-assets.”