Table of Contents

Overarching principles and particular events that have preceded Ethereum 2.0’s upcoming upgrade are examined in this article, as are all the stages that make up its timeline.

What is Ethereum 2.0 all about?

The largest blockchain upgrade in history is about to go live. On November 3, the official deposit protocol went live, marking the first stage in Ethereum’s move to Proof of Stake. Over 1 million ETH or $600 million has been staked since then.

On December 1st, 2020, the Ethereum 2.0 Beacon Network became live.

While Ethereum gas costs in DeFi july 2020 rose to as much as 900 gwei, Ethereum has been widely criticized for its usefulness.

There has been a lot of excitement over the $51 billion blockchain network transitioning to its new version, which will allow for more scalability through the use of shabling while also utilizing Proof of Stake for a sophisticated consensus process.

However, a large number of people are likely to be ignorant that Proof of Stake has always been on Ethereum’s roadmap from the start Ethereum Founder Vitalik Buterin submitted research on Proof of Stake in 2014, years before Ethereum 1.0 was released in 2015.

There have been numerous revisions and fine-tuning around the rewards design since then, but the combination of rising usage and restrictions of Ethereum’s existing scalability allowed to expedite the creation of this upgrade and ultimately put it into the launching holes.

The fundamental architectural concepts of Ethereum 2.0 are based on the lessons acquired through Ethereum’s operations as a Proof-of-Work chain, with an emphasis on decentralization, resilience, security, and durability. Facilitating wide involvement and lowering entrance barriers has been a critical aspect of enabling decentralization. Consequently, no’super-node’ structures such as fixed validators or delegation procedures are required in the protocol architecture. Since it is distinct from its competitors, Ethereum’s consensus path stands out. It offers delegated staking, unlike its competitors Polkadot, Cardan and others (such as Cosmos and NEAR), which have a set or maximum number of network validators.

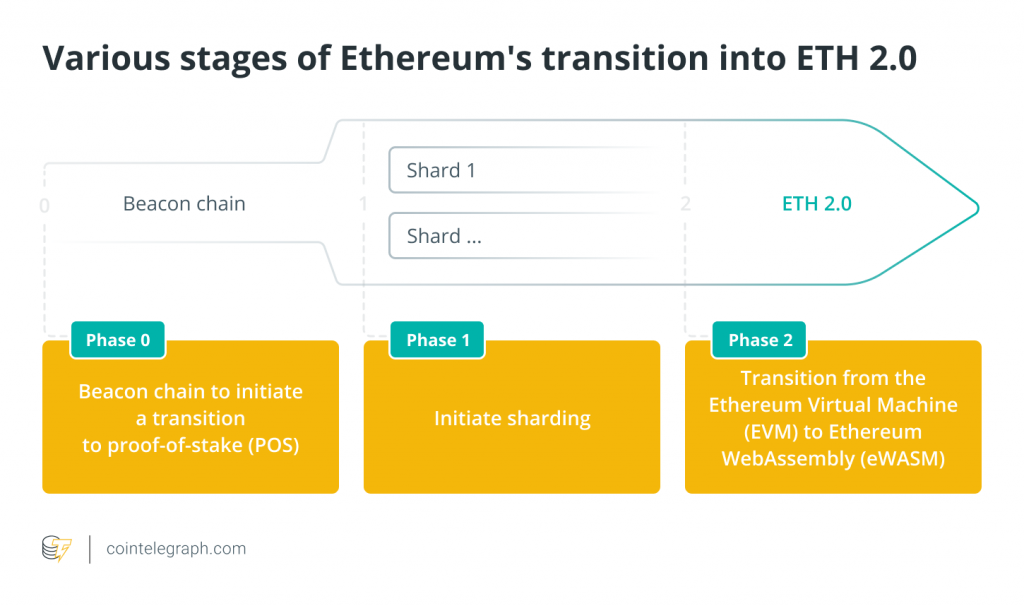

In three stages, Ethereum 2.0 will be released. All ETH pledged in Phase 0 of the Beacon Chain deployment is frozen until the existing eth1 chain is merged into a shard on eth2. Currently, this is scheduled to happen before Phase 2 goes live in the next 12-24 months. Early involvement cannot be opted out of because of the way the system is set up. The Beacon Chain will only accept ETH sent during Phase 0 of the protocol.

Transitioning to Ethereum 2.0

Ether’s 2.0 transition may be divided into several phases.

Phase 0

The Beacon Chain is a new feature in Ethereum 2.0, introduced in Phase 0 of the upgrade. The Beacon Chain, which will be live on December 1st, 2020, symbolizes the transition from PoW to PoS, allowing traders to stake their Ethereum and become validators. The Beacon Chain is separate from Ethereum’s mainnet and is unaffected by Phase 0’s changes. The Beacon chain and mainnet, on the other hand, will be linked in the future. Beacon Chain’s proof-of-stake mechanism must “merge” with Mainnet in order to achieve this goal of “merging.”

In addition, prospective validators can still show interest in the Beacon Chain by putting up 32 ETH as a security deposit. It’s a big ask to ask consumers to stake 32 ETH, knowing that 32 ETH is worth tens of thousands of dollars. While Ethereum 2.0 is still in development, stowed money will be kept for at least two years before being released. As a result of the rigorous entrance criteria, early participants are required to be deeply dedicated to the project’s future.

Phase 1

Although Ethereum 2.0 was originally scheduled to launch in the second half of 2021, it has now been postponed until early 2022 due to incomplete development and code audits. Next, the Beacon Chain will be integrated with the mainnet, making the transition to a PoS consensus method official. Eth2 will store all of Ethereum’s transaction history and facilitate smart contracts on the Proof-of-Stake network starting with Phase 1. As Ethereum 2.0 eliminates mining from the network, holders and validators will have to stand up to the plate. Many miners are anticipated to stake their assets in order to become validators.

The Ethereum 2.0 upgrade’s first phase was intended to include sharding, according to its original design. To shard a database, you must divide it into smaller chains, or shards, like in this instance the blockchain. As a result, the network’s burden will be distributed among 64 additional chains on Eth2. By reducing the amount of hardware required to run a node, shards simplify things. After the mainnet & beacon chain have combined, this update will take place.

Validators and other users will be able to operate their own shards on Ethereum 2.0, validating transactions and preventing congestion on the mainchain. For shard networks to be accepted securely into the Ethereum ecosystem, a proof-of-stake consensus technique is necessary. On the Beacon Chain, staking will be implemented, laying the groundwork for the next shard chain update.

Phase 2

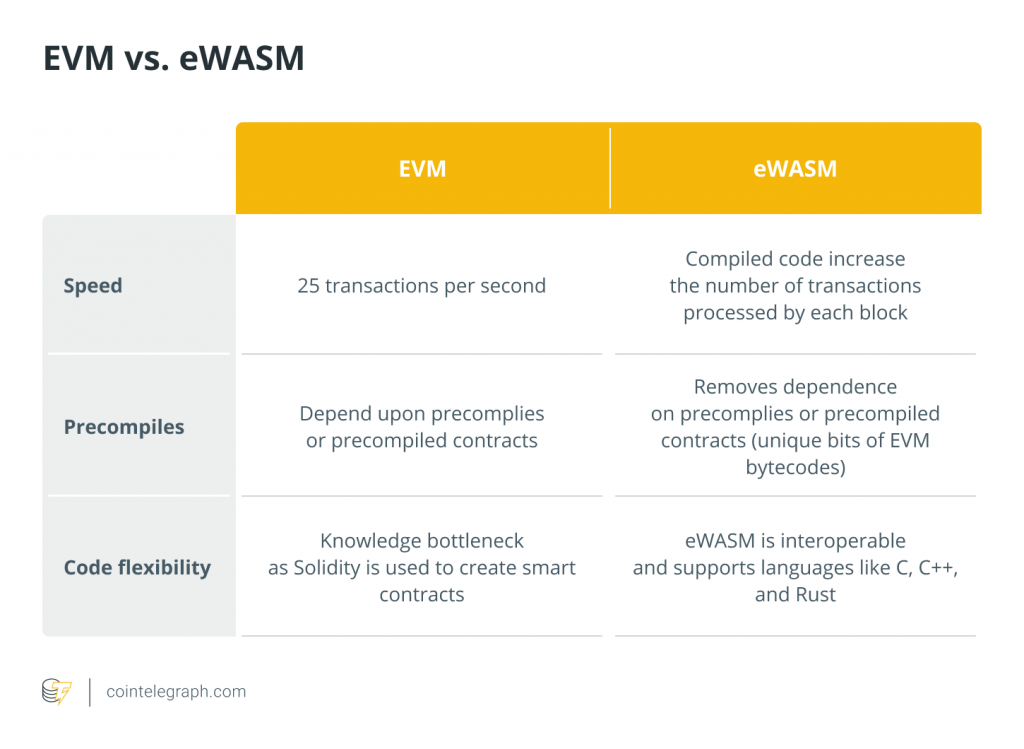

Finally, Ethereum WebAssembly, or eWASM, will be introduced in Phase 2 of the project. W3C established WebAssembly with the goal of making Ethereum far more effective than it is now. EWA (Ethereum WebAssembly) is an implementation proposal for the Ethereum smart contract implementation layer that would be a deterministic subset of EWA.

Currently, Ethereum features an EVM, which stands for Ethereum Virtual Machine. Ethereum’s global supercomputer can be powered by an EVM. Decentralized apps and smart contracts are both operating on this machine, which is accessible to anybody in the globe (DApps). As well as enabling wallet addresses for operations and computing transaction fees for each one, the EVM contains all of the code required to run instructions on Ethereum.

For example, the EVM can tell if a smart contract needs to be terminated because it consumes too much gas, or if a decentralized application is deterministic because it always uses the same input and output data, or if a smart contract is seperated because if something goes wrong, the Ethereum network as a whole is unaffected. It is true that the Ethereum network has become overly busy. The EVM is running significantly slower than expected due to the high volume of transactions. Ether’s EVM is especially complicated since it was developed in a hard-to-understand programming language called Solidity. To substitute the EVM, the eWASM was developed particularly for use in Phase 2.

Compared to the EVM, the eWASM generates code considerably more quickly, resulting in quicker network processes. When you use the eWASM, gas operates more efficiently, and you may use the eWASM with a variety of standard coding languages, such as C and C++. The eWASM’s main goal is to make Ethereum developments more accessible to the general public.

Ethereum 2.0 staking

To begin, you must decide whether or not you intend to stake your ETH. It all boils down to finding the right balance between risk and reward. In order to stake, one must take on a certain amount of risk and, in return, receive a return.

Despite the fact that various staking service providers reduce risks or offer alternate solutions, all Ethereum 2.0 stakeholders should be aware of the following essential characteristics:

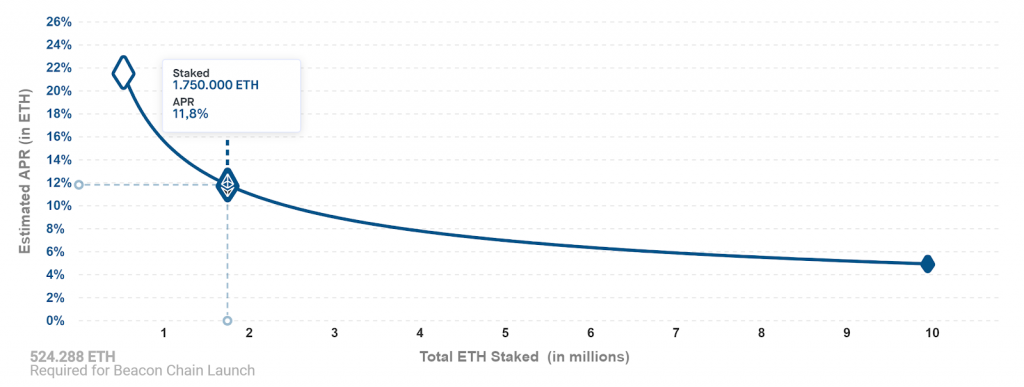

Reward rates of up to 17%

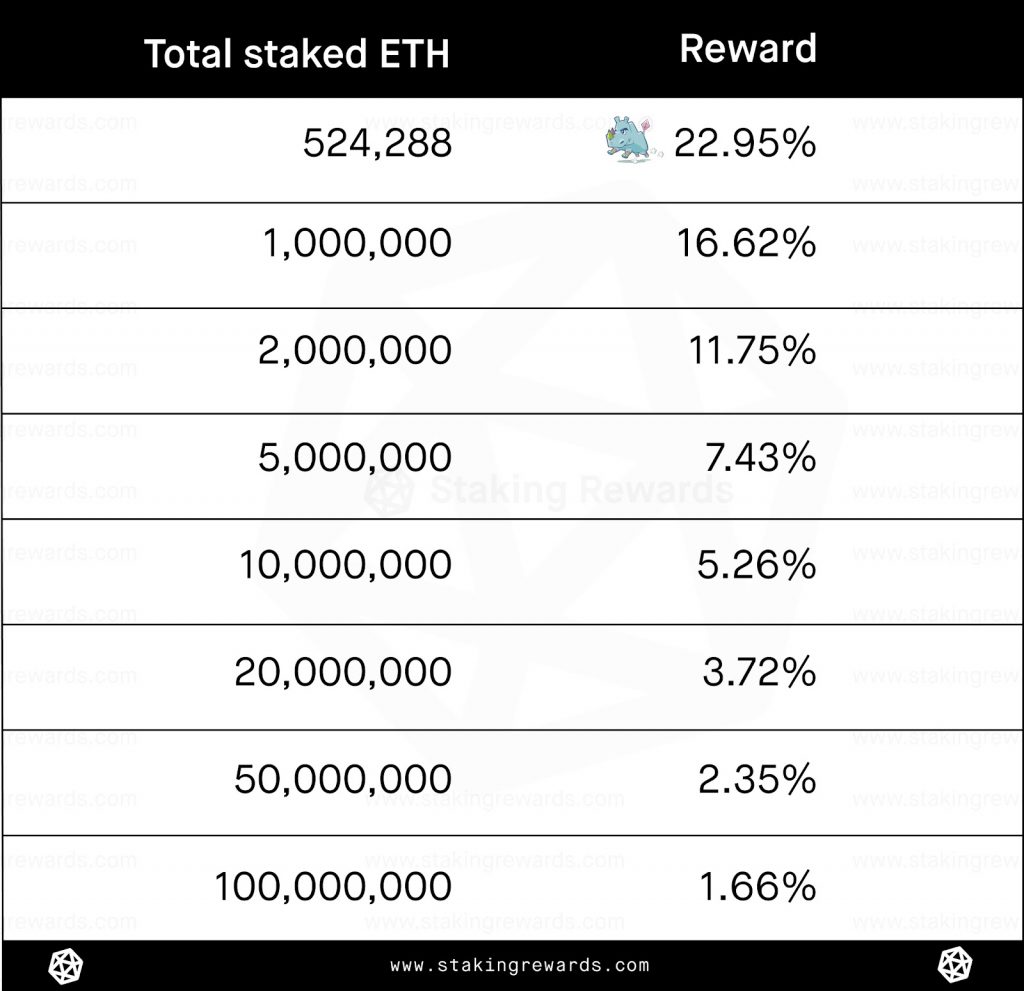

The dynamic inflation curve used in Ethereum 2.0 compensates validators for protecting the network while limiting the issue of new money.

Any total staked amount may be projected using the Ethereum Staking Simulator to predict your winnings. The figures are merely estimates, but they are quite close to the real thing and also match Vitalik Buterin’s estimates.

32 ETH Staking Minimum

A verification on the Beacon Chain will cost you 32 ETH to run. As a result, ETH stakes may only be 32 ETH or greater per validator instance. Staking fractions of 32 ETH is only possible with solutions that pool money, such as custodian Staking Providers or Staking Pools.

Staked ETH is restricted till Phase 1.5.

The start of eth2 phase 1.5 is still unknown, with estimates ranging from 12 to 24 months.

To avoid this, you can use a centralized exchange or stake pool, which will represent your staked ETH on the eth1 chain in a marketable way (ERC-20 tokens). We’ll go through each of these in more detail later on.

The dynamic lock-up period (exit queue) will continue even after phase 1.5 to prevent large-scale withdrawals of staked ETH. For the time being, this is set at 256 epochs.

Funding may be reduced.

Holders risk being “slashed” (permanently compromised) if their validator engages in harmful behavior, such as duplicate signing or encircling voting. Even though slashing is usually reserved for demonstrably poor behavior and should never occur for normal users unless in the case of client problems, it is critical that you understand all elements of validator node setup before you begin. When using eth2, the cutting penalty is proportional to the entire amount of underlying funds that have been sliced at the same time. Slashing merely one validator with 32 ETH results in a relatively little punishment. However, if a Provider’s infrastructure malfunctions on a big scale, the resulting penalty might be considerably larger for everyone. Staking Service providers should be extensively assessed for their trustworthiness before engaging in large-scale infrastructure operations. Some Providers may provide insurance at a lower cost.

Ethereum 2.0 (ETH 2.0) staking is one-way.

Once you go over to eth2, there’s no going back. There is no way to get your capital or accumulated rewards back once you pay your ETH to the staking agreement to start your validator on the beacon chain.

After considering all of this, you should know the answers to the following questions prior to deciding whether or not to stake:

- The answer to this question is yes or no.

- For how long do I intend to keep my Ethereum Classic?

- In the next year or two, will I require direct access to my funds?

- Do I want to be a part of Ethereum’s growth?

Ethereum 2.0 Staking Service Solutions

A validator node’s infrastructure and knowledge are both required for staking and operating. As a result, you must choose whether to perform it yourself or to use stake providers to subcontract the work. Users can transfer the process of staking to other parties while still maintaining full control over their assets if they want to use a provider. In order to decrease risk and operational costs, enhance availability, and improve reward consistency for their target client groups, staking service providers are intended to fulfill the staking function optimally.

Self-run Validator Nodes

This will be your preferred choice if you are a passionate long-term ETH holder with sound technical knowledge. With complete custody management, node operators help the eth2 network be more secure and decentralized overall.

Pre-configured Validator Nodes

An easy method to operate a validator that you fully own and manage. You may save a lot of time and work on the initial configuration of your validators by using pre-configured validator equipment or cloud operations.

Validator-as-a-service Solutions

Institutions and individuals with substantial net worth In order to maintain control over their assets, ETH holders want a solution that is safe, dependable, and easy to use. Rather than keeping track of your validator duties, Validator-as-a-Service solutions just hold onto your signed validator keys and allow you keep full control of your cash via the withdrawal keys. You will, however, require 32 ETH in order to use their services. As a result, the majority of these programs are categorized as either semi-custodial or custodial.

Staking Pools

Staking Pools are most popular among retail investors and DeFi members. Staking pools have the distinct advantage of not requiring full 32 ETH. People with fewer than 32 ETH will be able to pool their ETH together to stake using staking pool services as a middle ground. Despite the fact that Staking Pool Operators own the majority of the assets, the custody is open and easy to track on the blockchain.

Lending Platforms

Investors and traders who prefer to leverage their assets will find this to be the ideal choice. Using a solution like LiquidStake gives you the option of both staking and borrowing money against your ETH.

Exchanges & Custodians

Consider this option if you’re searching for the quickest way to stake, don’t have a lot of time to devote to maintaining or monitoring your involvement in staking, or only want to stake a little amount of ETH each time. Simply put your ETH into their wallets and sign up for an account, and you’re good to go. The most significant disadvantage of this receptacle is that you will not be the owner of the coins you collect. Your keys and coins are off limits.

Please use caution while selecting a solution and service provider. Choosing a supplier generally requires a long-term engagement of 12-24 months or more because money are locked up until stage 1.5. You should choose with a company that has a proven track record of reliable service and support and won’t go out of business in the near future. Changing service providers afterwards would be a highly dangerous endeavor, since it would put your private keys at risk.

Final Thoughts

It’s time to pay attention to Ethereum 2.0 and the staking process. Because of staking, the network will be much more scalable in the future. Users’ revenue will be more steady thanks to the staking procedure as well. All cryptocurrencies appear to be moving toward staking in the near future. Because it consumes less electricity and does not need the same level of computer capacity as mining.